7 Steps to Get Out of Debt and Stay Out of Debt

This post may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

We live in a world where debt is not just acceptable, it’s expected.

Between the ready availability of credit and the constant barrage of marketing, it’s no wonder that over 41% of Americans are in debt. And that number just keeps rising.

But the fact that you’re reading this suggests you’ve had an ah-ha moment like I did and are ready to get out of debt once and for all.

Stress less & save more!

This FREE budget guide will help you create a budget that works for you!

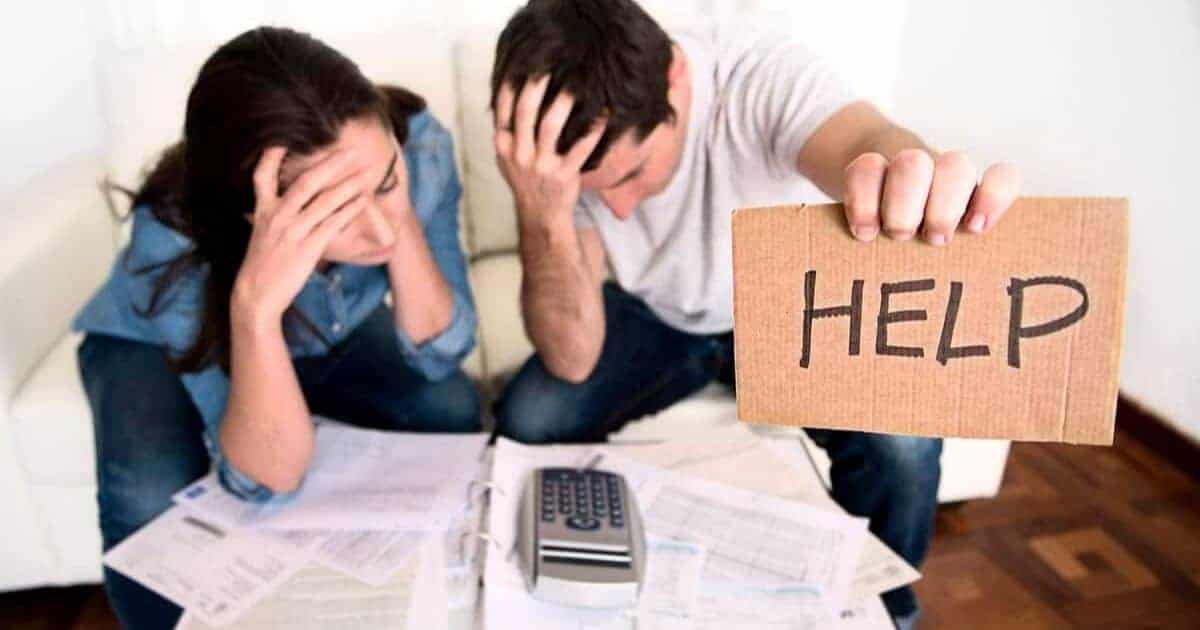

You’re Not Alone

If you’re struggling with debt, just know that you’re not alone and there is a way out.

I was one of those who thought debt was perfectly normal and even advantageous. (Credit card rewards can cloud anyone’s better judgment.)

Fortunately, I never had any problem paying more than the minimums. But even when I wasn’t carrying a balance, I was still spending money I didn’t have.

I was actually spending next month’s paycheck without even realizing it!

It took a renewed focus on our family’s goals and priorities to change my mindset and finally decide to tackle our debt once and for all.

If you’re ready to make the same decision, here are 7 steps you can take to get out of debt and stay out of debt.

Step 1 – Evaluate How You Got Into Debt

The first thing you need to figure out is how you got into debt to begin with.

Are you an impulse buyer? A spontaneous spender? Someone who grabs what they want, without a thought toward how they’ll pay for it.

Do you feel like you’ve got plenty of money and have no idea how you found yourself in debt? Does your bank account always seems to have enough to cover your spending, but you still find yourself struggling?

Perhaps your debt was more happenstance or strategic. Or maybe you were hit by massive medical bills or took out student loans to better yourself and you’re just trying to pay things off as quickly as possible.

Whatever the reason behind your debt, the key to moving forward is recognizing your path to this point so you can deal with the behavior that got you here.

Step 2 – Determine Your Priorities

Regardless of how you got into debt, you’ll need to adjust your spending habits moving forward if you want to not only eliminate your debt but prevent adding to it.

Track Your Spending

The most important thing you can do is stop mindless spending.

The best way to gain awareness is to start tracking your spending.

This will let you know exactly where your money is going so you can reassess your spending and direct more money toward your debt.

Make a Budget

Making a budget or spending plan will help you focus on your priorities and keep you on track.

Budgets have a reputation for being restrictive and stifling, but don’t think of budgeting as a punishment.

Instead, think of your budget as your roadmap.

For this journey to a debt-free life, you’ll want to really focus on the areas you can cut back in order to free up more cash to put toward your debt.

Follow Your Budget

The most important part of budgeting is to actually pay attention to your budget.

My spending habits didn’t really change until I started checking the budget before I made a purchase.

The awareness that simply tracking your spending brings shouldn’t be understated. But without becoming intentional with your spending, you’ll still find yourself struggling to make any progress.

My favorite way to budget is with

You can also use a cash-based envelope system for a more tangible way to stick to your goals. Separate your budget across differently labeled envelopes and only spend the cash you have available.

