How We Cut Our Grocery Bill by 50%

How We Cut Our Grocery Bill by 50%

How We Cut Our Grocery Bill by 50%

May 22, 2018

Savings >

Savings >

Strategies & Techniques

Strategies & Techniques

I’ve been feeling pretty discouraged lately.

It seems every time I look at our finances, things are moving in the wrong direction.

We’ve been hit with one thing after another - car repairs, medical expenses, vet bills, more car repairs - it feels like it will never end.

But when I do a deep dive and analyze our other spending categories, I feel a sense of accomplishment.

We’ve reduced most of our spending in general, cut out some things, cut back in others.

Once the house sells (please let the house sell) we’ll practically be cutting our monthly expenses in half.

But the boogieman of budgeting always seems to be the grocery category, so I’m most proud of myself for managing to not just bring it under control but to actually tame it.

Then and Now

In 2017, our monthly grocery expenses averaged out to over $800.

That’s for a family of 3.

And we don’t live in a high cost of living area or buy organic everything.

Honestly, we just didn’t plan or pay attention.

We also spent almost $200 a month eating out.

That’s $1000 per month on food for 3 people.

That’s insane.

So far this year our monthly grocery spend averages a little over $400 and our dining out at $50.

How We Did It

It’s a rather daunting process to cut your food spending in half, but for us, it really came down to an attitude and behavior adjustment.

We tend to be a family who indulges our food cravings.

I’m a lazy cook.

I don’t enjoy it and I prefer not to do it, so if the opportunity to NOT cook presents itself, I’ll jump on it.

I used to anyway.

I used to get super stressed about what to make for dinner, what days did I have time to cook dinner or would it be a drive-thru night if we didn’t have leftovers.

Our grocery bill would rise as I’d hit the store almost every other day trying to find something to cook last minute or just grabbing skillet-ready meals.

More often than not, I’d actually swing through the drive-thru for lunch on our way home from the grocery store, and still feel unprepared for dinner.

The three little words I longed to hear from Mr. GFB were “Let’s eat out.”

The App That Changed My Attitude

I knew from the growing numbers in our budget that we needed to make a change.

I tried to plan out our meals for the week but usually failed.

I’d forget some ingredient or that we had Cub Scouts and didn't have time to cook that night.

I was beginning to feel defeated when I discovered the app Plan To Eat.

