Bare-Bones Budget: What Is It and How to Make Your Own

Bare-Bones Budget: What Is It and How to Make Your Own

Bare-Bones Budget: What Is It and How to Make Your Own

Apr 5, 2020

Budgeting >

Budgeting >

Advanced Concepts

Advanced Concepts

Has a sudden change in your finances left you strapped for cash? Or maybe you're just curious to know how much you should be saving in case of a future emergency.

Either way, a bare-bones budget may be the solution.

What Is a Bare-Bones Budget?

A bare-bones budget is a budget that reflects only your most essential expenses.

It consists of all your needs and none of your wants.

Essentially, it's a survival budget. It's the minimum amount you need to pay your necessary living expenses.

Why You Need a Bare-Bone Budget

There are a few reasons you may want to create a bare-bones budget.

First, if you find yourself in an emergency, you'll have a guide to help you through it. Knowing your bare minimum expenses can help you quickly identify the areas you can cut in case of a crisis.

Second, it's a great way to gain awareness about how much income you need to survive. Knowledge of your needs can help you focus your priorities and adapt your spending habits.

Third, adopting a bare-bones budget is a great way to make massive headway toward a financial goal. Whether you're paying off debt or building your emergency fund, using a bare-bones budget in the short term can help you hit your targets faster.

What a Bare-Bones Budget Includes

A bare-bones budget should only include the absolute essentials you need to get by.

If you're a fan of Dave Ramsey, he calls these your Four Walls - food, utilities, shelter, and transportation.

For most of us, these areas consist of:

housing

utilities

gas for essential transportation

minimums due on your debt

essential food items

basic phone service

Another area to make sure you're covering is insurance. Canceling your healthcare or home and auto insurance runs the risk of doing more harm than good to your finances.

What Isn't Included In a Bare-Bones Budget

We all have different aspects of our lives that we consider essential to spend on.

However, if you're trying to justify the expenses below, you're probably not being honest with yourself about what constitutes a want versus a need.

Your bare-bones budget should not include some of these common expenses:

entertainment spending

cable or satellite

clothing (unless required for work purposes)

large data plans for your cell phone

restaurants

vacations

hobbies

non-essential personal care (hair coloring, manicures, cosmetics, etc.)

It's easy to overlook some of our typical spending habits when we're building out a regular budget, but you need to make sure you're being brutally honest about what your needs are when making your bare-bones budget.

How To Create a Bare-Bones Budget

Since the need for prioritizing is mostly done for you, making a bare-bones budget is a bit easier than your typical budget.

Here's a step by step guide to making a bare-bones budget.

Step 1: List Your Expenses

Looking at last month's expenses, start listing out all your outflows.

As you write things down, make a note next to obvious expenses you'll want to carry over, like your housing and utility costs.

Step 2: Slash Non-Essential Expenses

Looking at your list of expenses, start crossing off the ones that aren't essential.

You should eliminate anything that doesn't directly impact your ability to survive.

Step 3: Prioritize Your Necessities

With your expenses narrowed down, it's time to prioritize them.

You should focus on the expenses that you need most for survival and that have the least wiggle room.

For example, you may be able to negotiate some of your bills, but you have to have food to feed your family.

Step 4: Reevaluate Priorities and Cut More

Consider this an exercise in double-checking yourself.

Look back through your expenses for costs you can't eliminate but may be able to reduce.

For example, your bare-bones budget may require a phone for communication, but an unlimited data plan would constitute a want, not a need.

Step 5: Tally up Your Remaining Expenses

Once you've identified, reduced, and prioritized until you've reached your bare minimums, it's time to add them all up.

Tally everything to see how much money you need to earn or have saved to afford your essentials.

When to Use a Bare-Bones Budget

There are several reasons you might need a bare-bones budget.

Typically things like a job loss or medical emergency may force you to adjust your spending. But there are some other reasons you may want to adopt a more restrictive budget.

Here are some common reasons you may need to use a bare-bones budget:

dealing with a family crisis

experiencing a natural disaster

having a medical emergency

a sudden job loss

paying off debt

building your emergency fund

breaking unhealthy spending habits

getting ahead of the paycheck-to-paycheck cycle

Whether the need comes from external influences or internal motivations, a bare-bones budget is a valuable resource to help you get through tough times.

