How To Save Your Budget From Hidden Subscriptions

How To Save Your Budget From Hidden Subscriptions

How To Save Your Budget From Hidden Subscriptions

Sep 16, 2021

Budgeting >

Budgeting >

Challenges & Solutions

Challenges & Solutions

One of the biggest hidden expenses many of us have is subscriptions.

We either get "surprised" by a recurring charge after the initial purchase or convince ourselves that a monthly subscription plan is a good deal without considering how much it's adding up to.

Subscriptions can be hard to track and budget sometimes, but if you want to be intentional with your spending, getting a grip on your subscriptions is a must.

Start With Determining How Many Active Subscriptions You Have

Take a minute and think about your monthly subscriptions.

How many do you have?

Do you even know?

Some popular ones might be Netflix, Hulu, YouTube, Amazon Prime, maybe even a subscription box or two.

We all have some sort of recurring billing or subscription service each month, the trick is to know what they are.

I've got a few that are obvious to me because they have their own budget categories - phone, internet, TV.

But there are also the ones I tend to forget about. The ones that are buried down in other budget categories like "apps," "entertainment," "security," and "fun money."

They're almost all online services or apps with recurring payments, either monthly or annual subscription plans that get lost or forgotten in our normal day-to-day spending categories.

How to Find Hidden Subscriptions

If you're in a similar situation, the first thing to do is figure out just how many active subscriptions you've currently got.

I started with reviewing my credit card purchases and found 16(!) monthly subscription charges.

As shocking as that may be, I knew that was just the monthly subscription plans and I probably had some quarterly or annual ones as well.

I ended up finding another 15(!!!) of those.

You'd think that would cover them all, but there are a few other places to check - iOS, Google Play, and Amazon.

These subscriptions aren't always easy to find so here are some walkthroughs for each service.

How to find your subscriptions on iPhone:

Tap App Store

Tap your profile pic in the upper right (you may have to sign in with your Apple ID)

Tap manage subscriptions

Here you can see all your active subscriptions and your expired ones. Under the active list, it should specify which of your Apple subscriptions has a future billing date or expiration date.

How to manage subscriptions on Amazon:

Log in

Hover over Account and Lists

Select Your Membership and Subscriptions

Services like Amazon Prime, Audible, and Kindle Unlimited should be listed here. However, some add-ons for Prime Video or digital subscriptions may require more digging.

Per Amazon's website:

Keep in mind that Subscribe with Amazon subscriptions are different than Amazon Video add-on subscriptions and other content subscriptions you may have purchased from the Appstore, Kindle Store, or Digital Software Store.

To view or manage other types of subscriptions, you'll need to open the related subscription manager in Your Account. For quick navigation to one of these pages, look for the "Don't see your subscription?" section at the bottom of Your Memberships and Subscriptions.

How to manage subscriptions on Google Play:

Open the Google Play Store

Make sure you're signed in to the correct Google account

Tap the menu

Tap Subscriptions

I don't have an Android, but according to Google's instructions, you can tap the subscription and then tap cancel to get further instructions.

How to Manage Your Active Subscriptions

After searching through all the places I could think of, I found 34(!!!) subscriptions we were paying for.

That's a lot of hidden expenses!

One of the most important mindset changes that helped us break free of debt was learning to be intentional with our spending.

But it's hard to be intentional after the fact, and that's pretty much how subscriptions work.

You may have made the decision for that initial subscription cost, but the future ones seem to pop up as an afterthought.

So to tackle this growing and potentially dangerous aspect of my budget, I want to make sure I've got complete awareness moving forward.

I've got three methods I'm going to use to help me gain more awareness and control over this recurring subscription situation.

Schedule future transactions in my budget.

Cancel all current subscriptions on my phone.

Make a habit of adding "renewal reminders" to my calendar so I can decide whether to continue a subscription before I'm charged.