Forget everything you think you know about budgeting and prepare to experience total control.

Step 3 – Stop Using Credit Cards

It’s best practice to stop doing the thing that got you into debt to begin with, and that means no more swiping for purchases.

That said, once you’ve proven to yourself that you can stick to your spending goals and not overspend, you could add a credit card back into the mix.

Just make 100% sure you can pay it off in full at any given time.

Under no circumstances should you continue to spend on any credit cards carrying a balance.

If you don’t have a card you can pay off in full at any time, I suggest you make the switch to cash or debit.

You’ll have an easier time adjusting your spending habits and you’ll avoid adding more debt on top of what you’ve already accumulated.

PRO TIP

If you don’t feel comfortable swiping your debit card at the gas station or carrying a stack of cash to the grocery store, buy gift cards to use at those stores instead.

Step 4 – Assess Your Debt

It can be a scary prospect, but you can’t make a plan to pay off your debt until you know how much there is to pay.

Gather up your latest credit card and loan statements and tally up your debt.

You’ll want to make a list of each lender, the amount you owe, the interest rate you’re paying on it, as well as the minimum payments due.

Step 5 – How Much Can You Afford to Pay?

Once you know how much debt you have and you’ve got a budget in place, you can start to look for extra money to pay your debt.

- Cut your expenses – Find where you can cut your spending and apply any of that savings directly to your debt.

- Make more money – Consider picking up a side hustle or selling your stuff and putting that money to your debt.

To get some clarity on your monthly bills, use a Monthly Bill Calendar to plot out your income and expenses.

It will help you see how far each paycheck can be stretched and if you should try to cancel or move some expenses based on when you’re paid.

Also, it’s a good idea to take a portion of any cash you free up to work on building an emergency fund to help shield you against unexpected expenses that may pop up and throw off your plans.

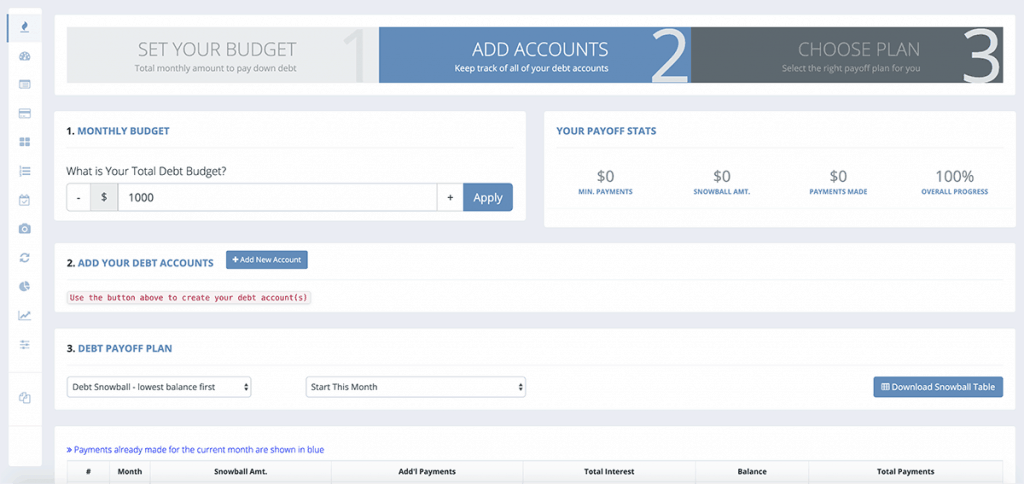

Step 6 – Make a Debt Payoff Plan

There are a couple of common approaches to paying off your debt – the

Choose Your Method

In a nutshell, the

The avalanche method promotes paying off the highest interest debt first. This allows you to pay off your debt faster and more cheaply.

Whether you choose the

Make Your Plan

Using the information you gather from following the previous steps, determine how much you can pay and split it up accordingly.

Using an app like undebt.it makes this easy to do. Simply plug in your debts, select your payoff method and schedule your payments.

You can even play around with the methods inside of

Make a plan to finally be debt-free! Undebt.it makes it easy to build a debt payoff plan and see it through.

Step 7 – Adjust Your Plan as Needed

Unexpected expenses happen.

I’m a huge fan of creating sinking funds for every potential expense I can think of, but even for those of us who think we’re prepared, something unexpected inevitably pops up that throws you off track.

The trick is to roll with the punches. Adjust your spending as needed and start again.

It can be deflating to see all your hard work and sacrifice wiped out. But once you’ve become more aware and intentional with your spending, you’ll find it much easier to get back on track.

Your budget is your plan, but that doesn’t mean it’s set in stone. You can make it as flexible as you need to.

Just like a flight that gets rerouted due to bad weather still ends up at its target destination, your route may change, but eventually, you will reach your goal.

Time to Get Started

None of the steps above will do you any good if you don’t actually start.

Having a plan only works if you implement it.

To review:

The 7 Steps to Getting Out of Debt

- Evaluate How You Got Into Debt

- Determine Your Priorities

- Stop Using Credit Cards

- Assess Your Debt

- How Much Can You Afford to Pay?

- Make a Debt Payoff Plan

- Adjust Your Plan as Needed

Make a commitment to follow the seven steps above and free yourself from the stress of debt forever.

Want to work together?

I would love to help you gain clarity and confidence with your money! If you’re ready to stress less, save more, and enjoy your money, click below to learn more about financial coaching.