Easy Ways to Simplify Your Finances

Easy Ways to Simplify Your Finances

Easy Ways to Simplify Your Finances

Feb 7, 2019

Budgeting >

Budgeting >

Strategies & Techniques

Strategies & Techniques

Have you ever felt like personal finance should be simplified?

Everything from budgeting, debt, retirement planning, investing, and even various types of insurance get lumped together under the personal finance label.

The topic can be pretty intimidating with so many aspects needing to be managed to keep your money goals on target. But there are ways you can manage your money without getting overwhelmed.

Learning how to simplify your finances will help you stress less and save more.

1 - Consolidate Your Accounts

One of the easiest ways to simplify finances is to consolidate your accounts.

I know some budgeting methods involve creating separate savings accounts for each of your goals. But the more accounts you have, the harder it is to track them.

You’ll make things much easier by consolidating your accounts into a simple checking and high-interest savings account.

2 - Automate Your Finances

I’ve talked before about the benefits of automating your finances. Automation can help you save more, pay less, and get out of debt quicker.

Automate your bill payments and savings to simplify the financial process.

Set up automatic payments so you never forget to pay a bill or get hit with a late fee. Plus, avoid the headache of juggling multiple payments every month.

Also, make sure to set up automation for your savings goals. You can simplify your financial future by automatically saving for retirement and unexpected expenses.

Automation will make your whole financial life simpler.

3 - Reduce the Credit Cards You Use

I’m a huge fan of credit card rewards, but it’s not always easy to keep track of the best card to use and when.

Reducing your total credit card usage to just one card is a great way to simplify your money.

You'll eliminate the need to track multiple payments, but also be better able to take advantage of the rewards program.

Using one card for everything means you'll earn rewards faster and you'll be less likely to forget about them.

If you’re looking to make things easy on yourself, find one card you like and stick with it.

4 - Switch to Cash

Want to make things as simple as possible?

Eliminate credit cards altogether.

Get back to basics and use only cash for your purchases.

And I’m talking about actual paper currency, not debit cards, checks, or budgeted funds. Those methods still require the added effort of reconciliation.

If you want to make things as simple as possible, only spending the cash in your pocket is the way to go.

5 - Reduce Your Bills

It stands to reason, if you have less to pay, you’ll have less to manage.

The fewer bills you have, the fewer due dates and accounts you'll have to track.

While you should automate your bill payments as a means of simplifying your budget, you can further simplify your expenses by reducing them altogether.

The low hanging fruit here is usually recurring payments.

Signing up for automatic subscriptions may seem like a way to simplify your expenses, but it's a negative way of automating things.

When it comes to your expenses, you want to make each purchase a deliberate one. Removing yourself from the equation with automation makes it mindless spending.

Eliminate the recurring subscriptions you can and make sure you're scheduling the ones you keep in your budget.

Not only will you simplify your expenses and simplify your budget, but you’ll save money as well.

6 - Get Rid of Debt

Debt is insanely stressful and a drag on your entire financial life.

Paying off your debt will definitely help you simplify things.

It’s not usually possible to flip a switch and eliminate your debt overnight. But there are some ways to simplify the debt you’re dealing with.

Instead of dealing with multiple minimum payments, high-interest rates, and potentially fees, consider using a balance transfer to consolidate your debt.

Check Bankrate or NerdWallet to find a low or no-interest card.

You'll need to do the math if there's a transfer fee involved. Typically the savings a lower interest card offers combined with the ease of only dealing with one payment makes it worth it.

You can also look to organize your debt payoff strategy to make the process simpler by using a program like Undebt.it.

Having a debt repayment plan simplifies the entire repayment process.

7 - Consolidate Your Budget Categories

A lot of people groan at the thought of budgeting. If you find budgeting to be a hassle, consider consolidating some categories to simplify your budget.

Evaluate your spending and savings categories to see what you can combine.

Do you really need a separate category to track your electric, gas, phone, and TV, or will a simple “utilities” category suffice?

It’s a personal preference, but fewer categories will mean less work figuring out where each purchase fits in.

It may not make the biggest impact on simplifying the financial process, but if it helps you actually use your budget, it's still a win.

8 - Digitize Your Documents

If you're still receiving paper statements or printing them off yourself, you're cluttering your life and making things more difficult.