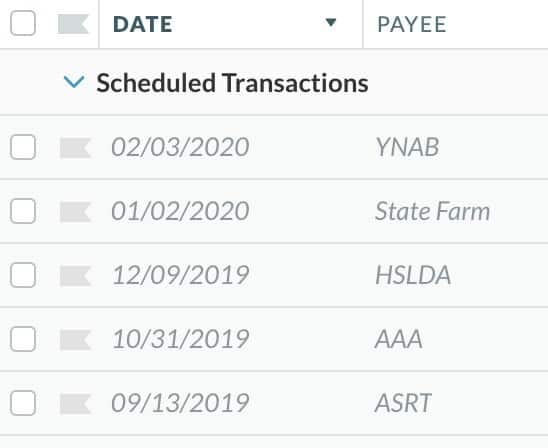

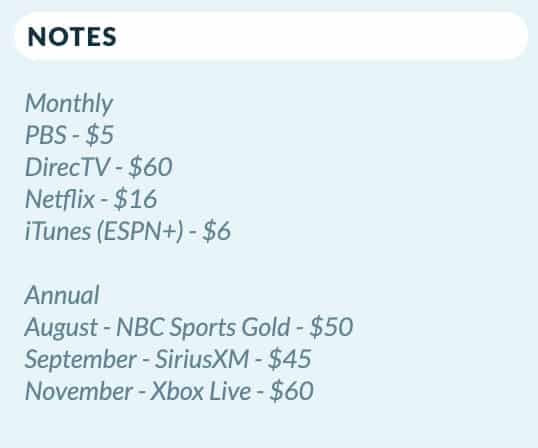

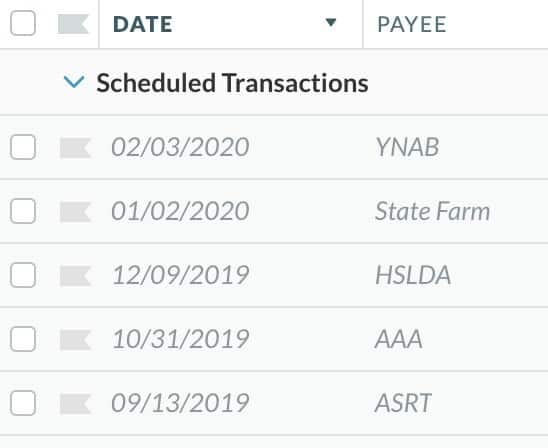

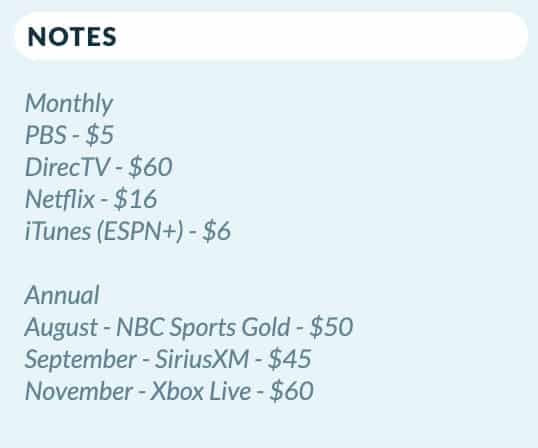

1 - Schedule Future Transactions

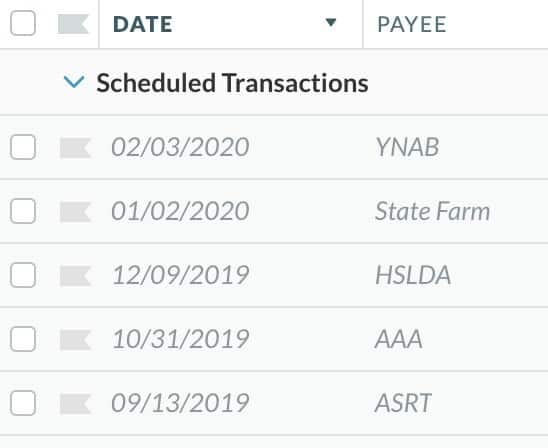

Scheduling future transactions in YNAB will make sure I budget as needed.

I won't run the risk of any surprise expenses derailing my budget, but they're still kind of afterthoughts when it comes to deliberately making the purchase decision.

