Monthly Money Challenge: Cash Diet

Monthly Money Challenge: Cash Diet

Monthly Money Challenge: Cash Diet

Nov 4, 2019

Money Challenges >

Money Challenges >

Strategies & Techniques

Strategies & Techniques

We live in a digital world and if you’re at all like me you enjoy the convenience that comes with it.

But for this month’s challenge, I was contemplating something that would seriously hamper that -- going on a cash diet.

What's a Cash Diet?

A cash diet is a lot like a regular diet, only instead of cutting carbs, you're cutting out the cards - no credit or debit cards. You can only spend actual cash.

It's a great way to detox after a spending binge or just when you need a financial reset, but it's no easy task.

The Problem With Going Cash-Only

You may not think credit cards are huge time savers but consider the convenience of paying at the pump, ordering anything online, or not having to find an ATM.

I may be spoiled, but I have no desire to drag my kid in and out of the car in Arizona summers to pay for gas.

I’ve been debating a cash-only challenge for a while, but haven’t been able to talk myself into giving up the convenience of credit cards.

Why Go On a Cash Diet?

It's easy in our digital world to get caught up in swiping the card and not even realize what you're spending.

Even with a budget, there can be a disconnect between seeing the numbers on a spreadsheet get smaller versus watching the actual cash disappear.

There are multiple benefits of a cash-only diet: becoming more aware and deliberate with your spending, being able to see your savings in a tangible way, and having less temptation to spend money you don't have.

But I've always made excuses because the logistics seemed a bridge too far.

Until it finally dawned on me that I don’t have to go on a complete cash-only diet. I can start by targeting a specific problem area.

Like giving up soda instead of all sweets, maybe a limited cash diet will be more doable.

So that’s my plan.

This month’s money challenge is to go on a cash-only diet in a single budget category.

