How to Use a Savings Tracker to Reach Your Financial Goals

How to Use a Savings Tracker to Reach Your Financial Goals

How to Use a Savings Tracker to Reach Your Financial Goals

Dec 3, 2020

Savings >

Savings >

Strategies & Techniques

Strategies & Techniques

Are you saving up for anything?

Maybe you’re planning an amazing vacation or you want to finally get your emergency fund topped off.

While in theory, saving money is simple. In practice, it can be anything but.

Especially if you’re trying to save without making other changes to you behavior.

Using a savings goal tracker will not only help you save money faster, it’ll make the process easy and fun too!

What is a Savings Tracker?

Have you ever seen one of those fundraising posters with a thermometer drawn on it?

You know the ones where they color in the donations as they reach different levels until gradually the thermometer is filled?

That’s a savings tracker!

A savings tracker is a visual representation of your goal and your progress towards reaching it.

Typically savings trackers are printable designs with sections you can color in to show your progress.

Some are specific to your goal, like a printable Christmas or Disney savings tracker.

Others are more customizable with room for you to specify not only your goals, but the length of time you want to take to reach it.

There are also challenge-based money goal trackers for things like a 52-week savings challenge or for paying off credit card debt.

Regardless of what you’re saving for, you can find or create a savings tracker to help you reach your goal.

Why You Should Use Savings Trackers to Reach Your Financial Goals

Savings trackers are a great way to reach your financial goals.

Not only do they help you clarify and visualize your goals, but by allowing you to visualize your progress, you’re conditioning yourself to succeed.

The visual reminder of your priorities and the steps you’ve taken to achieve them helps keep you focused and motivated.

How to Use a Savings Tracker

So you’re convinced you need to start tracking your savings, but how do you go about actually using or creating a savings tracker?

First, you need to decide on a few things:

What are you saving for?

How much do you need to save?

Is there a time you need the money by?

Once you know what you’re saving for, how much you need, and when you need it by, you’re ready to start tracking.

How to fill in your savings trackers

There are different types of savings trackers, each with different methods of filling in your progress.

Usually, you’ll start by dividing up your coloring spaces by the total amount you want to save. This way each colored-in segment corresponds to a specific amount saved.