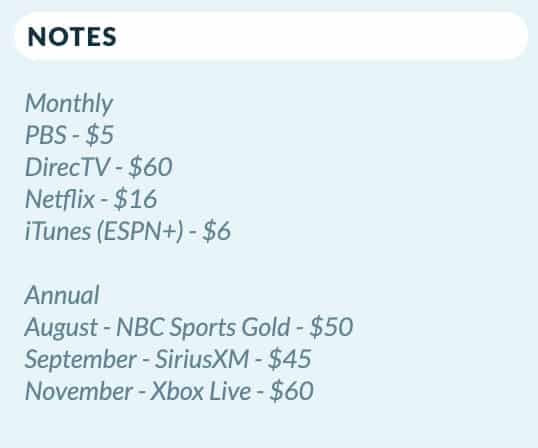

To get a clearer picture of all the subscriptions we have, I've also added each recurring expense into the notes section of my budget categories. Now I can see at a glance what we're paying and when.

This helps give me a bit of a heads up so I can make more intentional decisions moving forward each month.

2 - Cancel All App Store Subscriptions

I won't even try to guess how many times I've "accidentally" paid for app subscriptions because I forgot to cancel before the free trial was over.

To avoid this in the future I'm canceling all my current mobile app subscriptions and making a point to cancel any trials immediately after I sign up.

It may seem severe, but it's easy enough to re-subscribe and it will force me to make that purchasing decision each time.

3 - Add Reminders to My Calendar

For all future subscriptions or free trials, I'm also adding a notification to my calendar. A "renewal reminder" at least a week before the charge hits my bank account.

This not only forces me to make the deliberate decision to purchase again or not but also gives me time to address the expenses that require more effort to cancel.

Services like DirecTV and SiriusXM can be a hassle to cancel since you have to call in person.

Giving myself a week to get it done makes sure I don't procrastinate past the renewal date.

Can You Justify the Value?

Buying into subscription plans isn't necessarily a bad thing as long as you can justify the value.

But they can quickly become a slippery slope toward credit card debt when those small monthly payments start to add up.

The goal isn't necessarily to eliminate your subscriptions, though that will undoubtedly save you time and money.

The idea is to make sure you're aware of the expense and deliberate in your choice to pay it.

Only you can set the priorities you have for your money.

One of the biggest hidden expenses many of us have is subscriptions.

We either get "surprised" by a recurring charge after the initial purchase or convince ourselves that a monthly subscription plan is a good deal without considering how much it's adding up to.

Subscriptions can be hard to track and budget sometimes, but if you want to be intentional with your spending, getting a grip on your subscriptions is a must.

Start With Determining How Many Active Subscriptions You Have

Take a minute and think about your monthly subscriptions.

How many do you have?

Do you even know?

Some popular ones might be Netflix, Hulu, YouTube, Amazon Prime, maybe even a subscription box or two.

We all have some sort of recurring billing or subscription service each month, the trick is to know what they are.

I've got a few that are obvious to me because they have their own budget categories - phone, internet, TV.

But there are also the ones I tend to forget about. The ones that are buried down in other budget categories like "apps," "entertainment," "security," and "fun money."

They're almost all online services or apps with recurring payments, either monthly or annual subscription plans that get lost or forgotten in our normal day-to-day spending categories.

How to Find Hidden Subscriptions

If you're in a similar situation, the first thing to do is figure out just how many active subscriptions you've currently got.

I started with reviewing my credit card purchases and found 16(!) monthly subscription charges.

As shocking as that may be, I knew that was just the monthly subscription plans and I probably had some quarterly or annual ones as well.

I ended up finding another 15(!!!) of those.

You'd think that would cover them all, but there are a few other places to check - iOS, Google Play, and Amazon.

These subscriptions aren't always easy to find so here are some walkthroughs for each service.

How to find your subscriptions on iPhone:

Tap App Store

Tap your profile pic in the upper right (you may have to sign in with your Apple ID)

Tap manage subscriptions

Here you can see all your active subscriptions and your expired ones. Under the active list, it should specify which of your Apple subscriptions has a future billing date or expiration date.

How to manage subscriptions on Amazon:

Log in

Hover over Account and Lists

Select Your Membership and Subscriptions

Services like Amazon Prime, Audible, and Kindle Unlimited should be listed here. However, some add-ons for Prime Video or digital subscriptions may require more digging.

