9 Quick and Easy Hacks to Improve Your Credit Score

9 Quick and Easy Hacks to Improve Your Credit Score

9 Quick and Easy Hacks to Improve Your Credit Score

Jan 19, 2022

Debt & Credit >

Debt & Credit >

Strategies & Techniques

Strategies & Techniques

Are you looking for quick hacks to improve your credit score fast?

Maybe you've made some mistakes in the past, or you prefer to use cash and need help building your credit history.

Or maybe you've already got good credit but are shooting for a perfect credit score.

Regardless of how high or low your credit score is, it never hurts to get it higher.

Your credit score can be used by a number of people to determine your reliability and the risk of doing business with you.

Employers, landlords, utility providers, insurance companies, and lenders may all take your credit score into account when determining your interest rates, so it pays to get your score as high as possible.

Here are some simple tricks to help you improve your credit score without much effort.

What Exactly is My Credit Score and Where Does it Come From?

Your credit score is a number typically ranging between 300-850 used by lenders to determine the likelihood of you repaying your debt. The higher your score, the better.

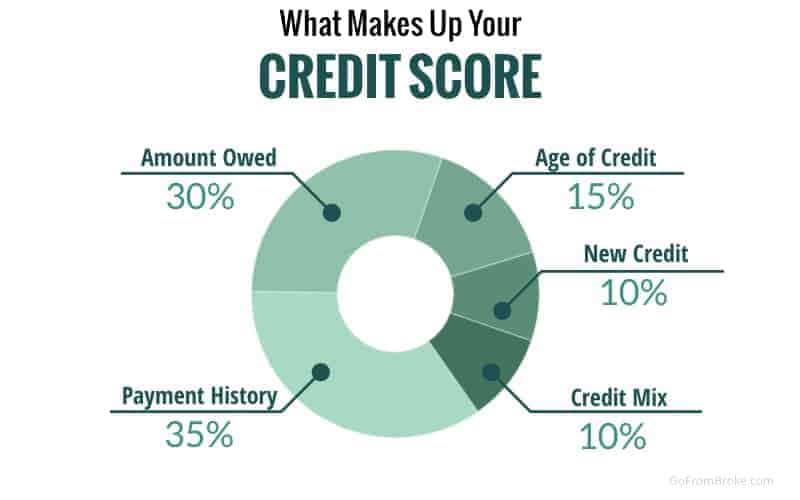

Three credit bureaus gather data on your credit usage: Equifax, TransUnion, and Experian.

Each credit reporting agency records things like your total amount of debt, the credit mix or type of debt (for example, revolving credit like credit card balances versus installment loans like a car loan or student loans), and any recent credit inquiry of new credit.

This mix of data makes up your credit report.

Credit scoring companies then take that info and generate a score to gauge your creditworthiness.

In the United States, there are two main credit scoring companies, VantageScore and FICO.

You can get your free credit score from these companies in a few ways.

The best way to check and monitor your credit score is to use a free tool like Credit Karma.

Credit Karma gathers information from both Transunion and Equifax to give you your VantageScore.

While you may not see the same scores as your lender, this free score should give you a ballpark area to know how well you're doing.

You can also check with your credit card company to see if you can get your FICO credit score for free. American Express and Discover often offer this benefit.

If you don't have that option, but you really want to see your FICO score, you can pay for it with myFICO.

Tips and Tricks to Improve Your Credit Score

Here are some credit score hacks to help you improve your credit score faster.

Pay Your Bills On Time

It should go without saying that your score is heavily reliant on paying your bills on time. A late payment can have a massive negative impact on your score.

Your payment history actually accounts for 35% of your score.

If you have a history of late payments the first and best way to improve your credit score is to start building a record of paying on time.

Automating your monthly payments is an easy way to make sure you keep your accounts in good standing and avoid late fees as well.

You can also use a monthly bill calendar to help you see your bills at a glance and make sure you're planning accordingly.

Dispute Errors on Your Credit Report

According to a survey from Credit.com, 21% of Americans found incorrect information in their credit report.

Correcting these errors is one of the fastest ways to improve your credit score and can often boost your credit score overnight.

You can get a free credit report from each of the three credit reporting agencies directly or by visiting AnnualCreditReport.com.