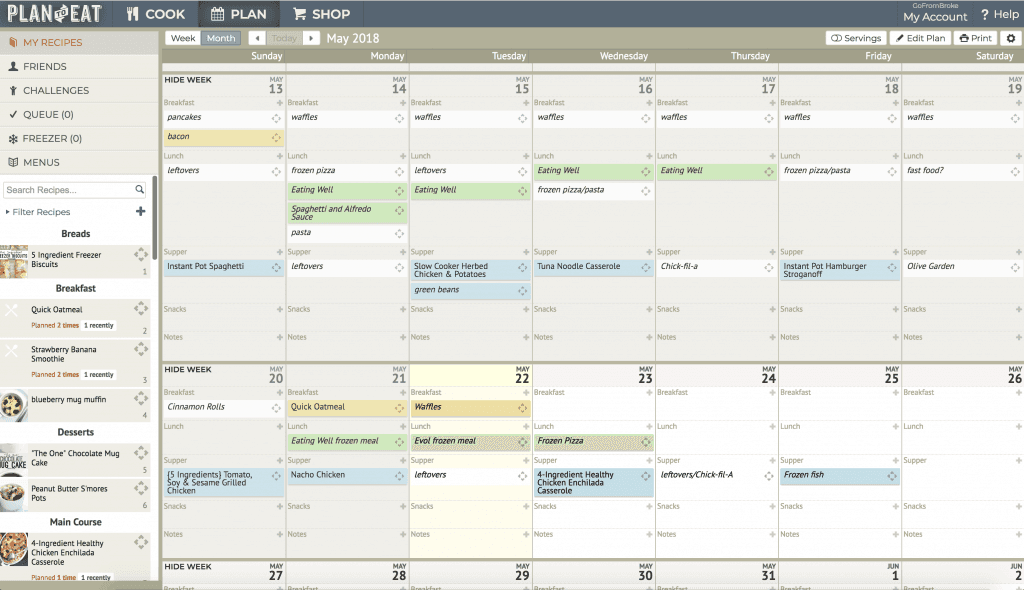

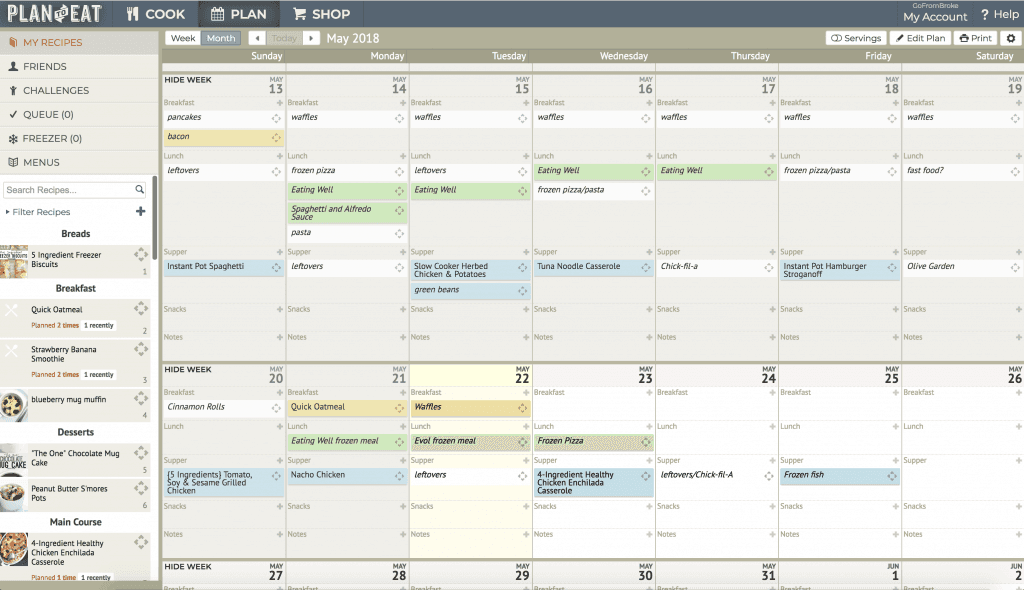

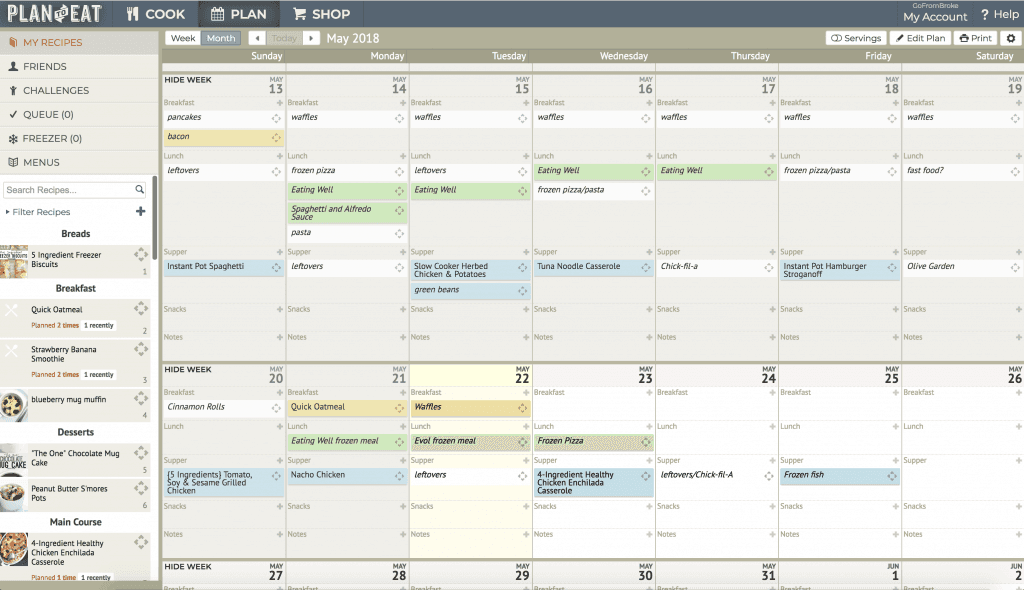

Plan To Eat is a menu planning app that does triple duty as a meal planner, recipe collector and shopping list creator all on one.