In today's digital environment, you may think you don't need to worry about your statements at all. But it's still a good idea to keep copies of them.

Banks make mistakes and technology fails. If you log in one day and things are off, you'll want a record to verify your claims to the bank.

While it's a good idea to keep past statements, you only need the digital files.

There's absolutely no need to save paper documents.

Digitizing your financial documents will simplify your finances and make it easier to organize things and find them when you need them.

9 - Invest in Index Funds vs Individual Stocks

It can be fun to invest in individual stocks, but doing the research and managing your own portfolio can be a huge time suck.

Consider using a Robo Advisor to invest in index funds if you want to play the market without much effort.

Not only do index funds make it easier to invest, but they're also cheaper and perform better than managed funds.

If you're looking to simplify things while still investing in the stock market, using Robo Advisors to invest in index funds is the easiest way to do it.

10 - Use a Password Manager

Password managers will help simplify your financial life by keeping track of all your logins.

Apart from storing your passwords, they also have the ability to generate more secure ones for you.

You can further simplify things by creating a folder to consolidate all your financial sites. That way you can easily find them when you need them.

Most password managers do more than just save your login information.

I use 1Password which also lets us store credit cards, driver's licenses, social security numbers, account numbers, rewards programs, membership numbers, and even software licenses.

1Password also lets me create secure notes to keep a record of any other financial information. I use these for keeping track of all the security questions and answers across the various accounts.