How to Use a Bare-Bones Budget

Once you've got your bare-bones budget made it's time to decide how and when you want to use it.

Use Your Bare-Bones Budget as a Guide

Using your bare-bones budget as a guide to help you limit your spending is a great way to make significant progress toward your financial goals.

Whether you want to pay down debt or build up your savings, a bare-bones budget will help you free up cash from non-essential spending to put toward your goals.

Use Your Bare-Bones Budget as Your Budget

Emergencies like a job loss will likely require you to replace your typical budget with your survival budget.

Eliminating unnecessary expenses in case of emergency is imperative to your financial well being.

How Long Should You Stay on a Bare-Bones Budget

The amount of time you stay on a bare-bones budget is entirely dependent on your reason for doing so.

If an emergency has forced you to adopt a minimal budget, you'll want to stick with it as long as your situation is uncertain.

For more goal-oriented reasons, you can choose your endpoint to coincide with reaching your goal or a particular milestone.

For example, you could use a bare-bones budget only until you can fully fund your emergency fund.

Another option would be to adopt a bare-bones budget intermittently and make financial sprints toward your goals.

This sprint approach may be good for significant goals, like paying off a lot of debt.

Using a bare-bones budget over a long period may be hard to maintain, but you can probably motivate yourself to adopt it for at least a month.

Monthly challenges are a great way to keep yourself motivated and on track.

Challenging yourself to adopt a bare-bones budget for even just a month will result in immediate savings.

But it may also help you identify and eliminate expenses for the long term that can help you work your way to financial freedom.

Tips for Making and Using a Bare-Bones Budget

A bare-bones budget may seem Simple and relatively easy on the surface, but in practice, it takes a lot of effort to curb your impulses.

We're all accustomed to living a certain way and spending to match a particular lifestyle. That's not an easy thing to give up.

Here are some tips to help you succeed with a bare-bones budget.

Be Honest With Yourself

The most important thing to remember when you're creating a bare-bones budget is that you need to be honest with yourself.

The purpose behind this budget is to save as much as humanly possible.

If you try to convince yourself that your Netflix, Spotify, and HBO subscriptions are essential to your well being, you're setting yourself up for failure.

You may have expenses you deem necessary that others don't. You just need to make sure you're honest with yourself about them.

For example, daycare would be an essential expense for a single mom who needs to go to work. But it wouldn't be for a stay-at-home mom who just needs a couple of hours to herself.

Prepare for Unexpected Expenses

As with any other budget, it's essential to factor in the unexpected. There may be infrequent necessities that pop up, catching you off guard.

Things like medication refills or doctor visits are easy to forget about and can throw your budget off track.

Avoid this by making sure you're budgeting at least a little bit toward future unknowns.

Save Money on the Essentials

Just because an expense is essential doesn't mean you have to pay the full price for it.

Food costs are the first place to look when it comes to saving money on your necessities.

Combine coupons, sales, and cash-back apps to save as much as possible when you hit the grocery store.

PRO TIP – Check to see if your grocery store offers fuel rewards on gift card purchases. You could save even more by buying a gift card to pay for your groceries and getting a discount on future gas purchases in the process.

Find Creative Ways to Enjoy the Same Things Without Spending Money

Just because you aren't spending money on entertainment doesn't mean you have to sit around and be bored.

There are plenty of ways you can enjoy a little fun that won't cost a penny. Check your local paper and library for free events or consider inviting friends over instead of going out.

If you're used to eating out a lot, the suddenness of making all your meals can be overwhelming. Make it easier by involving friends and family. Have batch cooking parties or take on pantry challenges together.

A little creativity can have a massive impact on your motivation and success.

Anytime you feel tempted by a non-essential expense, use your imagination or check Pinterest or Google for ideas that can help you achieve the same outcome without the cost.

Focus on the Positive

Adopting a bare-bones budget may feel like a punishment, especially if it's due to an unforeseen emergency, but it's important to try to find the bright side.

Keep your focus on your progress toward either savings or maintaining your cash flow.