The calendar interface was the game changer for me.

I can literally just drag a recipe onto a day and boom, dinner is planned, ingredients are added to my list and my stress level normalizes.

I can see at a glance (or make a note if I needed to) of what days we have late nights so I can plan to cook the day before and have leftovers at the ready.

It’s not a free app but was well worth the $39/year subscription just for the reduction in my stress level.

But it also more than pays for itself with the savings I generate by cooking at home.

I credit the Plan To Eat app with the drastic drop in our dining out spending.

The month I began using the app, our spending on take-out fell by 70%.

Having a plan made eating out unnecessary and not wanting to waste ingredients made it undesirable.

[lasso ref="plantoeat" id="4194" link_id="33610"]

The Service That Changed My Habits

Even with a meal plan in place, our grocery bill was still a little higher than I liked.

I’d gotten it down to about $600 a month, but my goal was $300 (I still haven’t hit that).

I started tracking exactly what we were buying so I could see if I could track down the items that were pushing us higher.

Turns out, I was buying some impulse items every trip.

Whether it was snacks or treats or something we’d need eventually but wasn’t part of the plan that week, it was a lot of little things adding up.

So lucky for me our local grocery store started offering a pick-up service.

Order your groceries online, apply any coupons, schedule a pickup time, and then simply drive up and have the groceries loaded into your car.

Amazing!

Switching to grocery pick-up helped me drop the impulse buys and get our bill down to around $450/month.

Not quite where I want it, but a huge improvement.

Moving Forward

Combining the Plan To Eat app with the grocery store pick-up has helped us slash our food spending.

We cut our spending from around $1000/month on groceries and eating out to about $500.

But I’m not done yet!

I still want to reduce the grocery bill a bit.

I haven’t been able to get the bill below $400 and I think it is because I was planning out 2 weeks at a time.

This meant I still had to swing by the store to get fresh produce.

Shopping in the store inevitably leads to unplanned spending for me so my goal for May is to not step foot in the grocery store.

That’s slightly impractical since we have family visiting soon and they’ll want to go buy some stuff, but as long as I don’t buy anything I’ll consider it a win.

I’ve also started planning our meals for just a week at a time so I can get a better handle on our weekly grocery expenses and hopefully identify other areas to improve on (I’m looking at you frozen lunches).

Overall, I’m hugely excited by our progress and honestly, even though I’m getting sick of the random expenses getting thrown our way, I’m relieved we’ve been able to handle them thanks to the improvements we’ve made in saving in other areas.

If you need help reigning in your food expenses, I hope this post gave you a couple of ideas to try. Let me know in the comments if you try them out or if you have any other tips!

I’ve been feeling pretty discouraged lately.

It seems every time I look at our finances, things are moving in the wrong direction.

We’ve been hit with one thing after another - car repairs, medical expenses, vet bills, more car repairs - it feels like it will never end.

But when I do a deep dive and analyze our other spending categories, I feel a sense of accomplishment.

We’ve reduced most of our spending in general, cut out some things, cut back in others.

Once the house sells (please let the house sell) we’ll practically be cutting our monthly expenses in half.

But the boogieman of budgeting always seems to be the grocery category, so I’m most proud of myself for managing to not just bring it under control but to actually tame it.

Then and Now

In 2017, our monthly grocery expenses averaged out to over $800.

That’s for a family of 3.

And we don’t live in a high cost of living area or buy organic everything.

Honestly, we just didn’t plan or pay attention.

We also spent almost $200 a month eating out.

That’s $1000 per month on food for 3 people.

That’s insane.

So far this year our monthly grocery spend averages a little over $400 and our dining out at $50.

How We Did It

It’s a rather daunting process to cut your food spending in half, but for us, it really came down to an attitude and behavior adjustment.

We tend to be a family who indulges our food cravings.

I’m a lazy cook.

I don’t enjoy it and I prefer not to do it, so if the opportunity to NOT cook presents itself, I’ll jump on it.

I used to anyway.