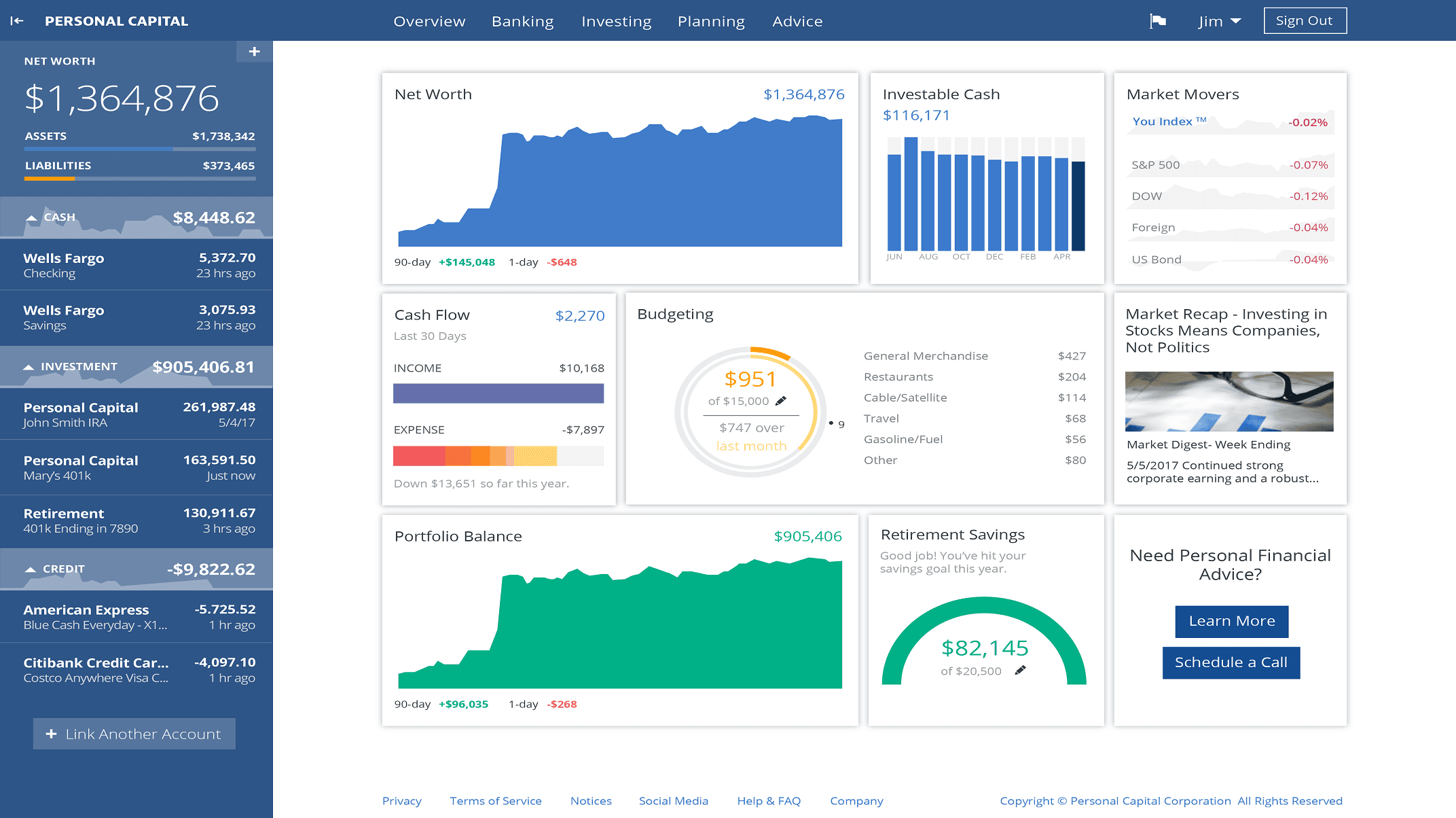

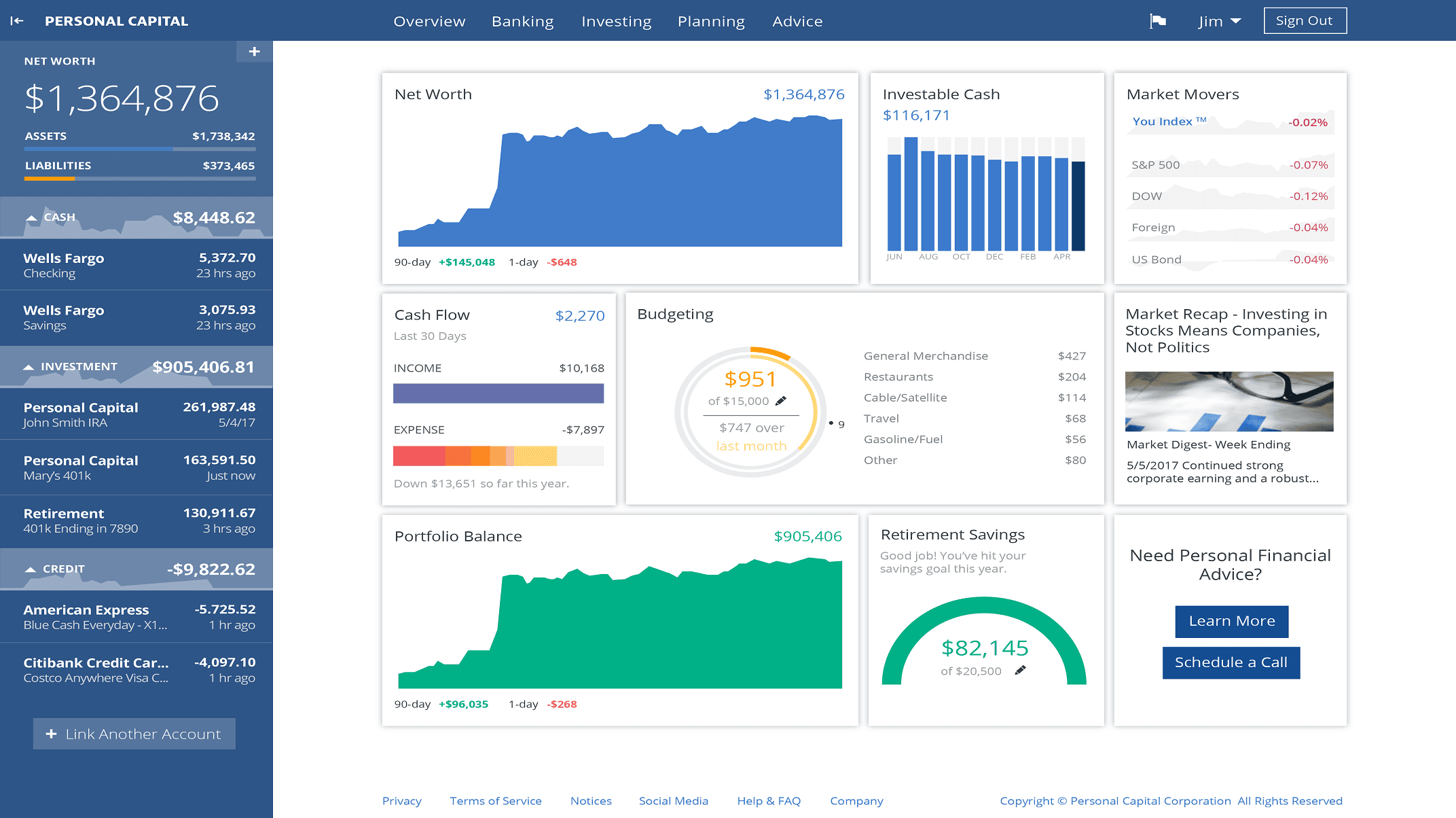

11 - Use A Financial Dashboard

One of the best ways to simplify your finances is to gather them all in one place for easy viewing.

Personal Capital is a free site that allows you to link your accounts to see your complete financial picture.

With Personal Capital you can see your account balances, net worth, cash flow, investment performance, and more.

Final Thoughts

Sometimes the easiest way to take control and get ahead is to simplify the process.

Managing your money can be complicated, but there are ways to simplify things and finally take control of your money.

Can you think of any other tricks or tips? Reach out and let me know how you simplify your finances!

Have you ever felt like personal finance should be simplified?

Everything from budgeting, debt, retirement planning, investing, and even various types of insurance get lumped together under the personal finance label.

The topic can be pretty intimidating with so many aspects needing to be managed to keep your money goals on target. But there are ways you can manage your money without getting overwhelmed.

Learning how to simplify your finances will help you stress less and save more.

1 - Consolidate Your Accounts

One of the easiest ways to simplify finances is to consolidate your accounts.

I know some budgeting methods involve creating separate savings accounts for each of your goals. But the more accounts you have, the harder it is to track them.

You’ll make things much easier by consolidating your accounts into a simple checking and high-interest savings account.

2 - Automate Your Finances

I’ve talked before about the benefits of automating your finances. Automation can help you save more, pay less, and get out of debt quicker.

Automate your bill payments and savings to simplify the financial process.

Set up automatic payments so you never forget to pay a bill or get hit with a late fee. Plus, avoid the headache of juggling multiple payments every month.

Also, make sure to set up automation for your savings goals. You can simplify your financial future by automatically saving for retirement and unexpected expenses.

Automation will make your whole financial life simpler.

3 - Reduce the Credit Cards You Use