Disputing something in your credit report isn't always the easiest process and may take some time. But once those negative items are removed, you should see your score increase immediately.

Just be aware that your score could fluctuate in unexpected ways in the short term.

When you file a dispute, VantageScore will exclude the entire account from your scoring, while FICO will only exclude the items in dispute.

That means your VantageScore will also lose any positives like the age of the account, payment history, and available credit as well.

This could result in a lower score until the dispute is resolved.

Pay Off Your Card Early

If you've already got a solid history of not carrying a credit card balance and paying your bills on time, a simple hack to improve your credit score is to pay your cards off early.

Thirty percent of your credit score comes from the total amount of credit you're using.

It's called your credit utilization ratio, and it calculates the amount of available credit compared to the amount you owe.

For example, say you have a few cards with limits that add up to $20,000, and your total amount due is $10,000. That's a 50% utilization rate.

To improve your credit score, you want this number below 30%.

The best way to lower your credit utilization ratio is to find out when your credit card reports your balance and pay it off before they report it. (Usually, the reporting date is your closing date, not your due date, but call to verify.)

If you pay for everything with a credit card, you likely have a high balance reported each month making your utilization ratio high.

Once you know when your credit card accounts report your balance to each credit bureau, make a plan to pay it off before that date.

By paying your balance before they report it, you'll knock your credit utilization rate way down, helping bump up your credit rating.

Be Strategic With Your Payoff Schedule

Credit utilization isn't just considered across your accounts but for each of your credit cards as well.

If you've got multiple credit cards you use for different types of purchases, figure out what the average utilization is across them.

You may think your gas-specific credit card only has a few purchases on it, but if its limit is super low, it may still have a high utilization ratio.

Ideally, you'll pay off all your cards before their reporting dates, but if you can't, paying off the one with the highest utilization rate before its reporting date would still help improve your credit score.

Pay Every Two Weeks

If you put all of your expenses on your card or make a large one-off purchase, it may be inflating your utilization.

Paying your card every two weeks will help raise your credit score by reducing your utilization ratio.

If you're carrying any debt, this may also be a good tactic to pay it off faster and cheaper.

You'll pay less interest by paying more frequently and by increasing your credit score you may qualify for a better interest rate and balance transfer offers.

Ask for a Credit Limit Increase

Disclaimer: only increase your credit limit if you know you won't be using it; otherwise you're defeating the purpose.

Asking your card issuer for an increase in your credit card limit allows you to reverse hack your credit utilization ratio.

Instead of reducing the amount you owe, you're increasing the amount available.

This means the overall utilization ratio goes down. Remember, for a good credit score you'll want to keep this number below 30%.

This tactic is how I was able to continually rotate my debt across zero percent interest credit cards until I could finally pay it all off.

I had a large amount of debt, but by continuing to increase my available credit (combined with the reduced amount owed as I was paying it off), my debt-to-credit ratio kept getting smaller.

The favorable utilization ratio combined with my payment history contributed to a score in the high 700s.

Another note of warning: If you can't control your spending, don't go raising your limits.

You'll do more harm than good that way.

Apart from adding to your debt, if you've got a low credit score due to overspending, asking for an increase may prompt your lender actually to decrease your limit.

Mix Up Your Credit Lines

Ten percent of your score comes from having a mix of credit types in use.

There are two main types of accounts:

open revolving credit accounts - these are the accounts that carry balances over from month to month like credit cards

installment loan accounts - these are made up of fixed-rate loans paid monthly over a predetermined amount of time like a mortgage, car loan, or student loan

So in addition to using your credit card, having a mortgage or auto loan can actually increase your score because loans are considered a different type of debt.

The practical application to something like this might be if you're planning to buy a big-ticket item (like a car) with cash, consider if a loan option may be more beneficial.

For example, many car dealers offer discounts and even 0% financing when you finance through them. If you have the cash in hand simply stick it into a high-yield savings account and set up an automatic payment schedule out of that account.

You'll get a discount, earn some interest, and boost your credit score all at once. (Note that adding a new line of credit will likely lower your score in the short term.)

Also, consider consolidating your credit card debt into a personal loan if you can get a favorable rate.

Not only will this mix up your credit lines, but it will reduce your credit utilization as well.