I used to get super stressed about what to make for dinner, what days did I have time to cook dinner or would it be a drive-thru night if we didn’t have leftovers.

Our grocery bill would rise as I’d hit the store almost every other day trying to find something to cook last minute or just grabbing skillet-ready meals.

More often than not, I’d actually swing through the drive-thru for lunch on our way home from the grocery store, and still feel unprepared for dinner.

The three little words I longed to hear from Mr. GFB were “Let’s eat out.”

The App That Changed My Attitude

I knew from the growing numbers in our budget that we needed to make a change.

I tried to plan out our meals for the week but usually failed.

I’d forget some ingredient or that we had Cub Scouts and didn't have time to cook that night.

I was beginning to feel defeated when I discovered the app Plan To Eat.

Plan To Eat is a menu planning app that does triple duty as a meal planner, recipe collector and shopping list creator all on one.

The calendar interface was the game changer for me.

I can literally just drag a recipe onto a day and boom, dinner is planned, ingredients are added to my list and my stress level normalizes.

I can see at a glance (or make a note if I needed to) of what days we have late nights so I can plan to cook the day before and have leftovers at the ready.

It’s not a free app but was well worth the $39/year subscription just for the reduction in my stress level.

But it also more than pays for itself with the savings I generate by cooking at home.

I credit the Plan To Eat app with the drastic drop in our dining out spending.

The month I began using the app, our spending on take-out fell by 70%.

Having a plan made eating out unnecessary and not wanting to waste ingredients made it undesirable.

[lasso ref="plantoeat" id="4194" link_id="33610"]

The Service That Changed My Habits

Even with a meal plan in place, our grocery bill was still a little higher than I liked.

I’d gotten it down to about $600 a month, but my goal was $300 (I still haven’t hit that).

I started tracking exactly what we were buying so I could see if I could track down the items that were pushing us higher.

Turns out, I was buying some impulse items every trip.

Whether it was snacks or treats or something we’d need eventually but wasn’t part of the plan that week, it was a lot of little things adding up.

So lucky for me our local grocery store started offering a pick-up service.

Order your groceries online, apply any coupons, schedule a pickup time, and then simply drive up and have the groceries loaded into your car.

Amazing!

Switching to grocery pick-up helped me drop the impulse buys and get our bill down to around $450/month.

Not quite where I want it, but a huge improvement.

Moving Forward

Combining the Plan To Eat app with the grocery store pick-up has helped us slash our food spending.

We cut our spending from around $1000/month on groceries and eating out to about $500.

But I’m not done yet!

I still want to reduce the grocery bill a bit.

I haven’t been able to get the bill below $400 and I think it is because I was planning out 2 weeks at a time.

This meant I still had to swing by the store to get fresh produce.

Shopping in the store inevitably leads to unplanned spending for me so my goal for May is to not step foot in the grocery store.

That’s slightly impractical since we have family visiting soon and they’ll want to go buy some stuff, but as long as I don’t buy anything I’ll consider it a win.

I’ve also started planning our meals for just a week at a time so I can get a better handle on our weekly grocery expenses and hopefully identify other areas to improve on (I’m looking at you frozen lunches).

Overall, I’m hugely excited by our progress and honestly, even though I’m getting sick of the random expenses getting thrown our way, I’m relieved we’ve been able to handle them thanks to the improvements we’ve made in saving in other areas.

If you need help reigning in your food expenses, I hope this post gave you a couple of ideas to try. Let me know in the comments if you try them out or if you have any other tips!

I’ve been feeling pretty discouraged lately.

It seems every time I look at our finances, things are moving in the wrong direction.

We’ve been hit with one thing after another - car repairs, medical expenses, vet bills, more car repairs - it feels like it will never end.

But when I do a deep dive and analyze our other spending categories, I feel a sense of accomplishment.

We’ve reduced most of our spending in general, cut out some things, cut back in others.

Once the house sells (please let the house sell) we’ll practically be cutting our monthly expenses in half.

But the boogieman of budgeting always seems to be the grocery category, so I’m most proud of myself for managing to not just bring it under control but to actually tame it.

Then and Now

In 2017, our monthly grocery expenses averaged out to over $800.

That’s for a family of 3.

