The Best Checking Accounts for Kids

This post may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

As I’ve mentioned before, Little Go From Broke has had his own budget for a while and it’s been working great.

Up until recently, I’ve still been responsible for the actual money.

Anytime Little GFB wants to buy something, while it comes out of his budget, it comes out of my account.

He just celebrated his 9th birthday recently and I think he’s ready for a little more responsibility. So Mr. GFB and I decided to sign him up for his first checking account.

There aren’t a lot of checking accounts for kids out there, but here are some of the better options I found.

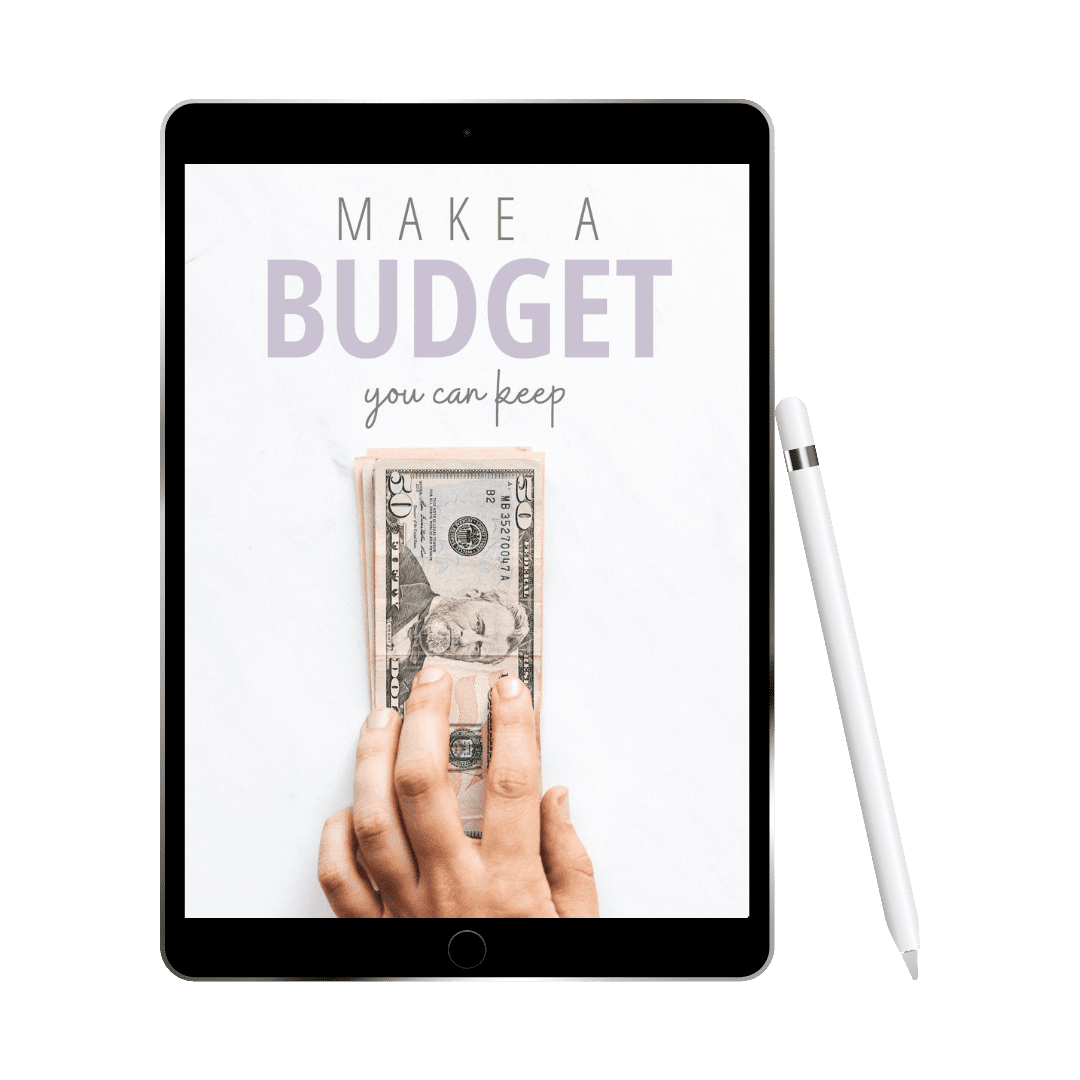

Stress less & save more!

This FREE budget guide will help you create a budget that works for you!