Get Credit For Saving Money and Paying Your Other Bills

There are a couple of different ways you can start getting credit for non "credit" activities.

Experian Boost is a service that will collect data on your utility and cell phone payments to help improve your payment history.

UltraFICO is another service that uses your checking and savings account balances to boost your FICO score.

Both of these will require you to give them access to your checking account, so if privacy is a concern, they may not be the best option.

Become an Authorized User on Someone Else's Account

If you know someone with excellent credit, see if they'll add you as an authorized user.

This may be a tough sell if you've got a bad history with credit cards or they're just super paranoid about adding people to their accounts (I know I would be).

But the fact is, they never have to give you access to the account and can just hang on to that card with your name on it for safekeeping.

Just by being an authorized user on their account, you'll inherit their positives - including payment history, credit mix, and length of credit history.

Your credit history makes up 15% of your score making this a great option if your credit history is short. If you have a family member like a parent or grandparent willing to add you as an authorized user, this is one of the best credit score hacks to boost your score.

Since their age of accounts will likely be much greater than yours, it could have an immediate impact.

Be aware though that it may affect your credit utilization (positively or negatively) depending on how high a balance the other person usually carries.

Time to Put These Credit Score Hacks to Work!

If you've got bad credit or your score just isn't where you want it, there are ways to improve it.

Lower credit scores can put a strain on your finances. You may have to pay higher deposits for utilities you may not qualify for favorable or lower interest rates.

While paying your bills on time and keeping the balances low is the best way to build and maintain healthy credit, the other credit score hacks above can also help raise your credit score fast.

Are you looking for quick hacks to improve your credit score fast?

Maybe you've made some mistakes in the past, or you prefer to use cash and need help building your credit history.

Or maybe you've already got good credit but are shooting for a perfect credit score.

Regardless of how high or low your credit score is, it never hurts to get it higher.

Your credit score can be used by a number of people to determine your reliability and the risk of doing business with you.

Employers, landlords, utility providers, insurance companies, and lenders may all take your credit score into account when determining your interest rates, so it pays to get your score as high as possible.

Here are some simple tricks to help you improve your credit score without much effort.

What Exactly is My Credit Score and Where Does it Come From?

Your credit score is a number typically ranging between 300-850 used by lenders to determine the likelihood of you repaying your debt. The higher your score, the better.

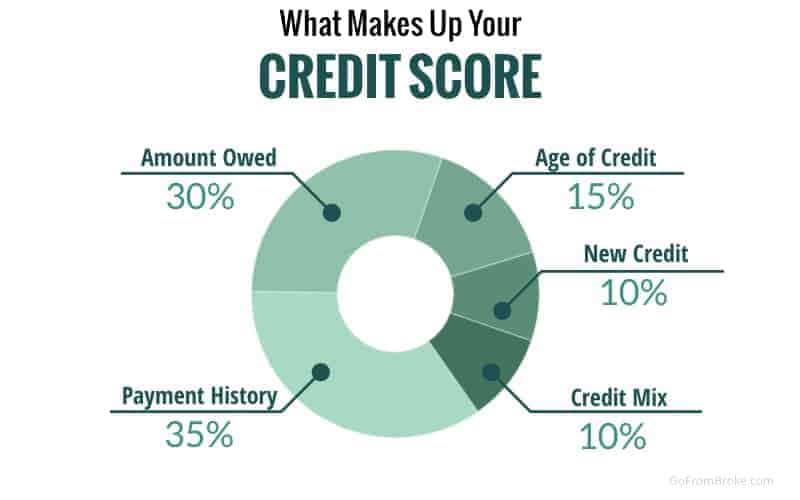

Three credit bureaus gather data on your credit usage: Equifax, TransUnion, and Experian.

Each credit reporting agency records things like your total amount of debt, the credit mix or type of debt (for example, revolving credit like credit card balances versus installment loans like a car loan or student loans), and any recent credit inquiry of new credit.

This mix of data makes up your credit report.

Credit scoring companies then take that info and generate a score to gauge your creditworthiness.

In the United States, there are two main credit scoring companies, VantageScore and FICO.

You can get your free credit score from these companies in a few ways.

The best way to check and monitor your credit score is to use a free tool like Credit Karma.