Per Amazon's website:

Keep in mind that Subscribe with Amazon subscriptions are different than Amazon Video add-on subscriptions and other content subscriptions you may have purchased from the Appstore, Kindle Store, or Digital Software Store.

To view or manage other types of subscriptions, you'll need to open the related subscription manager in Your Account. For quick navigation to one of these pages, look for the "Don't see your subscription?" section at the bottom of Your Memberships and Subscriptions.

How to manage subscriptions on Google Play:

Open the Google Play Store

Make sure you're signed in to the correct Google account

Tap the menu

Tap Subscriptions

I don't have an Android, but according to Google's instructions, you can tap the subscription and then tap cancel to get further instructions.

How to Manage Your Active Subscriptions

After searching through all the places I could think of, I found 34(!!!) subscriptions we were paying for.

That's a lot of hidden expenses!

One of the most important mindset changes that helped us break free of debt was learning to be intentional with our spending.

But it's hard to be intentional after the fact, and that's pretty much how subscriptions work.

You may have made the decision for that initial subscription cost, but the future ones seem to pop up as an afterthought.

So to tackle this growing and potentially dangerous aspect of my budget, I want to make sure I've got complete awareness moving forward.

I've got three methods I'm going to use to help me gain more awareness and control over this recurring subscription situation.

Schedule future transactions in my budget.

Cancel all current subscriptions on my phone.

Make a habit of adding "renewal reminders" to my calendar so I can decide whether to continue a subscription before I'm charged.

1 - Schedule Future Transactions

Scheduling future transactions in YNAB will make sure I budget as needed.

I won't run the risk of any surprise expenses derailing my budget, but they're still kind of afterthoughts when it comes to deliberately making the purchase decision.

To get a clearer picture of all the subscriptions we have, I've also added each recurring expense into the notes section of my budget categories. Now I can see at a glance what we're paying and when.

This helps give me a bit of a heads up so I can make more intentional decisions moving forward each month.

2 - Cancel All App Store Subscriptions

I won't even try to guess how many times I've "accidentally" paid for app subscriptions because I forgot to cancel before the free trial was over.

To avoid this in the future I'm canceling all my current mobile app subscriptions and making a point to cancel any trials immediately after I sign up.

It may seem severe, but it's easy enough to re-subscribe and it will force me to make that purchasing decision each time.

3 - Add Reminders to My Calendar

For all future subscriptions or free trials, I'm also adding a notification to my calendar. A "renewal reminder" at least a week before the charge hits my bank account.

This not only forces me to make the deliberate decision to purchase again or not but also gives me time to address the expenses that require more effort to cancel.

Services like DirecTV and SiriusXM can be a hassle to cancel since you have to call in person.

Giving myself a week to get it done makes sure I don't procrastinate past the renewal date.

Can You Justify the Value?

Buying into subscription plans isn't necessarily a bad thing as long as you can justify the value.

But they can quickly become a slippery slope toward credit card debt when those small monthly payments start to add up.

The goal isn't necessarily to eliminate your subscriptions, though that will undoubtedly save you time and money.

The idea is to make sure you're aware of the expense and deliberate in your choice to pay it.

Only you can set the priorities you have for your money.

One of the biggest hidden expenses many of us have is subscriptions.

We either get "surprised" by a recurring charge after the initial purchase or convince ourselves that a monthly subscription plan is a good deal without considering how much it's adding up to.

Subscriptions can be hard to track and budget sometimes, but if you want to be intentional with your spending, getting a grip on your subscriptions is a must.

Start With Determining How Many Active Subscriptions You Have

Take a minute and think about your monthly subscriptions.

How many do you have?

Do you even know?

Some popular ones might be Netflix, Hulu, YouTube, Amazon Prime, maybe even a subscription box or two.

We all have some sort of recurring billing or subscription service each month, the trick is to know what they are.

I've got a few that are obvious to me because they have their own budget categories - phone, internet, TV.

But there are also the ones I tend to forget about. The ones that are buried down in other budget categories like "apps," "entertainment," "security," and "fun money."

They're almost all online services or apps with recurring payments, either monthly or annual subscription plans that get lost or forgotten in our normal day-to-day spending categories.

How to Find Hidden Subscriptions

If you're in a similar situation, the first thing to do is figure out just how many active subscriptions you've currently got.

