How a Monthly Bill Calendar Can Improve Your Finances

How a Monthly Bill Calendar Can Improve Your Finances

How a Monthly Bill Calendar Can Improve Your Finances

Jan 2, 2020

Budgeting >

Budgeting >

Strategies & Techniques

Strategies & Techniques

Do you struggle with budgeting?

Feel stressed when the bills come in, not knowing if you'll have the money in the bank before they're due?

Even if it feels like you're making good money, you might be wondering where it all goes when you see your bank balance.

If any of that sounds familiar, try using a monthly calendar to organize your bills.

Why You Should Use a Monthly Bill Calendar

The first time I tried to make a budget I gave up almost immediately.

The initial excitement quickly faded into frustration and defeat after I realized we didn't have the money to cover our monthly bills.

Several failed attempts later I heard the founder of YNAB teaching to budget only the money you have, not the money you expect to get.

His approach was to focus on the expenses you have to cover until you get paid again instead of trying to forecast out the whole month.

Hearing this was my ah-ha moment.

By only looking at my immediate obligations, I was able to feel more in control of my finances.

Not only could I pay the bills, but I could also focus on our savings goals.

Instead of having more month than money, we started to notice we had excess beyond our bills and everyday expenses. Money that we could put towards emergency and sinking funds.

How to Make a Monthly Bill Calendar

Creating a bill calendar is a simple process:

Choose a calendar.

Write in your bills.

Write in your paydays.

It isn't complicated, but having everything plotted out so you can keep track of bills and payments and see things at a glance gives you a new awareness of your finances.

To get started you'll want to choose your calendar first. Depending on your preferences you can either use a printed calendar or a digital one to track your bills.

How to Use a Printed Bill Calendar

If you're a pen and paper kind of person the best way to get started is to print off a blank monthly calendar.