Credit Karma gathers information from both Transunion and Equifax to give you your VantageScore.

While you may not see the same scores as your lender, this free score should give you a ballpark area to know how well you're doing.

You can also check with your credit card company to see if you can get your FICO credit score for free. American Express and Discover often offer this benefit.

If you don't have that option, but you really want to see your FICO score, you can pay for it with myFICO.

Tips and Tricks to Improve Your Credit Score

Here are some credit score hacks to help you improve your credit score faster.

Pay Your Bills On Time

It should go without saying that your score is heavily reliant on paying your bills on time. A late payment can have a massive negative impact on your score.

Your payment history actually accounts for 35% of your score.

If you have a history of late payments the first and best way to improve your credit score is to start building a record of paying on time.

Automating your monthly payments is an easy way to make sure you keep your accounts in good standing and avoid late fees as well.

You can also use a monthly bill calendar to help you see your bills at a glance and make sure you're planning accordingly.

Dispute Errors on Your Credit Report

According to a survey from Credit.com, 21% of Americans found incorrect information in their credit report.

Correcting these errors is one of the fastest ways to improve your credit score and can often boost your credit score overnight.

You can get a free credit report from each of the three credit reporting agencies directly or by visiting AnnualCreditReport.com.

Disputing something in your credit report isn't always the easiest process and may take some time. But once those negative items are removed, you should see your score increase immediately.

Just be aware that your score could fluctuate in unexpected ways in the short term.

When you file a dispute, VantageScore will exclude the entire account from your scoring, while FICO will only exclude the items in dispute.

That means your VantageScore will also lose any positives like the age of the account, payment history, and available credit as well.

This could result in a lower score until the dispute is resolved.

Pay Off Your Card Early

If you've already got a solid history of not carrying a credit card balance and paying your bills on time, a simple hack to improve your credit score is to pay your cards off early.

Thirty percent of your credit score comes from the total amount of credit you're using.

It's called your credit utilization ratio, and it calculates the amount of available credit compared to the amount you owe.

For example, say you have a few cards with limits that add up to $20,000, and your total amount due is $10,000. That's a 50% utilization rate.

To improve your credit score, you want this number below 30%.

The best way to lower your credit utilization ratio is to find out when your credit card reports your balance and pay it off before they report it. (Usually, the reporting date is your closing date, not your due date, but call to verify.)

If you pay for everything with a credit card, you likely have a high balance reported each month making your utilization ratio high.

Once you know when your credit card accounts report your balance to each credit bureau, make a plan to pay it off before that date.

By paying your balance before they report it, you'll knock your credit utilization rate way down, helping bump up your credit rating.

Be Strategic With Your Payoff Schedule

Credit utilization isn't just considered across your accounts but for each of your credit cards as well.

If you've got multiple credit cards you use for different types of purchases, figure out what the average utilization is across them.

You may think your gas-specific credit card only has a few purchases on it, but if its limit is super low, it may still have a high utilization ratio.

Ideally, you'll pay off all your cards before their reporting dates, but if you can't, paying off the one with the highest utilization rate before its reporting date would still help improve your credit score.

Pay Every Two Weeks

If you put all of your expenses on your card or make a large one-off purchase, it may be inflating your utilization.

Paying your card every two weeks will help raise your credit score by reducing your utilization ratio.

If you're carrying any debt, this may also be a good tactic to pay it off faster and cheaper.

You'll pay less interest by paying more frequently and by increasing your credit score you may qualify for a better interest rate and balance transfer offers.

Ask for a Credit Limit Increase

Disclaimer: only increase your credit limit if you know you won't be using it; otherwise you're defeating the purpose.

Asking your card issuer for an increase in your credit card limit allows you to reverse hack your credit utilization ratio.

Instead of reducing the amount you owe, you're increasing the amount available.

This means the overall utilization ratio goes down. Remember, for a good credit score you'll want to keep this number below 30%.

This tactic is how I was able to continually rotate my debt across zero percent interest credit cards until I could finally pay it all off.

I had a large amount of debt, but by continuing to increase my available credit (combined with the reduced amount owed as I was paying it off), my debt-to-credit ratio kept getting smaller.