And we don’t live in a high cost of living area or buy organic everything.

Honestly, we just didn’t plan or pay attention.

We also spent almost $200 a month eating out.

That’s $1000 per month on food for 3 people.

That’s insane.

So far this year our monthly grocery spend averages a little over $400 and our dining out at $50.

How We Did It

It’s a rather daunting process to cut your food spending in half, but for us, it really came down to an attitude and behavior adjustment.

We tend to be a family who indulges our food cravings.

I’m a lazy cook.

I don’t enjoy it and I prefer not to do it, so if the opportunity to NOT cook presents itself, I’ll jump on it.

I used to anyway.

I used to get super stressed about what to make for dinner, what days did I have time to cook dinner or would it be a drive-thru night if we didn’t have leftovers.

Our grocery bill would rise as I’d hit the store almost every other day trying to find something to cook last minute or just grabbing skillet-ready meals.

More often than not, I’d actually swing through the drive-thru for lunch on our way home from the grocery store, and still feel unprepared for dinner.

The three little words I longed to hear from Mr. GFB were “Let’s eat out.”

The App That Changed My Attitude

I knew from the growing numbers in our budget that we needed to make a change.

I tried to plan out our meals for the week but usually failed.

I’d forget some ingredient or that we had Cub Scouts and didn't have time to cook that night.

I was beginning to feel defeated when I discovered the app Plan To Eat.

Plan To Eat is a menu planning app that does triple duty as a meal planner, recipe collector and shopping list creator all on one.

The calendar interface was the game changer for me.

I can literally just drag a recipe onto a day and boom, dinner is planned, ingredients are added to my list and my stress level normalizes.

I can see at a glance (or make a note if I needed to) of what days we have late nights so I can plan to cook the day before and have leftovers at the ready.

It’s not a free app but was well worth the $39/year subscription just for the reduction in my stress level.

But it also more than pays for itself with the savings I generate by cooking at home.

I credit the Plan To Eat app with the drastic drop in our dining out spending.

The month I began using the app, our spending on take-out fell by 70%.

Having a plan made eating out unnecessary and not wanting to waste ingredients made it undesirable.

[lasso ref="plantoeat" id="4194" link_id="33610"]

The Service That Changed My Habits

Even with a meal plan in place, our grocery bill was still a little higher than I liked.

I’d gotten it down to about $600 a month, but my goal was $300 (I still haven’t hit that).

I started tracking exactly what we were buying so I could see if I could track down the items that were pushing us higher.

Turns out, I was buying some impulse items every trip.

Whether it was snacks or treats or something we’d need eventually but wasn’t part of the plan that week, it was a lot of little things adding up.

So lucky for me our local grocery store started offering a pick-up service.

Order your groceries online, apply any coupons, schedule a pickup time, and then simply drive up and have the groceries loaded into your car.

Amazing!

Switching to grocery pick-up helped me drop the impulse buys and get our bill down to around $450/month.

Not quite where I want it, but a huge improvement.

Moving Forward

Combining the Plan To Eat app with the grocery store pick-up has helped us slash our food spending.

We cut our spending from around $1000/month on groceries and eating out to about $500.

But I’m not done yet!

I still want to reduce the grocery bill a bit.

I haven’t been able to get the bill below $400 and I think it is because I was planning out 2 weeks at a time.

This meant I still had to swing by the store to get fresh produce.

Shopping in the store inevitably leads to unplanned spending for me so my goal for May is to not step foot in the grocery store.

That’s slightly impractical since we have family visiting soon and they’ll want to go buy some stuff, but as long as I don’t buy anything I’ll consider it a win.

I’ve also started planning our meals for just a week at a time so I can get a better handle on our weekly grocery expenses and hopefully identify other areas to improve on (I’m looking at you frozen lunches).

Overall, I’m hugely excited by our progress and honestly, even though I’m getting sick of the random expenses getting thrown our way, I’m relieved we’ve been able to handle them thanks to the improvements we’ve made in saving in other areas.

If you need help reigning in your food expenses, I hope this post gave you a couple of ideas to try. Let me know in the comments if you try them out or if you have any other tips!

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

You're in good hands

You're in good hands

You're in good hands

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.