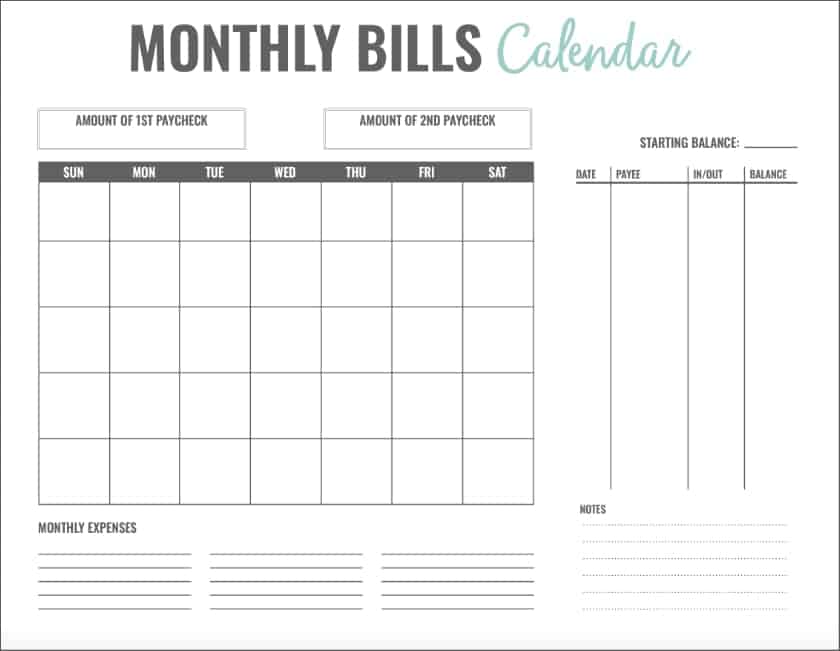

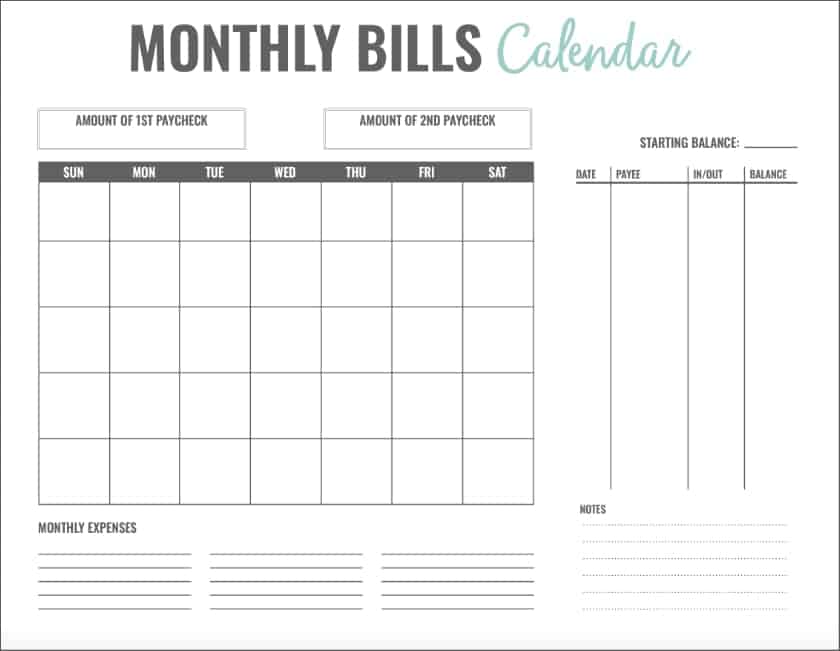

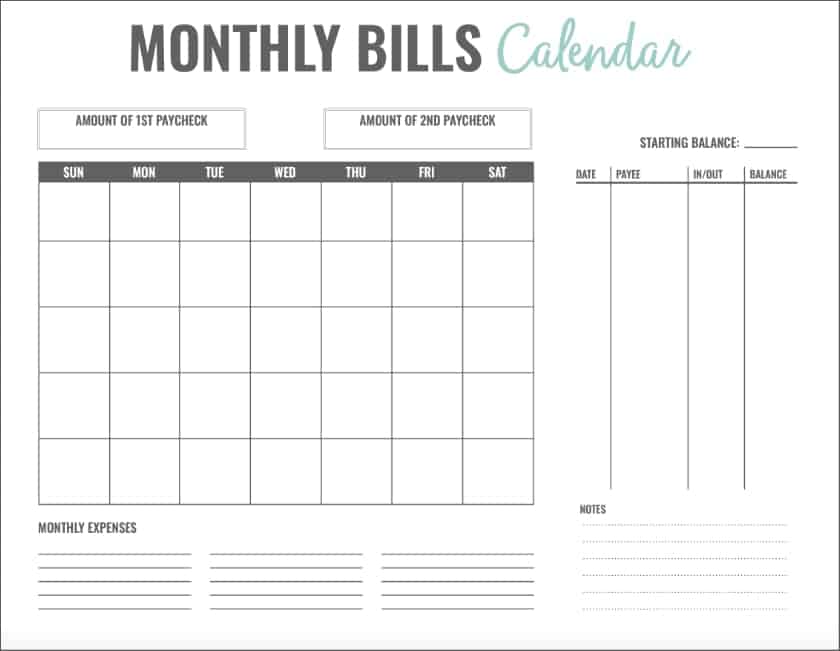

This is an older version printable bill calendar I used to use. You can grab an updated copy in my Make a Budget You Can Keep guide.

Then, start plugging in your information.

At a minimum, you'll want to add in your bills and paydays.

For a little more awareness, you can download my printable bill calendar template to track your spending and organize your daily expenses too.

While I usually tend to lean toward digital solutions, I prefer to print out my bill calendar.

Being able to stick it someplace like the fridge keeps it in sight and helps me stay focused.

Having a visual reminder of what's coming up is helpful for me to watch my spending and track monthly bill payments. Plus, keeping it front and center makes me more likely to use it and update it.

How To Use a Digital Bill Calendar

Most budgeting apps operate on a monthly basis, but they may not have a traditional monthly calendar view.

Being able to view your upcoming income and expenses at a glance is what makes using a monthly calendar helpful.

If you prefer a digital solution, you can use any calendar app to organize your bills (Google Calendar is a good free online calendar option). Creating a bill payment calendar on a digital calendar is the same as with a printed one.

Write in your bill due dates.

Add in your expected paydays.

Using a digital calendar for monthly bill payment tracking has the added benefit of letting you add reminders.

Bill payment calendar software allows you to use reminders to alert you when it's time to pay your bills.