I’m a huge fan of credit card rewards, but it’s not always easy to keep track of the best card to use and when.

Reducing your total credit card usage to just one card is a great way to simplify your money.

You'll eliminate the need to track multiple payments, but also be better able to take advantage of the rewards program.

Using one card for everything means you'll earn rewards faster and you'll be less likely to forget about them.

If you’re looking to make things easy on yourself, find one card you like and stick with it.

4 - Switch to Cash

Want to make things as simple as possible?

Eliminate credit cards altogether.

Get back to basics and use only cash for your purchases.

And I’m talking about actual paper currency, not debit cards, checks, or budgeted funds. Those methods still require the added effort of reconciliation.

If you want to make things as simple as possible, only spending the cash in your pocket is the way to go.

5 - Reduce Your Bills

It stands to reason, if you have less to pay, you’ll have less to manage.

The fewer bills you have, the fewer due dates and accounts you'll have to track.

While you should automate your bill payments as a means of simplifying your budget, you can further simplify your expenses by reducing them altogether.

The low hanging fruit here is usually recurring payments.

Signing up for automatic subscriptions may seem like a way to simplify your expenses, but it's a negative way of automating things.

When it comes to your expenses, you want to make each purchase a deliberate one. Removing yourself from the equation with automation makes it mindless spending.

Eliminate the recurring subscriptions you can and make sure you're scheduling the ones you keep in your budget.

Not only will you simplify your expenses and simplify your budget, but you’ll save money as well.

6 - Get Rid of Debt

Debt is insanely stressful and a drag on your entire financial life.

Paying off your debt will definitely help you simplify things.

It’s not usually possible to flip a switch and eliminate your debt overnight. But there are some ways to simplify the debt you’re dealing with.

Instead of dealing with multiple minimum payments, high-interest rates, and potentially fees, consider using a balance transfer to consolidate your debt.