Instead of feeling deprived that you can't order pizza tonight, be proud that by saving that money, you can pay your water bill next month.

So much about our finances comes down to our mindset. If you can learn to think in abundance and see the positives, you'll be able to master your money regardless of the budget you use.

Final Thoughts

Knowing how to make and stick to a bare-bones budget can be a lifesaver if you ever find yourself in an uncertain financial situation. It can also be helpful if you're trying to reach some challenging financial goals.

I hope you never need a bare-bones budget, but knowing your essential expenses is beneficial even if you never have to reduce your spending to match.

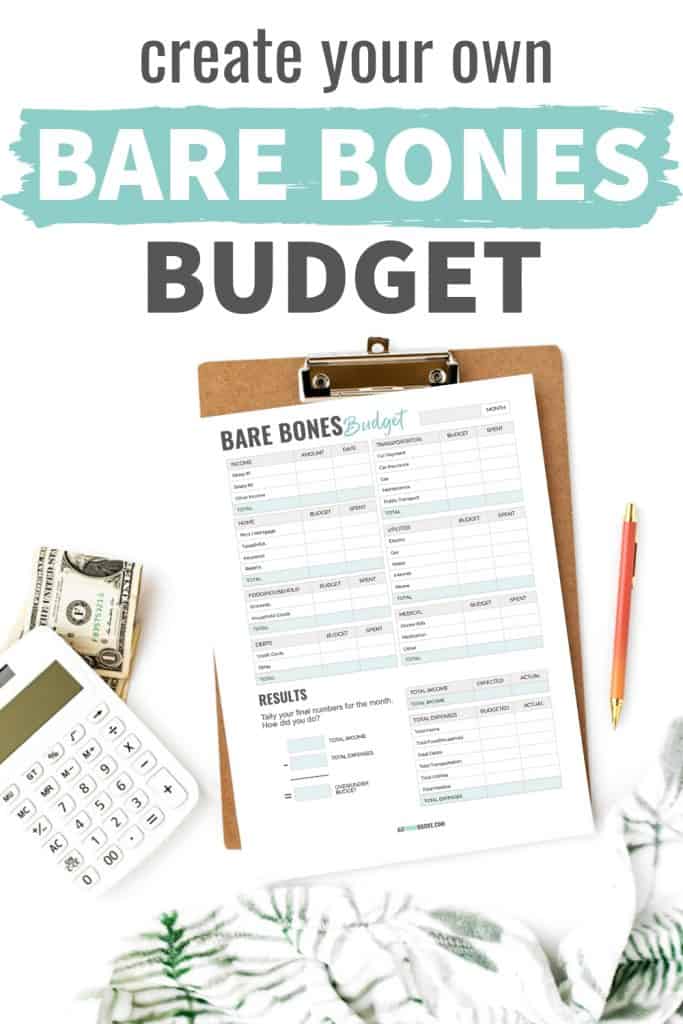

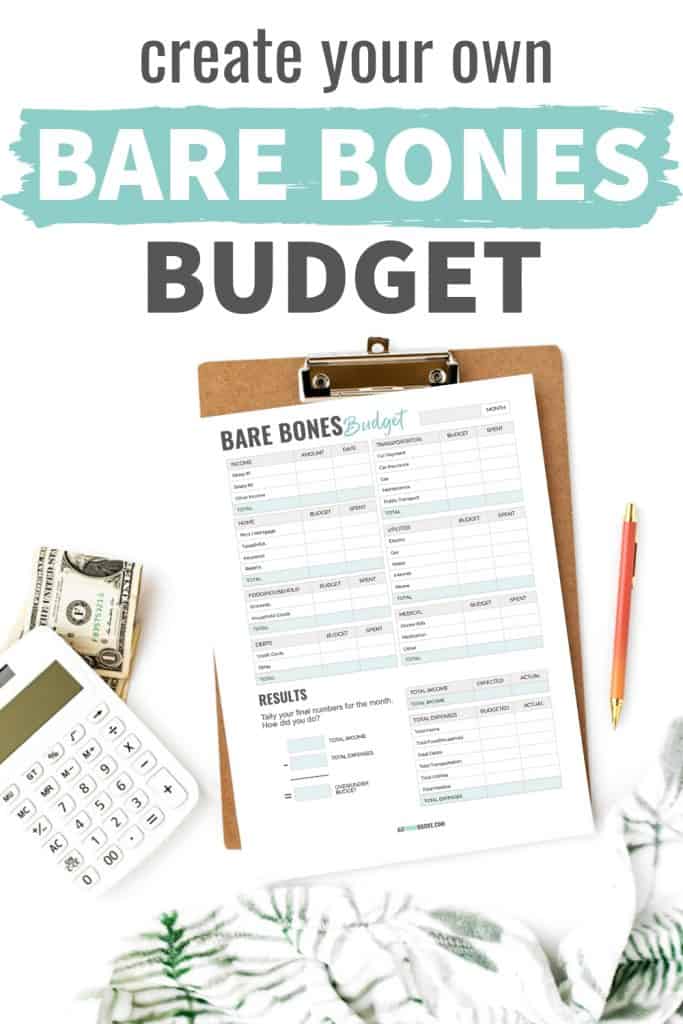

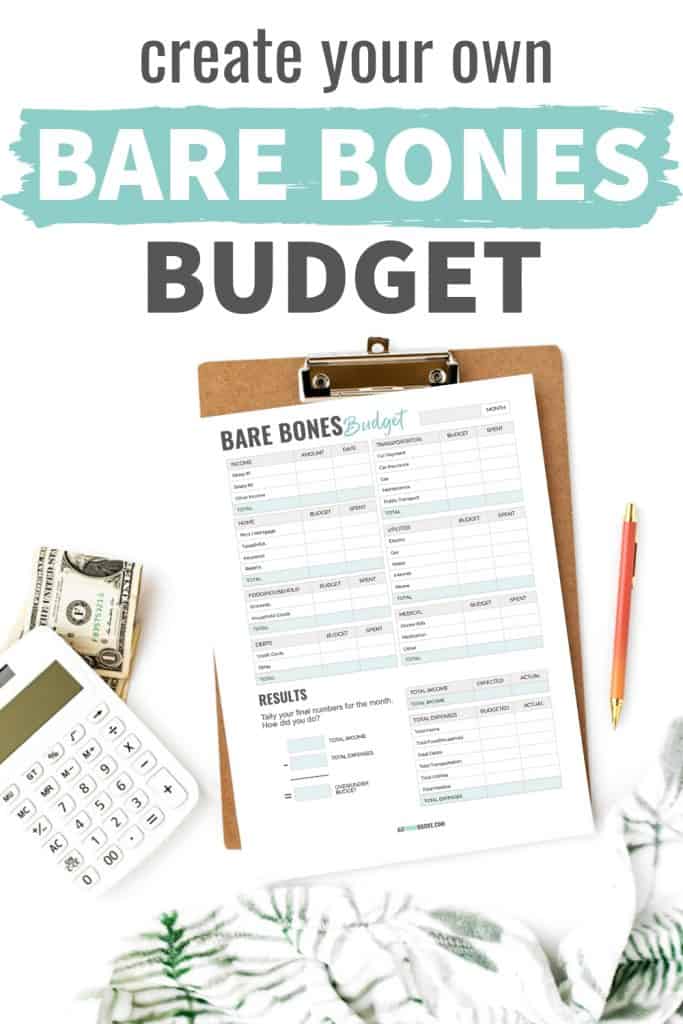

Download a free copy of my bare-bones budget worksheet to start making yours today!

Has a sudden change in your finances left you strapped for cash? Or maybe you're just curious to know how much you should be saving in case of a future emergency.

Either way, a bare-bones budget may be the solution.

What Is a Bare-Bones Budget?

A bare-bones budget is a budget that reflects only your most essential expenses.

It consists of all your needs and none of your wants.

Essentially, it's a survival budget. It's the minimum amount you need to pay your necessary living expenses.

Why You Need a Bare-Bone Budget

There are a few reasons you may want to create a bare-bones budget.

First, if you find yourself in an emergency, you'll have a guide to help you through it. Knowing your bare minimum expenses can help you quickly identify the areas you can cut in case of a crisis.