The favorable utilization ratio combined with my payment history contributed to a score in the high 700s.

Another note of warning: If you can't control your spending, don't go raising your limits.

You'll do more harm than good that way.

Apart from adding to your debt, if you've got a low credit score due to overspending, asking for an increase may prompt your lender actually to decrease your limit.

Mix Up Your Credit Lines

Ten percent of your score comes from having a mix of credit types in use.

There are two main types of accounts:

open revolving credit accounts - these are the accounts that carry balances over from month to month like credit cards

installment loan accounts - these are made up of fixed-rate loans paid monthly over a predetermined amount of time like a mortgage, car loan, or student loan

So in addition to using your credit card, having a mortgage or auto loan can actually increase your score because loans are considered a different type of debt.

The practical application to something like this might be if you're planning to buy a big-ticket item (like a car) with cash, consider if a loan option may be more beneficial.

For example, many car dealers offer discounts and even 0% financing when you finance through them. If you have the cash in hand simply stick it into a high-yield savings account and set up an automatic payment schedule out of that account.

You'll get a discount, earn some interest, and boost your credit score all at once. (Note that adding a new line of credit will likely lower your score in the short term.)

Also, consider consolidating your credit card debt into a personal loan if you can get a favorable rate.

Not only will this mix up your credit lines, but it will reduce your credit utilization as well.

Get Credit For Saving Money and Paying Your Other Bills

There are a couple of different ways you can start getting credit for non "credit" activities.

Experian Boost is a service that will collect data on your utility and cell phone payments to help improve your payment history.

UltraFICO is another service that uses your checking and savings account balances to boost your FICO score.

Both of these will require you to give them access to your checking account, so if privacy is a concern, they may not be the best option.

Become an Authorized User on Someone Else's Account

If you know someone with excellent credit, see if they'll add you as an authorized user.

This may be a tough sell if you've got a bad history with credit cards or they're just super paranoid about adding people to their accounts (I know I would be).

But the fact is, they never have to give you access to the account and can just hang on to that card with your name on it for safekeeping.

Just by being an authorized user on their account, you'll inherit their positives - including payment history, credit mix, and length of credit history.

Your credit history makes up 15% of your score making this a great option if your credit history is short. If you have a family member like a parent or grandparent willing to add you as an authorized user, this is one of the best credit score hacks to boost your score.

Since their age of accounts will likely be much greater than yours, it could have an immediate impact.

Be aware though that it may affect your credit utilization (positively or negatively) depending on how high a balance the other person usually carries.

Time to Put These Credit Score Hacks to Work!

If you've got bad credit or your score just isn't where you want it, there are ways to improve it.

Lower credit scores can put a strain on your finances. You may have to pay higher deposits for utilities you may not qualify for favorable or lower interest rates.

While paying your bills on time and keeping the balances low is the best way to build and maintain healthy credit, the other credit score hacks above can also help raise your credit score fast.

Are you looking for quick hacks to improve your credit score fast?

Maybe you've made some mistakes in the past, or you prefer to use cash and need help building your credit history.

Or maybe you've already got good credit but are shooting for a perfect credit score.

Regardless of how high or low your credit score is, it never hurts to get it higher.

Your credit score can be used by a number of people to determine your reliability and the risk of doing business with you.

Employers, landlords, utility providers, insurance companies, and lenders may all take your credit score into account when determining your interest rates, so it pays to get your score as high as possible.

Here are some simple tricks to help you improve your credit score without much effort.

What Exactly is My Credit Score and Where Does it Come From?

Your credit score is a number typically ranging between 300-850 used by lenders to determine the likelihood of you repaying your debt. The higher your score, the better.