This way you never get another late fee or and you'll get alerted before subscriptions renew so you don't get surprised by the charge.

If you don't want to mix your bills in with your other calendar items you can use a dedicated bill payment app or bill scheduler.

Prism and Chronicle are both good options if you prefer a dedicated bill payment organizer app.

Why A Monthly Bill Calendar Works

If you're living paycheck to paycheck, using a billing calendar is a great way to break that cycle.

Stay Focused

Using a calendar to plot your bills can help you get laser-focused on what your current money needs to do.

You'll see at a glance what bills and expenses you have to pay before you get paid again.

It's easy to give up on budgeting when you have more month than money. But by breaking your month down and seeing where the bills fall in relation to your paydays you're able to plan accordingly.

Plus, only focusing on your pay period gives you the option to funnel any extra cash into a savings goal.

Stay Motivated

Running out of money before you've budgeted out the entire month can make you feel like a failure before you've even got started.

You know what you owe, but not how you'll pay for it.

But when you narrow down the scope of your budget and create an immediate bill pay checklist you can more easily cover those expenses.

Then you can decide whether you want to plan for future obligations or save any excess into an emergency or sinking fund.

For example, if you get paid on the 1st and 15th of the month it may be impossible to cover all your monthly expenses with your first paycheck.

But if you only focus on the bills due before the 15th, you may find you have a lot more wiggle room.

Studies have shown people are more likely to stick with shorter-term budgets. So depending on how often you get paid this may also be a more effective way to stick to your overall budget.

PRO TIP – Once you've got your bills plotted out on the calendar, make a note of any payment clusters. These are days or weeks where it seems like a lot is due around the same time. Those larger expenses bundled together can wipe out an entire paycheck. If you notice any bigger bills coming due around the same time, call to find out if you can move your payment date. Adjusting your bill payment schedule can help you break out of the paycheck to paycheck cycle even faster.

Ready to Manage Your Bills Better?

Adjusting to a pay-period planning cycle for our finances had a huge impact on our momentum.

Being able to see where our bills fall in relation to our paychecks is what made everything come together.

If you'd like to give calendar bill planning a try, you can download the worksheet I use below.

My monthly bills worksheet has:

an un-dated calendar for you to plot out your bills and paydays

a register for you to keep track of your income and expenses

an area for listing out your bills

a section for any notes you want to make.

If you'd prefer a track your expenses separately, you can download my free printable expense tracker below.

Do you struggle with budgeting?

Feel stressed when the bills come in, not knowing if you'll have the money in the bank before they're due?

Even if it feels like you're making good money, you might be wondering where it all goes when you see your bank balance.

If any of that sounds familiar, try using a monthly calendar to organize your bills.

Why You Should Use a Monthly Bill Calendar

The first time I tried to make a budget I gave up almost immediately.

The initial excitement quickly faded into frustration and defeat after I realized we didn't have the money to cover our monthly bills.

Several failed attempts later I heard the founder of YNAB teaching to budget only the money you have, not the money you expect to get.

His approach was to focus on the expenses you have to cover until you get paid again instead of trying to forecast out the whole month.

Hearing this was my ah-ha moment.

By only looking at my immediate obligations, I was able to feel more in control of my finances.

Not only could I pay the bills, but I could also focus on our savings goals.

Instead of having more month than money, we started to notice we had excess beyond our bills and everyday expenses. Money that we could put towards emergency and sinking funds.

How to Make a Monthly Bill Calendar

Creating a bill calendar is a simple process:

Choose a calendar.

Write in your bills.

Write in your paydays.

It isn't complicated, but having everything plotted out so you can keep track of bills and payments and see things at a glance gives you a new awareness of your finances.

To get started you'll want to choose your calendar first. Depending on your preferences you can either use a printed calendar or a digital one to track your bills.

How to Use a Printed Bill Calendar

If you're a pen and paper kind of person the best way to get started is to print off a blank monthly calendar.

This is an older version printable bill calendar I used to use. You can grab an updated copy in my Make a Budget You Can Keep guide.

Then, start plugging in your information.

At a minimum, you'll want to add in your bills and paydays.

For a little more awareness, you can download my printable bill calendar template to track your spending and organize your daily expenses too.

While I usually tend to lean toward digital solutions, I prefer to print out my bill calendar.