How to Go On a Cash Diet

Step 1: Choose Your Cash Diet Category

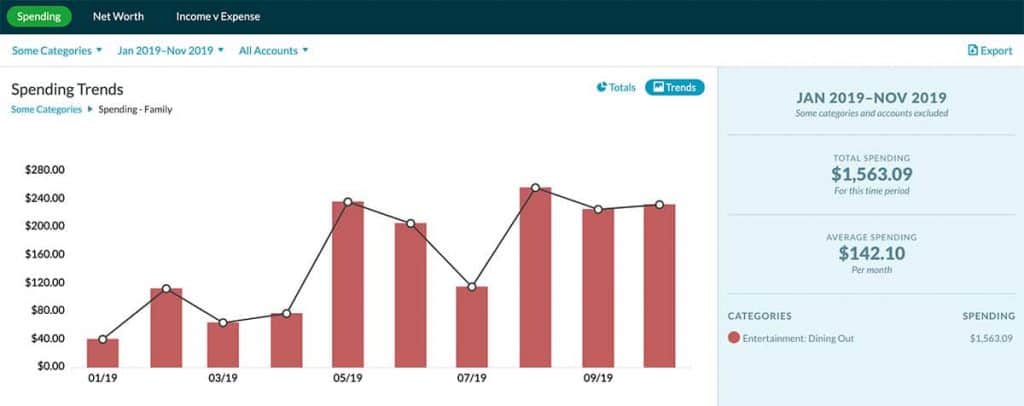

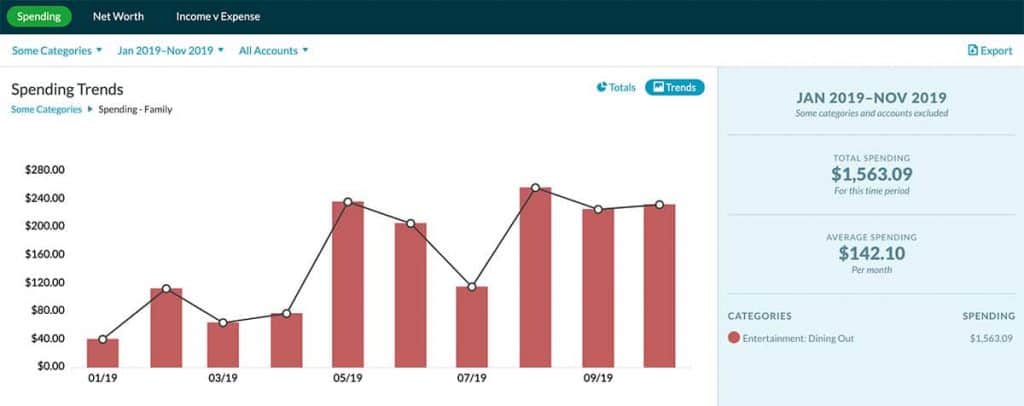

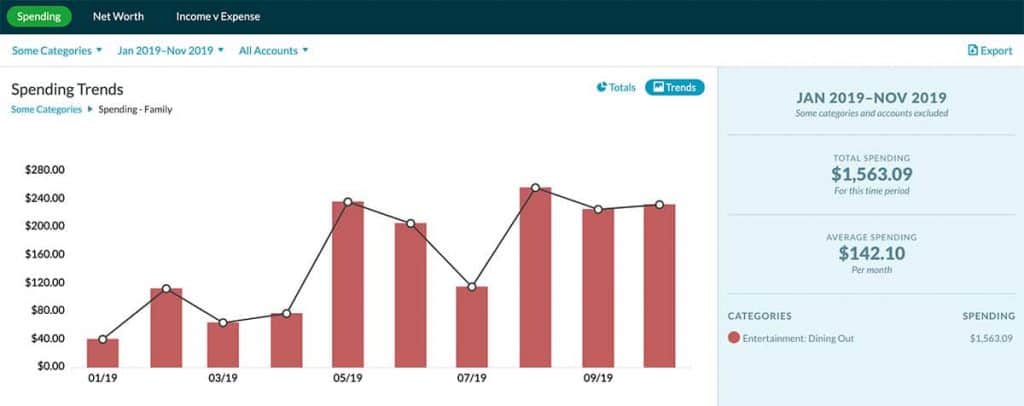

This is an easy one for me. Dining out is like a black hole in our family's budget - always sucking up the excesses in other categories to cover the inevitable overspending.

While we’ve come a long way from the hundreds we used to spend per month, it's still an area we can improve on.

If you want to join in on the challenge, pinpoint the one category in your budget that you tend to overspend or just want to reign in.

Some common ones are:

Eating out

Clothing

Groceries

Entertainment

Personal Care

Household Goods & Home Improvement

Once you’ve picked your category it’s time to make your plan.

Step 2: Make a Spending or Savings Goal & Hit Up the ATM

Switching to cash isn’t a solution in itself. It may help prevent overspending, but what if we overestimate how much we want to spend from the start?

I’m guessing if I have cash left over by the end of the month, I’m going to see it as an excuse to order some pizza.

Since the whole point of this experiment is to see if I can save money in a problem category, I’ve looked back over our Dining Out expenses this year and am setting a goal to spend a little less than our average.

Based on our average, I think a cash diet of $125 looks good.

YNAB makes this really easy. You can choose a specific spending category in reports and select a date range to generate your average spending.

If you haven't been tracking your spending and aren't sure what's a good goal amount, take a look at your previous credit card and bank statements to tally up your expenses.

It may be a bit of work, but you want to set a reasonable goal or you risk setting yourself up for failure.

Once you’ve decided on a spending goal it’s time to hit the ATM and get the cash you can use for the month.

Step 3: Put Your Cash Someplace Safe

One of the downsides to carrying cash is the ease with which you can lose it.

Maybe not the safest place...

To avoid that risk, I’m only going to carry enough cash to cover one meal out - at a fast-food restaurant.

I’m hoping that will also curb the impulse to eat out when it’s not been planned.

Spontaneous dining excursions have been a big weakness for us. Limiting the cash on hand will force us to pre-plan any restaurant spending.

For the cash I’m not carrying on me, I’ve got an envelope labeled and stored in a safe spot.

Step 4: Record Your Purchases

Since I don’t usually spend cash, I don’t budget it. This means I have a bad habit of treating cash as “free” money to spend without tracking.

For this challenge, I want to shift my mindset to be as deliberate with cash spending as I am with other purchases.

So I’m planning on writing down every purchase on the cash envelope and sticking receipts inside for accountability.

This will not only give us a running tally of how much cash we have but being able to match up the receipts to that tally will keep us honest - no raiding the cash stash!

Evaluating The Results

The final step will come at the end of the month when we get to either suffer the indignity of eating my cooking or celebrate our frugality by ordering take-out.

I’m joking.

My cooking isn’t that bad.

But it will be easy to see how well this particular challenge works out for saving money based on how much cash is left.

So are you up for a cash diet this month?

Hit me up on social media if you want to join in!