Second, it's a great way to gain awareness about how much income you need to survive. Knowledge of your needs can help you focus your priorities and adapt your spending habits.

Third, adopting a bare-bones budget is a great way to make massive headway toward a financial goal. Whether you're paying off debt or building your emergency fund, using a bare-bones budget in the short term can help you hit your targets faster.

What a Bare-Bones Budget Includes

A bare-bones budget should only include the absolute essentials you need to get by.

If you're a fan of Dave Ramsey, he calls these your Four Walls - food, utilities, shelter, and transportation.

For most of us, these areas consist of:

housing

utilities

gas for essential transportation

minimums due on your debt

essential food items

basic phone service

Another area to make sure you're covering is insurance. Canceling your healthcare or home and auto insurance runs the risk of doing more harm than good to your finances.

What Isn't Included In a Bare-Bones Budget

We all have different aspects of our lives that we consider essential to spend on.

However, if you're trying to justify the expenses below, you're probably not being honest with yourself about what constitutes a want versus a need.

Your bare-bones budget should not include some of these common expenses:

entertainment spending

cable or satellite

clothing (unless required for work purposes)

large data plans for your cell phone

restaurants

vacations

hobbies

non-essential personal care (hair coloring, manicures, cosmetics, etc.)

It's easy to overlook some of our typical spending habits when we're building out a regular budget, but you need to make sure you're being brutally honest about what your needs are when making your bare-bones budget.

How To Create a Bare-Bones Budget

Since the need for prioritizing is mostly done for you, making a bare-bones budget is a bit easier than your typical budget.

Here's a step by step guide to making a bare-bones budget.

Step 1: List Your Expenses

Looking at last month's expenses, start listing out all your outflows.

As you write things down, make a note next to obvious expenses you'll want to carry over, like your housing and utility costs.

Step 2: Slash Non-Essential Expenses

Looking at your list of expenses, start crossing off the ones that aren't essential.

You should eliminate anything that doesn't directly impact your ability to survive.

Step 3: Prioritize Your Necessities

With your expenses narrowed down, it's time to prioritize them.

You should focus on the expenses that you need most for survival and that have the least wiggle room.

For example, you may be able to negotiate some of your bills, but you have to have food to feed your family.

Step 4: Reevaluate Priorities and Cut More

Consider this an exercise in double-checking yourself.

Look back through your expenses for costs you can't eliminate but may be able to reduce.

For example, your bare-bones budget may require a phone for communication, but an unlimited data plan would constitute a want, not a need.

Step 5: Tally up Your Remaining Expenses

Once you've identified, reduced, and prioritized until you've reached your bare minimums, it's time to add them all up.

Tally everything to see how much money you need to earn or have saved to afford your essentials.

When to Use a Bare-Bones Budget

There are several reasons you might need a bare-bones budget.

Typically things like a job loss or medical emergency may force you to adjust your spending. But there are some other reasons you may want to adopt a more restrictive budget.

Here are some common reasons you may need to use a bare-bones budget:

dealing with a family crisis

experiencing a natural disaster

having a medical emergency

a sudden job loss

paying off debt

building your emergency fund

breaking unhealthy spending habits

getting ahead of the paycheck-to-paycheck cycle

Whether the need comes from external influences or internal motivations, a bare-bones budget is a valuable resource to help you get through tough times.

How to Use a Bare-Bones Budget

Once you've got your bare-bones budget made it's time to decide how and when you want to use it.

Use Your Bare-Bones Budget as a Guide

Using your bare-bones budget as a guide to help you limit your spending is a great way to make significant progress toward your financial goals.

Whether you want to pay down debt or build up your savings, a bare-bones budget will help you free up cash from non-essential spending to put toward your goals.

Use Your Bare-Bones Budget as Your Budget

Emergencies like a job loss will likely require you to replace your typical budget with your survival budget.

Eliminating unnecessary expenses in case of emergency is imperative to your financial well being.

How Long Should You Stay on a Bare-Bones Budget

The amount of time you stay on a bare-bones budget is entirely dependent on your reason for doing so.

If an emergency has forced you to adopt a minimal budget, you'll want to stick with it as long as your situation is uncertain.