Being able to stick it someplace like the fridge keeps it in sight and helps me stay focused.

Having a visual reminder of what's coming up is helpful for me to watch my spending and track monthly bill payments. Plus, keeping it front and center makes me more likely to use it and update it.

How To Use a Digital Bill Calendar

Most budgeting apps operate on a monthly basis, but they may not have a traditional monthly calendar view.

Being able to view your upcoming income and expenses at a glance is what makes using a monthly calendar helpful.

If you prefer a digital solution, you can use any calendar app to organize your bills (Google Calendar is a good free online calendar option). Creating a bill payment calendar on a digital calendar is the same as with a printed one.

Write in your bill due dates.

Add in your expected paydays.

Using a digital calendar for monthly bill payment tracking has the added benefit of letting you add reminders.

Bill payment calendar software allows you to use reminders to alert you when it's time to pay your bills.

This way you never get another late fee or and you'll get alerted before subscriptions renew so you don't get surprised by the charge.

If you don't want to mix your bills in with your other calendar items you can use a dedicated bill payment app or bill scheduler.

Prism and Chronicle are both good options if you prefer a dedicated bill payment organizer app.

Why A Monthly Bill Calendar Works

If you're living paycheck to paycheck, using a billing calendar is a great way to break that cycle.

Stay Focused

Using a calendar to plot your bills can help you get laser-focused on what your current money needs to do.

You'll see at a glance what bills and expenses you have to pay before you get paid again.

It's easy to give up on budgeting when you have more month than money. But by breaking your month down and seeing where the bills fall in relation to your paydays you're able to plan accordingly.

Plus, only focusing on your pay period gives you the option to funnel any extra cash into a savings goal.

Stay Motivated

Running out of money before you've budgeted out the entire month can make you feel like a failure before you've even got started.

You know what you owe, but not how you'll pay for it.

But when you narrow down the scope of your budget and create an immediate bill pay checklist you can more easily cover those expenses.

Then you can decide whether you want to plan for future obligations or save any excess into an emergency or sinking fund.

For example, if you get paid on the 1st and 15th of the month it may be impossible to cover all your monthly expenses with your first paycheck.

But if you only focus on the bills due before the 15th, you may find you have a lot more wiggle room.

Studies have shown people are more likely to stick with shorter-term budgets. So depending on how often you get paid this may also be a more effective way to stick to your overall budget.

PRO TIP – Once you've got your bills plotted out on the calendar, make a note of any payment clusters. These are days or weeks where it seems like a lot is due around the same time. Those larger expenses bundled together can wipe out an entire paycheck. If you notice any bigger bills coming due around the same time, call to find out if you can move your payment date. Adjusting your bill payment schedule can help you break out of the paycheck to paycheck cycle even faster.

Ready to Manage Your Bills Better?

Adjusting to a pay-period planning cycle for our finances had a huge impact on our momentum.

Being able to see where our bills fall in relation to our paychecks is what made everything come together.

If you'd like to give calendar bill planning a try, you can download the worksheet I use below.

My monthly bills worksheet has:

an un-dated calendar for you to plot out your bills and paydays

a register for you to keep track of your income and expenses

an area for listing out your bills

a section for any notes you want to make.

If you'd prefer a track your expenses separately, you can download my free printable expense tracker below.

Do you struggle with budgeting?

Feel stressed when the bills come in, not knowing if you'll have the money in the bank before they're due?

Even if it feels like you're making good money, you might be wondering where it all goes when you see your bank balance.

If any of that sounds familiar, try using a monthly calendar to organize your bills.

Why You Should Use a Monthly Bill Calendar

The first time I tried to make a budget I gave up almost immediately.

The initial excitement quickly faded into frustration and defeat after I realized we didn't have the money to cover our monthly bills.

Several failed attempts later I heard the founder of YNAB teaching to budget only the money you have, not the money you expect to get.

His approach was to focus on the expenses you have to cover until you get paid again instead of trying to forecast out the whole month.

Hearing this was my ah-ha moment.

By only looking at my immediate obligations, I was able to feel more in control of my finances.

Not only could I pay the bills, but I could also focus on our savings goals.

Instead of having more month than money, we started to notice we had excess beyond our bills and everyday expenses. Money that we could put towards emergency and sinking funds.