Check Bankrate or NerdWallet to find a low or no-interest card.

You'll need to do the math if there's a transfer fee involved. Typically the savings a lower interest card offers combined with the ease of only dealing with one payment makes it worth it.

You can also look to organize your debt payoff strategy to make the process simpler by using a program like Undebt.it.

Having a debt repayment plan simplifies the entire repayment process.

7 - Consolidate Your Budget Categories

A lot of people groan at the thought of budgeting. If you find budgeting to be a hassle, consider consolidating some categories to simplify your budget.

Evaluate your spending and savings categories to see what you can combine.

Do you really need a separate category to track your electric, gas, phone, and TV, or will a simple “utilities” category suffice?

It’s a personal preference, but fewer categories will mean less work figuring out where each purchase fits in.

It may not make the biggest impact on simplifying the financial process, but if it helps you actually use your budget, it's still a win.

8 - Digitize Your Documents

If you're still receiving paper statements or printing them off yourself, you're cluttering your life and making things more difficult.

In today's digital environment, you may think you don't need to worry about your statements at all. But it's still a good idea to keep copies of them.

Banks make mistakes and technology fails. If you log in one day and things are off, you'll want a record to verify your claims to the bank.

While it's a good idea to keep past statements, you only need the digital files.

There's absolutely no need to save paper documents.

Digitizing your financial documents will simplify your finances and make it easier to organize things and find them when you need them.

9 - Invest in Index Funds vs Individual Stocks

It can be fun to invest in individual stocks, but doing the research and managing your own portfolio can be a huge time suck.

Consider using a Robo Advisor to invest in index funds if you want to play the market without much effort.

Not only do index funds make it easier to invest, but they're also cheaper and perform better than managed funds.

If you're looking to simplify things while still investing in the stock market, using Robo Advisors to invest in index funds is the easiest way to do it.

10 - Use a Password Manager

Password managers will help simplify your financial life by keeping track of all your logins.

Apart from storing your passwords, they also have the ability to generate more secure ones for you.

You can further simplify things by creating a folder to consolidate all your financial sites. That way you can easily find them when you need them.

Most password managers do more than just save your login information.

I use 1Password which also lets us store credit cards, driver's licenses, social security numbers, account numbers, rewards programs, membership numbers, and even software licenses.

1Password also lets me create secure notes to keep a record of any other financial information. I use these for keeping track of all the security questions and answers across the various accounts.