For more goal-oriented reasons, you can choose your endpoint to coincide with reaching your goal or a particular milestone.

For example, you could use a bare-bones budget only until you can fully fund your emergency fund.

Another option would be to adopt a bare-bones budget intermittently and make financial sprints toward your goals.

This sprint approach may be good for significant goals, like paying off a lot of debt.

Using a bare-bones budget over a long period may be hard to maintain, but you can probably motivate yourself to adopt it for at least a month.

Monthly challenges are a great way to keep yourself motivated and on track.

Challenging yourself to adopt a bare-bones budget for even just a month will result in immediate savings.

But it may also help you identify and eliminate expenses for the long term that can help you work your way to financial freedom.

Tips for Making and Using a Bare-Bones Budget

A bare-bones budget may seem Simple and relatively easy on the surface, but in practice, it takes a lot of effort to curb your impulses.

We're all accustomed to living a certain way and spending to match a particular lifestyle. That's not an easy thing to give up.

Here are some tips to help you succeed with a bare-bones budget.

Be Honest With Yourself

The most important thing to remember when you're creating a bare-bones budget is that you need to be honest with yourself.

The purpose behind this budget is to save as much as humanly possible.

If you try to convince yourself that your Netflix, Spotify, and HBO subscriptions are essential to your well being, you're setting yourself up for failure.

You may have expenses you deem necessary that others don't. You just need to make sure you're honest with yourself about them.

For example, daycare would be an essential expense for a single mom who needs to go to work. But it wouldn't be for a stay-at-home mom who just needs a couple of hours to herself.

Prepare for Unexpected Expenses

As with any other budget, it's essential to factor in the unexpected. There may be infrequent necessities that pop up, catching you off guard.

Things like medication refills or doctor visits are easy to forget about and can throw your budget off track.

Avoid this by making sure you're budgeting at least a little bit toward future unknowns.

Save Money on the Essentials

Just because an expense is essential doesn't mean you have to pay the full price for it.

Food costs are the first place to look when it comes to saving money on your necessities.

Combine coupons, sales, and cash-back apps to save as much as possible when you hit the grocery store.

PRO TIP – Check to see if your grocery store offers fuel rewards on gift card purchases. You could save even more by buying a gift card to pay for your groceries and getting a discount on future gas purchases in the process.

Find Creative Ways to Enjoy the Same Things Without Spending Money

Just because you aren't spending money on entertainment doesn't mean you have to sit around and be bored.

There are plenty of ways you can enjoy a little fun that won't cost a penny. Check your local paper and library for free events or consider inviting friends over instead of going out.

If you're used to eating out a lot, the suddenness of making all your meals can be overwhelming. Make it easier by involving friends and family. Have batch cooking parties or take on pantry challenges together.

A little creativity can have a massive impact on your motivation and success.

Anytime you feel tempted by a non-essential expense, use your imagination or check Pinterest or Google for ideas that can help you achieve the same outcome without the cost.

Focus on the Positive

Adopting a bare-bones budget may feel like a punishment, especially if it's due to an unforeseen emergency, but it's important to try to find the bright side.

Keep your focus on your progress toward either savings or maintaining your cash flow.

Instead of feeling deprived that you can't order pizza tonight, be proud that by saving that money, you can pay your water bill next month.

So much about our finances comes down to our mindset. If you can learn to think in abundance and see the positives, you'll be able to master your money regardless of the budget you use.

Final Thoughts

Knowing how to make and stick to a bare-bones budget can be a lifesaver if you ever find yourself in an uncertain financial situation. It can also be helpful if you're trying to reach some challenging financial goals.

I hope you never need a bare-bones budget, but knowing your essential expenses is beneficial even if you never have to reduce your spending to match.

Download a free copy of my bare-bones budget worksheet to start making yours today!

Has a sudden change in your finances left you strapped for cash? Or maybe you're just curious to know how much you should be saving in case of a future emergency.

Either way, a bare-bones budget may be the solution.

What Is a Bare-Bones Budget?

A bare-bones budget is a budget that reflects only your most essential expenses.

It consists of all your needs and none of your wants.

Essentially, it's a survival budget. It's the minimum amount you need to pay your necessary living expenses.