We live in a digital world and if you’re at all like me you enjoy the convenience that comes with it.

But for this month’s challenge, I was contemplating something that would seriously hamper that -- going on a cash diet.

What's a Cash Diet?

A cash diet is a lot like a regular diet, only instead of cutting carbs, you're cutting out the cards - no credit or debit cards. You can only spend actual cash.

It's a great way to detox after a spending binge or just when you need a financial reset, but it's no easy task.

The Problem With Going Cash-Only

You may not think credit cards are huge time savers but consider the convenience of paying at the pump, ordering anything online, or not having to find an ATM.

I may be spoiled, but I have no desire to drag my kid in and out of the car in Arizona summers to pay for gas.

I’ve been debating a cash-only challenge for a while, but haven’t been able to talk myself into giving up the convenience of credit cards.

Why Go On a Cash Diet?

It's easy in our digital world to get caught up in swiping the card and not even realize what you're spending.

Even with a budget, there can be a disconnect between seeing the numbers on a spreadsheet get smaller versus watching the actual cash disappear.

There are multiple benefits of a cash-only diet: becoming more aware and deliberate with your spending, being able to see your savings in a tangible way, and having less temptation to spend money you don't have.

But I've always made excuses because the logistics seemed a bridge too far.

Until it finally dawned on me that I don’t have to go on a complete cash-only diet. I can start by targeting a specific problem area.

Like giving up soda instead of all sweets, maybe a limited cash diet will be more doable.

So that’s my plan.

This month’s money challenge is to go on a cash-only diet in a single budget category.

How to Go On a Cash Diet

Step 1: Choose Your Cash Diet Category

This is an easy one for me. Dining out is like a black hole in our family's budget - always sucking up the excesses in other categories to cover the inevitable overspending.

While we’ve come a long way from the hundreds we used to spend per month, it's still an area we can improve on.

If you want to join in on the challenge, pinpoint the one category in your budget that you tend to overspend or just want to reign in.

Some common ones are:

Eating out

Clothing

Groceries

Entertainment

Personal Care

Household Goods & Home Improvement

Once you’ve picked your category it’s time to make your plan.

Step 2: Make a Spending or Savings Goal & Hit Up the ATM

Switching to cash isn’t a solution in itself. It may help prevent overspending, but what if we overestimate how much we want to spend from the start?

I’m guessing if I have cash left over by the end of the month, I’m going to see it as an excuse to order some pizza.

Since the whole point of this experiment is to see if I can save money in a problem category, I’ve looked back over our Dining Out expenses this year and am setting a goal to spend a little less than our average.

Based on our average, I think a cash diet of $125 looks good.

YNAB makes this really easy. You can choose a specific spending category in reports and select a date range to generate your average spending.

If you haven't been tracking your spending and aren't sure what's a good goal amount, take a look at your previous credit card and bank statements to tally up your expenses.

It may be a bit of work, but you want to set a reasonable goal or you risk setting yourself up for failure.

Once you’ve decided on a spending goal it’s time to hit the ATM and get the cash you can use for the month.

Step 3: Put Your Cash Someplace Safe

One of the downsides to carrying cash is the ease with which you can lose it.

Maybe not the safest place...

To avoid that risk, I’m only going to carry enough cash to cover one meal out - at a fast-food restaurant.

I’m hoping that will also curb the impulse to eat out when it’s not been planned.

Spontaneous dining excursions have been a big weakness for us. Limiting the cash on hand will force us to pre-plan any restaurant spending.

For the cash I’m not carrying on me, I’ve got an envelope labeled and stored in a safe spot.

Step 4: Record Your Purchases

Since I don’t usually spend cash, I don’t budget it. This means I have a bad habit of treating cash as “free” money to spend without tracking.

For this challenge, I want to shift my mindset to be as deliberate with cash spending as I am with other purchases.

So I’m planning on writing down every purchase on the cash envelope and sticking receipts inside for accountability.

This will not only give us a running tally of how much cash we have but being able to match up the receipts to that tally will keep us honest - no raiding the cash stash!

Evaluating The Results

The final step will come at the end of the month when we get to either suffer the indignity of eating my cooking or celebrate our frugality by ordering take-out.

I’m joking.

My cooking isn’t that bad.

But it will be easy to see how well this particular challenge works out for saving money based on how much cash is left.

So are you up for a cash diet this month?

Hit me up on social media if you want to join in!