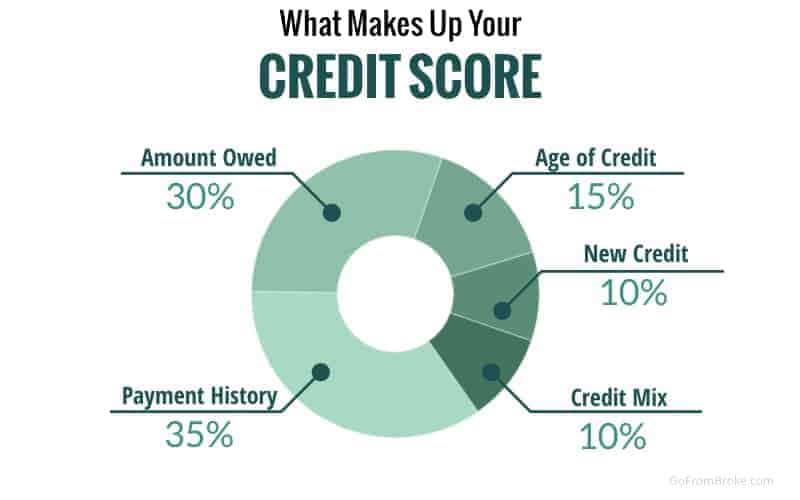

Three credit bureaus gather data on your credit usage: Equifax, TransUnion, and Experian.

Each credit reporting agency records things like your total amount of debt, the credit mix or type of debt (for example, revolving credit like credit card balances versus installment loans like a car loan or student loans), and any recent credit inquiry of new credit.

This mix of data makes up your credit report.

Credit scoring companies then take that info and generate a score to gauge your creditworthiness.

In the United States, there are two main credit scoring companies, VantageScore and FICO.

You can get your free credit score from these companies in a few ways.

The best way to check and monitor your credit score is to use a free tool like Credit Karma.

Credit Karma gathers information from both Transunion and Equifax to give you your VantageScore.

While you may not see the same scores as your lender, this free score should give you a ballpark area to know how well you're doing.

You can also check with your credit card company to see if you can get your FICO credit score for free. American Express and Discover often offer this benefit.

If you don't have that option, but you really want to see your FICO score, you can pay for it with myFICO.

Tips and Tricks to Improve Your Credit Score

Here are some credit score hacks to help you improve your credit score faster.

Pay Your Bills On Time

It should go without saying that your score is heavily reliant on paying your bills on time. A late payment can have a massive negative impact on your score.

Your payment history actually accounts for 35% of your score.

If you have a history of late payments the first and best way to improve your credit score is to start building a record of paying on time.

Automating your monthly payments is an easy way to make sure you keep your accounts in good standing and avoid late fees as well.

You can also use a monthly bill calendar to help you see your bills at a glance and make sure you're planning accordingly.

Dispute Errors on Your Credit Report

According to a survey from Credit.com, 21% of Americans found incorrect information in their credit report.

Correcting these errors is one of the fastest ways to improve your credit score and can often boost your credit score overnight.

You can get a free credit report from each of the three credit reporting agencies directly or by visiting AnnualCreditReport.com.

Disputing something in your credit report isn't always the easiest process and may take some time. But once those negative items are removed, you should see your score increase immediately.

Just be aware that your score could fluctuate in unexpected ways in the short term.

When you file a dispute, VantageScore will exclude the entire account from your scoring, while FICO will only exclude the items in dispute.

That means your VantageScore will also lose any positives like the age of the account, payment history, and available credit as well.

This could result in a lower score until the dispute is resolved.

Pay Off Your Card Early

If you've already got a solid history of not carrying a credit card balance and paying your bills on time, a simple hack to improve your credit score is to pay your cards off early.

Thirty percent of your credit score comes from the total amount of credit you're using.

It's called your credit utilization ratio, and it calculates the amount of available credit compared to the amount you owe.

For example, say you have a few cards with limits that add up to $20,000, and your total amount due is $10,000. That's a 50% utilization rate.

To improve your credit score, you want this number below 30%.

The best way to lower your credit utilization ratio is to find out when your credit card reports your balance and pay it off before they report it. (Usually, the reporting date is your closing date, not your due date, but call to verify.)

If you pay for everything with a credit card, you likely have a high balance reported each month making your utilization ratio high.

Once you know when your credit card accounts report your balance to each credit bureau, make a plan to pay it off before that date.

By paying your balance before they report it, you'll knock your credit utilization rate way down, helping bump up your credit rating.

Be Strategic With Your Payoff Schedule

Credit utilization isn't just considered across your accounts but for each of your credit cards as well.

If you've got multiple credit cards you use for different types of purchases, figure out what the average utilization is across them.

You may think your gas-specific credit card only has a few purchases on it, but if its limit is super low, it may still have a high utilization ratio.