Why You Need a Bare-Bone Budget

There are a few reasons you may want to create a bare-bones budget.

First, if you find yourself in an emergency, you'll have a guide to help you through it. Knowing your bare minimum expenses can help you quickly identify the areas you can cut in case of a crisis.

Second, it's a great way to gain awareness about how much income you need to survive. Knowledge of your needs can help you focus your priorities and adapt your spending habits.

Third, adopting a bare-bones budget is a great way to make massive headway toward a financial goal. Whether you're paying off debt or building your emergency fund, using a bare-bones budget in the short term can help you hit your targets faster.

What a Bare-Bones Budget Includes

A bare-bones budget should only include the absolute essentials you need to get by.

If you're a fan of Dave Ramsey, he calls these your Four Walls - food, utilities, shelter, and transportation.

For most of us, these areas consist of:

housing

utilities

gas for essential transportation

minimums due on your debt

essential food items

basic phone service

Another area to make sure you're covering is insurance. Canceling your healthcare or home and auto insurance runs the risk of doing more harm than good to your finances.

What Isn't Included In a Bare-Bones Budget

We all have different aspects of our lives that we consider essential to spend on.

However, if you're trying to justify the expenses below, you're probably not being honest with yourself about what constitutes a want versus a need.

Your bare-bones budget should not include some of these common expenses:

entertainment spending

cable or satellite

clothing (unless required for work purposes)

large data plans for your cell phone

restaurants

vacations

hobbies

non-essential personal care (hair coloring, manicures, cosmetics, etc.)

It's easy to overlook some of our typical spending habits when we're building out a regular budget, but you need to make sure you're being brutally honest about what your needs are when making your bare-bones budget.

How To Create a Bare-Bones Budget

Since the need for prioritizing is mostly done for you, making a bare-bones budget is a bit easier than your typical budget.

Here's a step by step guide to making a bare-bones budget.

Step 1: List Your Expenses

Looking at last month's expenses, start listing out all your outflows.

As you write things down, make a note next to obvious expenses you'll want to carry over, like your housing and utility costs.

Step 2: Slash Non-Essential Expenses

Looking at your list of expenses, start crossing off the ones that aren't essential.

You should eliminate anything that doesn't directly impact your ability to survive.

Step 3: Prioritize Your Necessities

With your expenses narrowed down, it's time to prioritize them.

You should focus on the expenses that you need most for survival and that have the least wiggle room.

For example, you may be able to negotiate some of your bills, but you have to have food to feed your family.

Step 4: Reevaluate Priorities and Cut More

Consider this an exercise in double-checking yourself.

Look back through your expenses for costs you can't eliminate but may be able to reduce.

For example, your bare-bones budget may require a phone for communication, but an unlimited data plan would constitute a want, not a need.

Step 5: Tally up Your Remaining Expenses

Once you've identified, reduced, and prioritized until you've reached your bare minimums, it's time to add them all up.

Tally everything to see how much money you need to earn or have saved to afford your essentials.

When to Use a Bare-Bones Budget

There are several reasons you might need a bare-bones budget.

Typically things like a job loss or medical emergency may force you to adjust your spending. But there are some other reasons you may want to adopt a more restrictive budget.

Here are some common reasons you may need to use a bare-bones budget:

dealing with a family crisis

experiencing a natural disaster

having a medical emergency

a sudden job loss

paying off debt

building your emergency fund

breaking unhealthy spending habits

getting ahead of the paycheck-to-paycheck cycle

Whether the need comes from external influences or internal motivations, a bare-bones budget is a valuable resource to help you get through tough times.

How to Use a Bare-Bones Budget

Once you've got your bare-bones budget made it's time to decide how and when you want to use it.

Use Your Bare-Bones Budget as a Guide

Using your bare-bones budget as a guide to help you limit your spending is a great way to make significant progress toward your financial goals.

Whether you want to pay down debt or build up your savings, a bare-bones budget will help you free up cash from non-essential spending to put toward your goals.

Use Your Bare-Bones Budget as Your Budget

Emergencies like a job loss will likely require you to replace your typical budget with your survival budget.