I started with reviewing my credit card purchases and found 16(!) monthly subscription charges.

As shocking as that may be, I knew that was just the monthly subscription plans and I probably had some quarterly or annual ones as well.

I ended up finding another 15(!!!) of those.

You'd think that would cover them all, but there are a few other places to check - iOS, Google Play, and Amazon.

These subscriptions aren't always easy to find so here are some walkthroughs for each service.

How to find your subscriptions on iPhone:

Tap App Store

Tap your profile pic in the upper right (you may have to sign in with your Apple ID)

Tap manage subscriptions

Here you can see all your active subscriptions and your expired ones. Under the active list, it should specify which of your Apple subscriptions has a future billing date or expiration date.

How to manage subscriptions on Amazon:

Log in

Hover over Account and Lists

Select Your Membership and Subscriptions

Services like Amazon Prime, Audible, and Kindle Unlimited should be listed here. However, some add-ons for Prime Video or digital subscriptions may require more digging.

Per Amazon's website:

Keep in mind that Subscribe with Amazon subscriptions are different than Amazon Video add-on subscriptions and other content subscriptions you may have purchased from the Appstore, Kindle Store, or Digital Software Store.

To view or manage other types of subscriptions, you'll need to open the related subscription manager in Your Account. For quick navigation to one of these pages, look for the "Don't see your subscription?" section at the bottom of Your Memberships and Subscriptions.

How to manage subscriptions on Google Play:

Open the Google Play Store

Make sure you're signed in to the correct Google account

Tap the menu

Tap Subscriptions

I don't have an Android, but according to Google's instructions, you can tap the subscription and then tap cancel to get further instructions.

How to Manage Your Active Subscriptions

After searching through all the places I could think of, I found 34(!!!) subscriptions we were paying for.

That's a lot of hidden expenses!

One of the most important mindset changes that helped us break free of debt was learning to be intentional with our spending.

But it's hard to be intentional after the fact, and that's pretty much how subscriptions work.

You may have made the decision for that initial subscription cost, but the future ones seem to pop up as an afterthought.

So to tackle this growing and potentially dangerous aspect of my budget, I want to make sure I've got complete awareness moving forward.

I've got three methods I'm going to use to help me gain more awareness and control over this recurring subscription situation.

Schedule future transactions in my budget.

Cancel all current subscriptions on my phone.

Make a habit of adding "renewal reminders" to my calendar so I can decide whether to continue a subscription before I'm charged.

1 - Schedule Future Transactions

Scheduling future transactions in YNAB will make sure I budget as needed.

I won't run the risk of any surprise expenses derailing my budget, but they're still kind of afterthoughts when it comes to deliberately making the purchase decision.

To get a clearer picture of all the subscriptions we have, I've also added each recurring expense into the notes section of my budget categories. Now I can see at a glance what we're paying and when.

This helps give me a bit of a heads up so I can make more intentional decisions moving forward each month.

2 - Cancel All App Store Subscriptions

I won't even try to guess how many times I've "accidentally" paid for app subscriptions because I forgot to cancel before the free trial was over.

To avoid this in the future I'm canceling all my current mobile app subscriptions and making a point to cancel any trials immediately after I sign up.

It may seem severe, but it's easy enough to re-subscribe and it will force me to make that purchasing decision each time.

3 - Add Reminders to My Calendar

For all future subscriptions or free trials, I'm also adding a notification to my calendar. A "renewal reminder" at least a week before the charge hits my bank account.

This not only forces me to make the deliberate decision to purchase again or not but also gives me time to address the expenses that require more effort to cancel.

Services like DirecTV and SiriusXM can be a hassle to cancel since you have to call in person.

Giving myself a week to get it done makes sure I don't procrastinate past the renewal date.

Can You Justify the Value?

Buying into subscription plans isn't necessarily a bad thing as long as you can justify the value.

But they can quickly become a slippery slope toward credit card debt when those small monthly payments start to add up.

The goal isn't necessarily to eliminate your subscriptions, though that will undoubtedly save you time and money.

The idea is to make sure you're aware of the expense and deliberate in your choice to pay it.

Only you can set the priorities you have for your money.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

You're in good hands

You're in good hands

You're in good hands

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.