Ideally, you'll pay off all your cards before their reporting dates, but if you can't, paying off the one with the highest utilization rate before its reporting date would still help improve your credit score.

Pay Every Two Weeks

If you put all of your expenses on your card or make a large one-off purchase, it may be inflating your utilization.

Paying your card every two weeks will help raise your credit score by reducing your utilization ratio.

If you're carrying any debt, this may also be a good tactic to pay it off faster and cheaper.

You'll pay less interest by paying more frequently and by increasing your credit score you may qualify for a better interest rate and balance transfer offers.

Ask for a Credit Limit Increase

Disclaimer: only increase your credit limit if you know you won't be using it; otherwise you're defeating the purpose.

Asking your card issuer for an increase in your credit card limit allows you to reverse hack your credit utilization ratio.

Instead of reducing the amount you owe, you're increasing the amount available.

This means the overall utilization ratio goes down. Remember, for a good credit score you'll want to keep this number below 30%.

This tactic is how I was able to continually rotate my debt across zero percent interest credit cards until I could finally pay it all off.

I had a large amount of debt, but by continuing to increase my available credit (combined with the reduced amount owed as I was paying it off), my debt-to-credit ratio kept getting smaller.

The favorable utilization ratio combined with my payment history contributed to a score in the high 700s.

Another note of warning: If you can't control your spending, don't go raising your limits.

You'll do more harm than good that way.

Apart from adding to your debt, if you've got a low credit score due to overspending, asking for an increase may prompt your lender actually to decrease your limit.

Mix Up Your Credit Lines

Ten percent of your score comes from having a mix of credit types in use.

There are two main types of accounts:

open revolving credit accounts - these are the accounts that carry balances over from month to month like credit cards

installment loan accounts - these are made up of fixed-rate loans paid monthly over a predetermined amount of time like a mortgage, car loan, or student loan

So in addition to using your credit card, having a mortgage or auto loan can actually increase your score because loans are considered a different type of debt.

The practical application to something like this might be if you're planning to buy a big-ticket item (like a car) with cash, consider if a loan option may be more beneficial.

For example, many car dealers offer discounts and even 0% financing when you finance through them. If you have the cash in hand simply stick it into a high-yield savings account and set up an automatic payment schedule out of that account.

You'll get a discount, earn some interest, and boost your credit score all at once. (Note that adding a new line of credit will likely lower your score in the short term.)

Also, consider consolidating your credit card debt into a personal loan if you can get a favorable rate.

Not only will this mix up your credit lines, but it will reduce your credit utilization as well.

Get Credit For Saving Money and Paying Your Other Bills

There are a couple of different ways you can start getting credit for non "credit" activities.

Experian Boost is a service that will collect data on your utility and cell phone payments to help improve your payment history.

UltraFICO is another service that uses your checking and savings account balances to boost your FICO score.

Both of these will require you to give them access to your checking account, so if privacy is a concern, they may not be the best option.

Become an Authorized User on Someone Else's Account

If you know someone with excellent credit, see if they'll add you as an authorized user.

This may be a tough sell if you've got a bad history with credit cards or they're just super paranoid about adding people to their accounts (I know I would be).

But the fact is, they never have to give you access to the account and can just hang on to that card with your name on it for safekeeping.

Just by being an authorized user on their account, you'll inherit their positives - including payment history, credit mix, and length of credit history.

Your credit history makes up 15% of your score making this a great option if your credit history is short. If you have a family member like a parent or grandparent willing to add you as an authorized user, this is one of the best credit score hacks to boost your score.

Since their age of accounts will likely be much greater than yours, it could have an immediate impact.

Be aware though that it may affect your credit utilization (positively or negatively) depending on how high a balance the other person usually carries.

Time to Put These Credit Score Hacks to Work!

If you've got bad credit or your score just isn't where you want it, there are ways to improve it.

Lower credit scores can put a strain on your finances. You may have to pay higher deposits for utilities you may not qualify for favorable or lower interest rates.

While paying your bills on time and keeping the balances low is the best way to build and maintain healthy credit, the other credit score hacks above can also help raise your credit score fast.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

You're in good hands

You're in good hands

You're in good hands

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.