Eliminating unnecessary expenses in case of emergency is imperative to your financial well being.

How Long Should You Stay on a Bare-Bones Budget

The amount of time you stay on a bare-bones budget is entirely dependent on your reason for doing so.

If an emergency has forced you to adopt a minimal budget, you'll want to stick with it as long as your situation is uncertain.

For more goal-oriented reasons, you can choose your endpoint to coincide with reaching your goal or a particular milestone.

For example, you could use a bare-bones budget only until you can fully fund your emergency fund.

Another option would be to adopt a bare-bones budget intermittently and make financial sprints toward your goals.

This sprint approach may be good for significant goals, like paying off a lot of debt.

Using a bare-bones budget over a long period may be hard to maintain, but you can probably motivate yourself to adopt it for at least a month.

Monthly challenges are a great way to keep yourself motivated and on track.

Challenging yourself to adopt a bare-bones budget for even just a month will result in immediate savings.

But it may also help you identify and eliminate expenses for the long term that can help you work your way to financial freedom.

Tips for Making and Using a Bare-Bones Budget

A bare-bones budget may seem Simple and relatively easy on the surface, but in practice, it takes a lot of effort to curb your impulses.

We're all accustomed to living a certain way and spending to match a particular lifestyle. That's not an easy thing to give up.

Here are some tips to help you succeed with a bare-bones budget.

Be Honest With Yourself

The most important thing to remember when you're creating a bare-bones budget is that you need to be honest with yourself.

The purpose behind this budget is to save as much as humanly possible.

If you try to convince yourself that your Netflix, Spotify, and HBO subscriptions are essential to your well being, you're setting yourself up for failure.

You may have expenses you deem necessary that others don't. You just need to make sure you're honest with yourself about them.

For example, daycare would be an essential expense for a single mom who needs to go to work. But it wouldn't be for a stay-at-home mom who just needs a couple of hours to herself.

Prepare for Unexpected Expenses

As with any other budget, it's essential to factor in the unexpected. There may be infrequent necessities that pop up, catching you off guard.

Things like medication refills or doctor visits are easy to forget about and can throw your budget off track.

Avoid this by making sure you're budgeting at least a little bit toward future unknowns.

Save Money on the Essentials

Just because an expense is essential doesn't mean you have to pay the full price for it.

Food costs are the first place to look when it comes to saving money on your necessities.

Combine coupons, sales, and cash-back apps to save as much as possible when you hit the grocery store.

PRO TIP – Check to see if your grocery store offers fuel rewards on gift card purchases. You could save even more by buying a gift card to pay for your groceries and getting a discount on future gas purchases in the process.

Find Creative Ways to Enjoy the Same Things Without Spending Money

Just because you aren't spending money on entertainment doesn't mean you have to sit around and be bored.

There are plenty of ways you can enjoy a little fun that won't cost a penny. Check your local paper and library for free events or consider inviting friends over instead of going out.

If you're used to eating out a lot, the suddenness of making all your meals can be overwhelming. Make it easier by involving friends and family. Have batch cooking parties or take on pantry challenges together.

A little creativity can have a massive impact on your motivation and success.

Anytime you feel tempted by a non-essential expense, use your imagination or check Pinterest or Google for ideas that can help you achieve the same outcome without the cost.

Focus on the Positive

Adopting a bare-bones budget may feel like a punishment, especially if it's due to an unforeseen emergency, but it's important to try to find the bright side.

Keep your focus on your progress toward either savings or maintaining your cash flow.

Instead of feeling deprived that you can't order pizza tonight, be proud that by saving that money, you can pay your water bill next month.

So much about our finances comes down to our mindset. If you can learn to think in abundance and see the positives, you'll be able to master your money regardless of the budget you use.

Final Thoughts

Knowing how to make and stick to a bare-bones budget can be a lifesaver if you ever find yourself in an uncertain financial situation. It can also be helpful if you're trying to reach some challenging financial goals.

I hope you never need a bare-bones budget, but knowing your essential expenses is beneficial even if you never have to reduce your spending to match.

Download a free copy of my bare-bones budget worksheet to start making yours today!

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

You're in good hands

You're in good hands

You're in good hands

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.