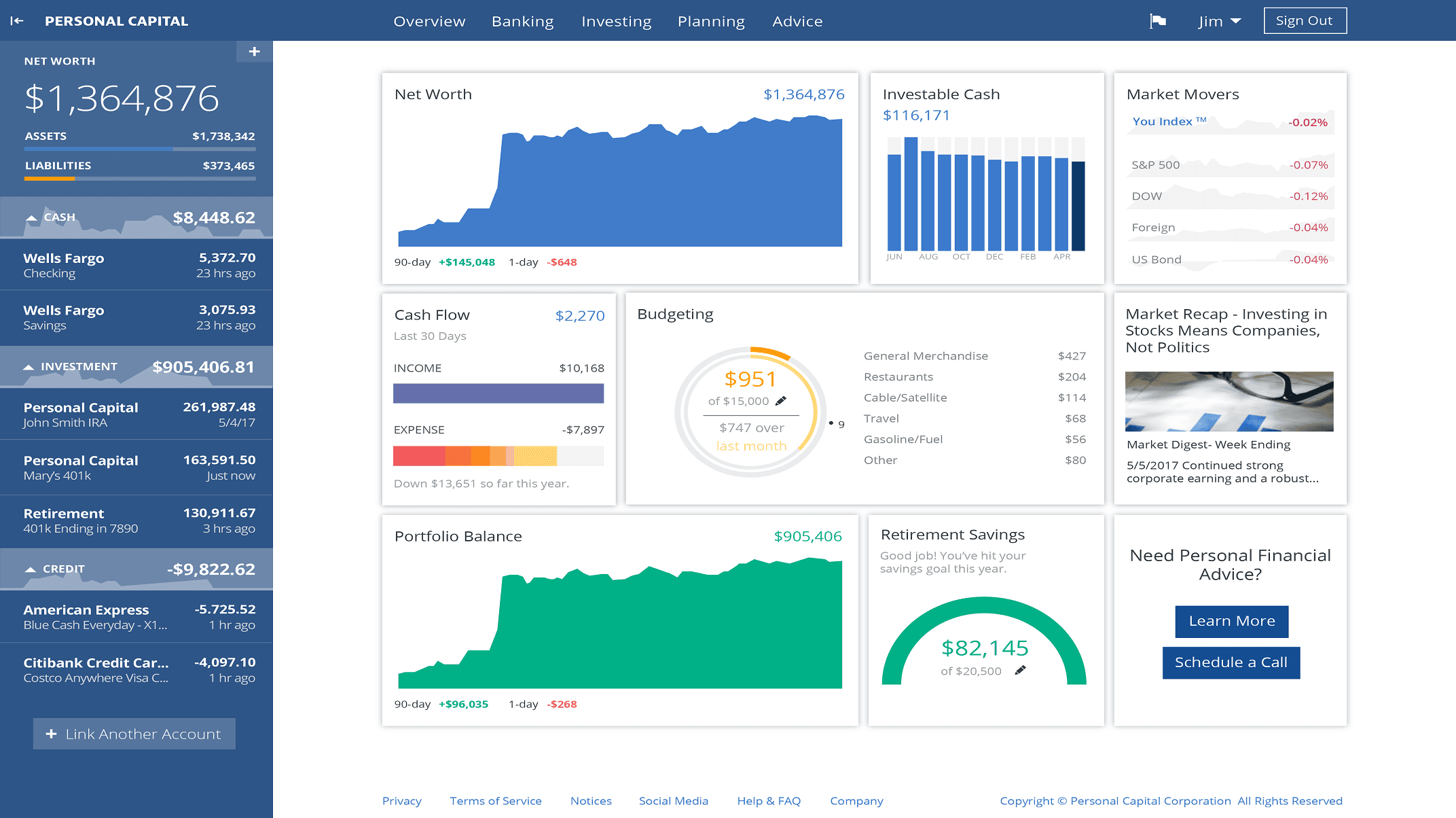

11 - Use A Financial Dashboard

One of the best ways to simplify your finances is to gather them all in one place for easy viewing.

Personal Capital is a free site that allows you to link your accounts to see your complete financial picture.

With Personal Capital you can see your account balances, net worth, cash flow, investment performance, and more.

Final Thoughts

Sometimes the easiest way to take control and get ahead is to simplify the process.

Managing your money can be complicated, but there are ways to simplify things and finally take control of your money.

Can you think of any other tricks or tips? Reach out and let me know how you simplify your finances!

Have you ever felt like personal finance should be simplified?

Everything from budgeting, debt, retirement planning, investing, and even various types of insurance get lumped together under the personal finance label.

The topic can be pretty intimidating with so many aspects needing to be managed to keep your money goals on target. But there are ways you can manage your money without getting overwhelmed.

Learning how to simplify your finances will help you stress less and save more.

1 - Consolidate Your Accounts

One of the easiest ways to simplify finances is to consolidate your accounts.

I know some budgeting methods involve creating separate savings accounts for each of your goals. But the more accounts you have, the harder it is to track them.

You’ll make things much easier by consolidating your accounts into a simple checking and high-interest savings account.

2 - Automate Your Finances

I’ve talked before about the benefits of automating your finances. Automation can help you save more, pay less, and get out of debt quicker.

Automate your bill payments and savings to simplify the financial process.

Set up automatic payments so you never forget to pay a bill or get hit with a late fee. Plus, avoid the headache of juggling multiple payments every month.

Also, make sure to set up automation for your savings goals. You can simplify your financial future by automatically saving for retirement and unexpected expenses.

Automation will make your whole financial life simpler.

3 - Reduce the Credit Cards You Use

I’m a huge fan of credit card rewards, but it’s not always easy to keep track of the best card to use and when.

Reducing your total credit card usage to just one card is a great way to simplify your money.

You'll eliminate the need to track multiple payments, but also be better able to take advantage of the rewards program.

Using one card for everything means you'll earn rewards faster and you'll be less likely to forget about them.

If you’re looking to make things easy on yourself, find one card you like and stick with it.

4 - Switch to Cash

Want to make things as simple as possible?

Eliminate credit cards altogether.

Get back to basics and use only cash for your purchases.