We live in a digital world and if you’re at all like me you enjoy the convenience that comes with it.

But for this month’s challenge, I was contemplating something that would seriously hamper that -- going on a cash diet.

What's a Cash Diet?

A cash diet is a lot like a regular diet, only instead of cutting carbs, you're cutting out the cards - no credit or debit cards. You can only spend actual cash.

It's a great way to detox after a spending binge or just when you need a financial reset, but it's no easy task.

The Problem With Going Cash-Only

You may not think credit cards are huge time savers but consider the convenience of paying at the pump, ordering anything online, or not having to find an ATM.

I may be spoiled, but I have no desire to drag my kid in and out of the car in Arizona summers to pay for gas.

I’ve been debating a cash-only challenge for a while, but haven’t been able to talk myself into giving up the convenience of credit cards.

Why Go On a Cash Diet?

It's easy in our digital world to get caught up in swiping the card and not even realize what you're spending.

Even with a budget, there can be a disconnect between seeing the numbers on a spreadsheet get smaller versus watching the actual cash disappear.

There are multiple benefits of a cash-only diet: becoming more aware and deliberate with your spending, being able to see your savings in a tangible way, and having less temptation to spend money you don't have.

But I've always made excuses because the logistics seemed a bridge too far.

Until it finally dawned on me that I don’t have to go on a complete cash-only diet. I can start by targeting a specific problem area.

Like giving up soda instead of all sweets, maybe a limited cash diet will be more doable.

So that’s my plan.

This month’s money challenge is to go on a cash-only diet in a single budget category.

How to Go On a Cash Diet

Step 1: Choose Your Cash Diet Category

This is an easy one for me. Dining out is like a black hole in our family's budget - always sucking up the excesses in other categories to cover the inevitable overspending.

While we’ve come a long way from the hundreds we used to spend per month, it's still an area we can improve on.

If you want to join in on the challenge, pinpoint the one category in your budget that you tend to overspend or just want to reign in.

Some common ones are:

Eating out

Clothing

Groceries

Entertainment

Personal Care

Household Goods & Home Improvement

Once you’ve picked your category it’s time to make your plan.

Step 2: Make a Spending or Savings Goal & Hit Up the ATM

Switching to cash isn’t a solution in itself. It may help prevent overspending, but what if we overestimate how much we want to spend from the start?

I’m guessing if I have cash left over by the end of the month, I’m going to see it as an excuse to order some pizza.

Since the whole point of this experiment is to see if I can save money in a problem category, I’ve looked back over our Dining Out expenses this year and am setting a goal to spend a little less than our average.

Based on our average, I think a cash diet of $125 looks good.

YNAB makes this really easy. You can choose a specific spending category in reports and select a date range to generate your average spending.

If you haven't been tracking your spending and aren't sure what's a good goal amount, take a look at your previous credit card and bank statements to tally up your expenses.

It may be a bit of work, but you want to set a reasonable goal or you risk setting yourself up for failure.

Once you’ve decided on a spending goal it’s time to hit the ATM and get the cash you can use for the month.

Step 3: Put Your Cash Someplace Safe

One of the downsides to carrying cash is the ease with which you can lose it.

Maybe not the safest place...

To avoid that risk, I’m only going to carry enough cash to cover one meal out - at a fast-food restaurant.

I’m hoping that will also curb the impulse to eat out when it’s not been planned.

Spontaneous dining excursions have been a big weakness for us. Limiting the cash on hand will force us to pre-plan any restaurant spending.

For the cash I’m not carrying on me, I’ve got an envelope labeled and stored in a safe spot.

Step 4: Record Your Purchases

Since I don’t usually spend cash, I don’t budget it. This means I have a bad habit of treating cash as “free” money to spend without tracking.

For this challenge, I want to shift my mindset to be as deliberate with cash spending as I am with other purchases.

So I’m planning on writing down every purchase on the cash envelope and sticking receipts inside for accountability.

This will not only give us a running tally of how much cash we have but being able to match up the receipts to that tally will keep us honest - no raiding the cash stash!

Evaluating The Results

The final step will come at the end of the month when we get to either suffer the indignity of eating my cooking or celebrate our frugality by ordering take-out.

I’m joking.

My cooking isn’t that bad.

But it will be easy to see how well this particular challenge works out for saving money based on how much cash is left.

So are you up for a cash diet this month?

Hit me up on social media if you want to join in!

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

You're in good hands

You're in good hands

You're in good hands

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.