How to Make a Monthly Bill Calendar

Creating a bill calendar is a simple process:

Choose a calendar.

Write in your bills.

Write in your paydays.

It isn't complicated, but having everything plotted out so you can keep track of bills and payments and see things at a glance gives you a new awareness of your finances.

To get started you'll want to choose your calendar first. Depending on your preferences you can either use a printed calendar or a digital one to track your bills.

How to Use a Printed Bill Calendar

If you're a pen and paper kind of person the best way to get started is to print off a blank monthly calendar.

This is an older version printable bill calendar I used to use. You can grab an updated copy in my Make a Budget You Can Keep guide.

Then, start plugging in your information.

At a minimum, you'll want to add in your bills and paydays.

For a little more awareness, you can download my printable bill calendar template to track your spending and organize your daily expenses too.

While I usually tend to lean toward digital solutions, I prefer to print out my bill calendar.

Being able to stick it someplace like the fridge keeps it in sight and helps me stay focused.

Having a visual reminder of what's coming up is helpful for me to watch my spending and track monthly bill payments. Plus, keeping it front and center makes me more likely to use it and update it.

How To Use a Digital Bill Calendar

Most budgeting apps operate on a monthly basis, but they may not have a traditional monthly calendar view.

Being able to view your upcoming income and expenses at a glance is what makes using a monthly calendar helpful.

If you prefer a digital solution, you can use any calendar app to organize your bills (Google Calendar is a good free online calendar option). Creating a bill payment calendar on a digital calendar is the same as with a printed one.

Write in your bill due dates.

Add in your expected paydays.

Using a digital calendar for monthly bill payment tracking has the added benefit of letting you add reminders.

Bill payment calendar software allows you to use reminders to alert you when it's time to pay your bills.

This way you never get another late fee or and you'll get alerted before subscriptions renew so you don't get surprised by the charge.

If you don't want to mix your bills in with your other calendar items you can use a dedicated bill payment app or bill scheduler.

Prism and Chronicle are both good options if you prefer a dedicated bill payment organizer app.

Why A Monthly Bill Calendar Works

If you're living paycheck to paycheck, using a billing calendar is a great way to break that cycle.

Stay Focused

Using a calendar to plot your bills can help you get laser-focused on what your current money needs to do.

You'll see at a glance what bills and expenses you have to pay before you get paid again.

It's easy to give up on budgeting when you have more month than money. But by breaking your month down and seeing where the bills fall in relation to your paydays you're able to plan accordingly.

Plus, only focusing on your pay period gives you the option to funnel any extra cash into a savings goal.

Stay Motivated

Running out of money before you've budgeted out the entire month can make you feel like a failure before you've even got started.

You know what you owe, but not how you'll pay for it.

But when you narrow down the scope of your budget and create an immediate bill pay checklist you can more easily cover those expenses.

Then you can decide whether you want to plan for future obligations or save any excess into an emergency or sinking fund.

For example, if you get paid on the 1st and 15th of the month it may be impossible to cover all your monthly expenses with your first paycheck.

But if you only focus on the bills due before the 15th, you may find you have a lot more wiggle room.

Studies have shown people are more likely to stick with shorter-term budgets. So depending on how often you get paid this may also be a more effective way to stick to your overall budget.

PRO TIP – Once you've got your bills plotted out on the calendar, make a note of any payment clusters. These are days or weeks where it seems like a lot is due around the same time. Those larger expenses bundled together can wipe out an entire paycheck. If you notice any bigger bills coming due around the same time, call to find out if you can move your payment date. Adjusting your bill payment schedule can help you break out of the paycheck to paycheck cycle even faster.

Ready to Manage Your Bills Better?

Adjusting to a pay-period planning cycle for our finances had a huge impact on our momentum.

Being able to see where our bills fall in relation to our paychecks is what made everything come together.

If you'd like to give calendar bill planning a try, you can download the worksheet I use below.

My monthly bills worksheet has:

an un-dated calendar for you to plot out your bills and paydays

a register for you to keep track of your income and expenses

an area for listing out your bills

a section for any notes you want to make.

If you'd prefer a track your expenses separately, you can download my free printable expense tracker below.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

You're in good hands

You're in good hands

You're in good hands

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.