And I’m talking about actual paper currency, not debit cards, checks, or budgeted funds. Those methods still require the added effort of reconciliation.

If you want to make things as simple as possible, only spending the cash in your pocket is the way to go.

5 - Reduce Your Bills

It stands to reason, if you have less to pay, you’ll have less to manage.

The fewer bills you have, the fewer due dates and accounts you'll have to track.

While you should automate your bill payments as a means of simplifying your budget, you can further simplify your expenses by reducing them altogether.

The low hanging fruit here is usually recurring payments.

Signing up for automatic subscriptions may seem like a way to simplify your expenses, but it's a negative way of automating things.

When it comes to your expenses, you want to make each purchase a deliberate one. Removing yourself from the equation with automation makes it mindless spending.

Eliminate the recurring subscriptions you can and make sure you're scheduling the ones you keep in your budget.

Not only will you simplify your expenses and simplify your budget, but you’ll save money as well.

6 - Get Rid of Debt

Debt is insanely stressful and a drag on your entire financial life.

Paying off your debt will definitely help you simplify things.

It’s not usually possible to flip a switch and eliminate your debt overnight. But there are some ways to simplify the debt you’re dealing with.

Instead of dealing with multiple minimum payments, high-interest rates, and potentially fees, consider using a balance transfer to consolidate your debt.

Check Bankrate or NerdWallet to find a low or no-interest card.

You'll need to do the math if there's a transfer fee involved. Typically the savings a lower interest card offers combined with the ease of only dealing with one payment makes it worth it.

You can also look to organize your debt payoff strategy to make the process simpler by using a program like Undebt.it.

Having a debt repayment plan simplifies the entire repayment process.

7 - Consolidate Your Budget Categories

A lot of people groan at the thought of budgeting. If you find budgeting to be a hassle, consider consolidating some categories to simplify your budget.

Evaluate your spending and savings categories to see what you can combine.

Do you really need a separate category to track your electric, gas, phone, and TV, or will a simple “utilities” category suffice?

It’s a personal preference, but fewer categories will mean less work figuring out where each purchase fits in.

It may not make the biggest impact on simplifying the financial process, but if it helps you actually use your budget, it's still a win.

8 - Digitize Your Documents

If you're still receiving paper statements or printing them off yourself, you're cluttering your life and making things more difficult.

In today's digital environment, you may think you don't need to worry about your statements at all. But it's still a good idea to keep copies of them.

Banks make mistakes and technology fails. If you log in one day and things are off, you'll want a record to verify your claims to the bank.

While it's a good idea to keep past statements, you only need the digital files.

There's absolutely no need to save paper documents.

Digitizing your financial documents will simplify your finances and make it easier to organize things and find them when you need them.

9 - Invest in Index Funds vs Individual Stocks

It can be fun to invest in individual stocks, but doing the research and managing your own portfolio can be a huge time suck.

Consider using a Robo Advisor to invest in index funds if you want to play the market without much effort.

Not only do index funds make it easier to invest, but they're also cheaper and perform better than managed funds.

If you're looking to simplify things while still investing in the stock market, using Robo Advisors to invest in index funds is the easiest way to do it.

10 - Use a Password Manager

Password managers will help simplify your financial life by keeping track of all your logins.

Apart from storing your passwords, they also have the ability to generate more secure ones for you.

You can further simplify things by creating a folder to consolidate all your financial sites. That way you can easily find them when you need them.

Most password managers do more than just save your login information.

I use 1Password which also lets us store credit cards, driver's licenses, social security numbers, account numbers, rewards programs, membership numbers, and even software licenses.

1Password also lets me create secure notes to keep a record of any other financial information. I use these for keeping track of all the security questions and answers across the various accounts.

11 - Use A Financial Dashboard

One of the best ways to simplify your finances is to gather them all in one place for easy viewing.

Personal Capital is a free site that allows you to link your accounts to see your complete financial picture.

With Personal Capital you can see your account balances, net worth, cash flow, investment performance, and more.

Final Thoughts

Sometimes the easiest way to take control and get ahead is to simplify the process.

Managing your money can be complicated, but there are ways to simplify things and finally take control of your money.

Can you think of any other tricks or tips? Reach out and let me know how you simplify your finances!

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

You're in good hands

You're in good hands

You're in good hands

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.