The Most Comprehensive Checking Accounts for Kids: GoHenry & Greenlight

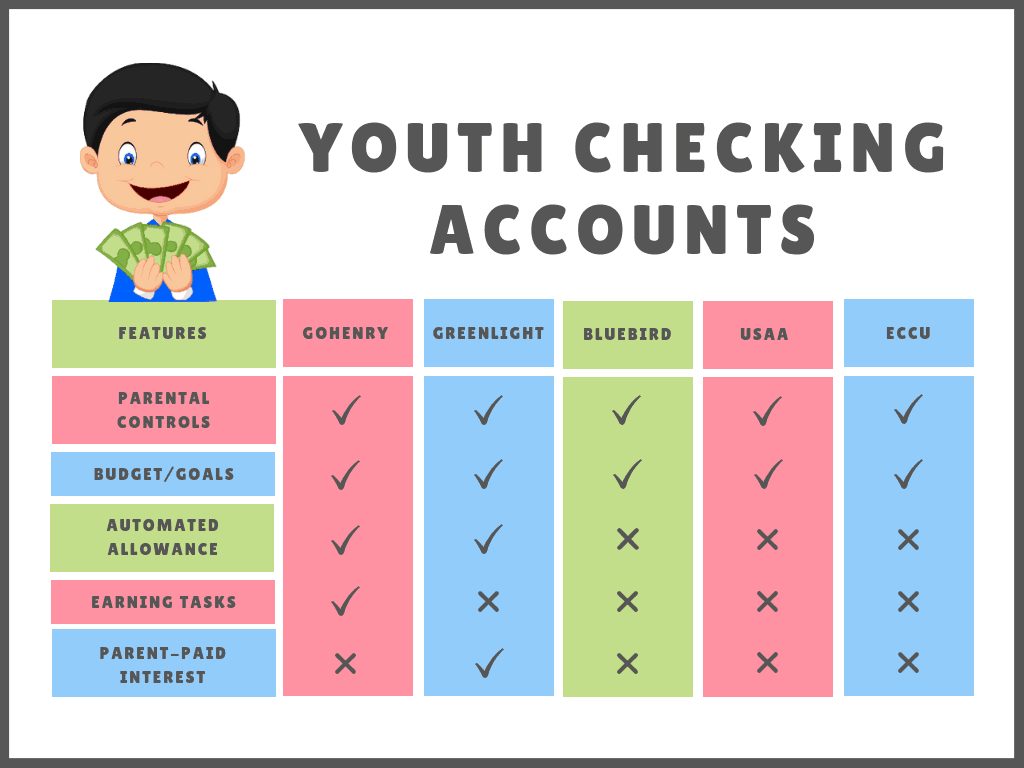

The most innovative and comprehensive products I found are from GoHenry and Greenlight.

Both programs offer prepaid debit cards with parental controls and notifications, savings goals, spending limits, and allowance and task-based payment options.

Greenlight even has the ability to set a parent-paid interest rate, which would be a great tool to demonstrate the power of compound interest.

They both seem like excellent products, with the only real downside being the monthly fee.

GoHenry charges $3.99 per month, per child, while Greenlight costs $4.99 per month for up to 5 children.

The tech nerd in me really wants to try one of these, but since Little GFB already has a

I also have a hard time reconciling the idea of teaching savings by spending money unnecessarily.

I’m a reluctant pass on these for now but may revisit one if his spending habits increase.

UPDATE: If you need help deciding between Gohenry vs Greenlight, determine what features you really need. Greenlight has recently added 2 additional offers, Greenlight + Invest and Greenlight Max.

If you’re interested in exposing your kids to investing, definitely check these out. Greenlight Max also offers additional protections (identity theft, cell phone, and purchase protection) as well as the ability to earn cash back from your purchases using the new Greenlight Black Card.

These new tiers do cost extra, but they may help tip the scales in favor of Greenlight vs GoHenry if you want the added benefits and investing options.

Good Checking Account for Older Kids: Bluebird

Bluebird is a prepaid debit card from American Express. We don’t actually qualify for this one as your child has to be 13 or over to use it, but I thought I’d mention it for those of you with older kids looking for options.

What I like about Bluebird is the ability to deposit cash at any Walmart.

I can’t stand budgeting cash and our bank doesn’t have any branches in our state to make it easy to deposit.

It’s not usually a problem since I rarely find myself with cash anyway, but Little GFB often gets cash gifts on holidays and birthdays so I love the idea of being able to deposit it at our local Walmart.

Unfortunately, he’s too young for this account right now and I’m not sure I’d be willing to switch banks in the future just for that feature.

Not Really a Checking Account: S Is for Savings

S Is for Savings is a unique approach from PNC bank to educating kids on finance. It uses Sesame Street characters to teach financial principles, which sounds pretty cool.

However, it seems more savings-centric as well as geared toward younger kids so not for us.

Little GFB already has a savings account and has long since outgrown Sesame Street.

If you have a younger kid, though, this might be worth a look.

The Family Bank: USAA

While I was excited to explore these products, in the end, we decided to open a Youth Checking account with our current bank, USAA.

It may not be as feature-rich as some of the others, but there’s something to be said for simplicity.

First, by going with USAA, I don’t have to create another account (and login) to manage things. Transfers are instantaneous and I still have a few parental controls in terms of notifications and spending limits.

Second, he already has a savings account with USAA which makes all our accounts nice and neatly organized together.

Little GFB’s spending is pretty rare so I’m thinking this more basic approach will work well for us.

However, I’m willing to reconsider the more robust options as he gets older or if his spending habits change.

UPDATE: Little GFB isn’t so little anymore (almost 13!), but to date simply using USAA has worked well for us. He still doesn’t spend much, so we’ll see moving forward, but we’ll be sticking with the USAA teen debit card for the foreseeable future.

An Addendum: ECCU

Just as I was finishing up this post I got an email about another youth-targeted account.

ECCU is a faith-based credit union that’s just rolled out new Start Young Youth Spending and Saving Accounts. Their purpose is to help facilitate teaching kids how to manage their finances.

There are no fees or minimum balance requirements, and it has a budget feature, a spending management feature, and parental controls (like spending limits and text alerts).

The accounts are divided into age ranges 0-7, 8-12, and 13-17. I’m not sure if the actual functionality is different depending on age, but the idea seems to be for parents to manage the youngest kids, co-manage the 8-12 year-olds and let the older kids bank on their own while monitoring their activity.

Each account receives a debit card, but cards issued to kids in the 0-7 range will have their parent’s name on them. Older kids will get a card in their own name.

On the surface, this looks like a great program. It appears to have much of the same functionality as the GoHenry and Greenlight accounts but without the fees.

To Review

In choosing a checking account for LIttle GFB, we went with simplicity over features. But any of these checking accounts for would be a great way to teach your kid how to manage their money.

Here’s a quick chart showing you how the different accounts compare.

Want to work together?

I would love to help you gain clarity and confidence with your money! If you’re ready to stress less, save more, and enjoy your money, click below to learn more about financial coaching.