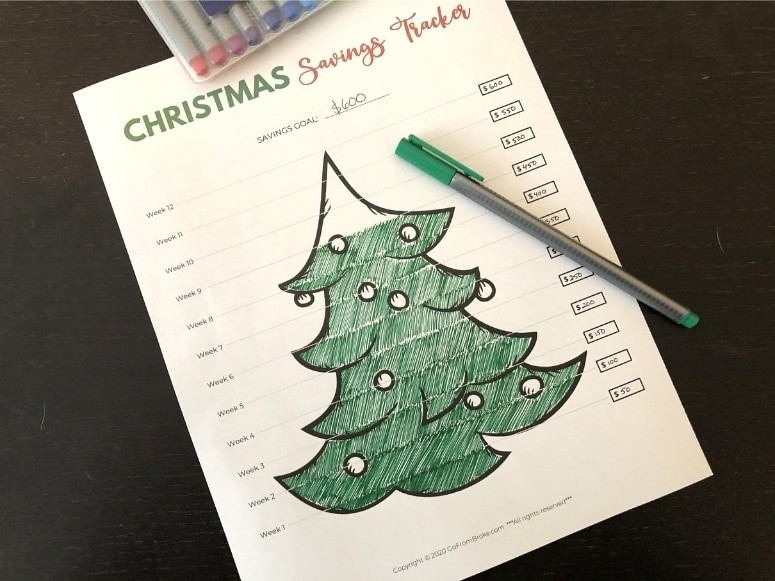

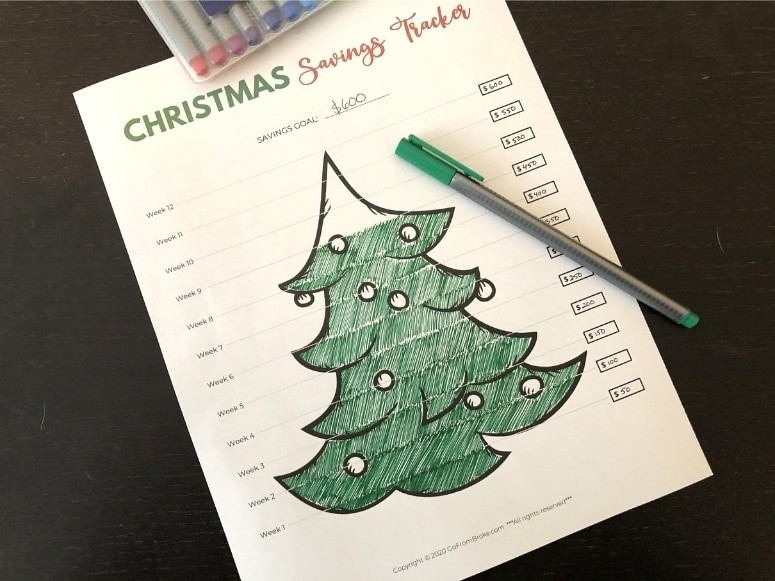

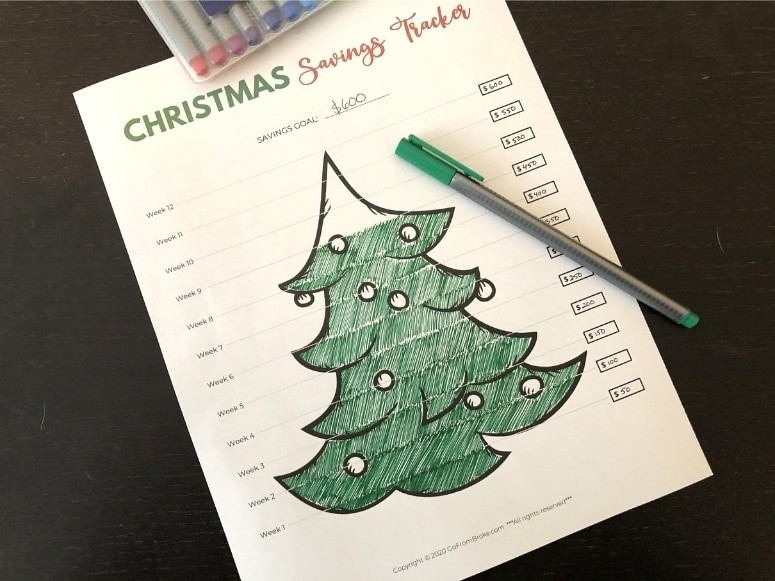

You can see in my Christmas savings tracker image below that I set a savings goal of $600 over a 12-week span. That means for each week my goal was to save $50. (600/12)

My Christmas savings tracker

Some trackers, specifically debt payoff and long-term savings goals, may not have dates associated with them. The same principle applies, however.

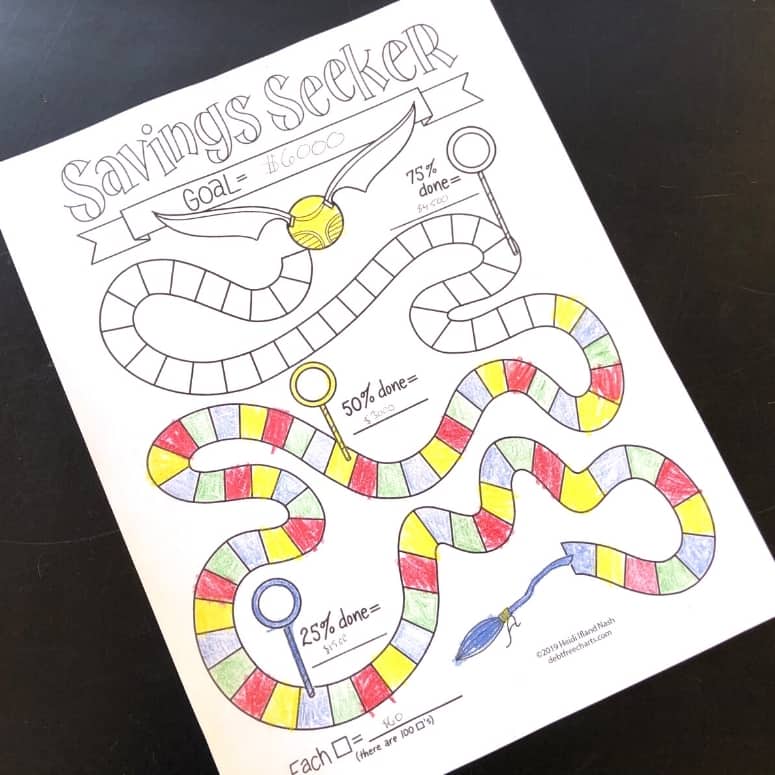

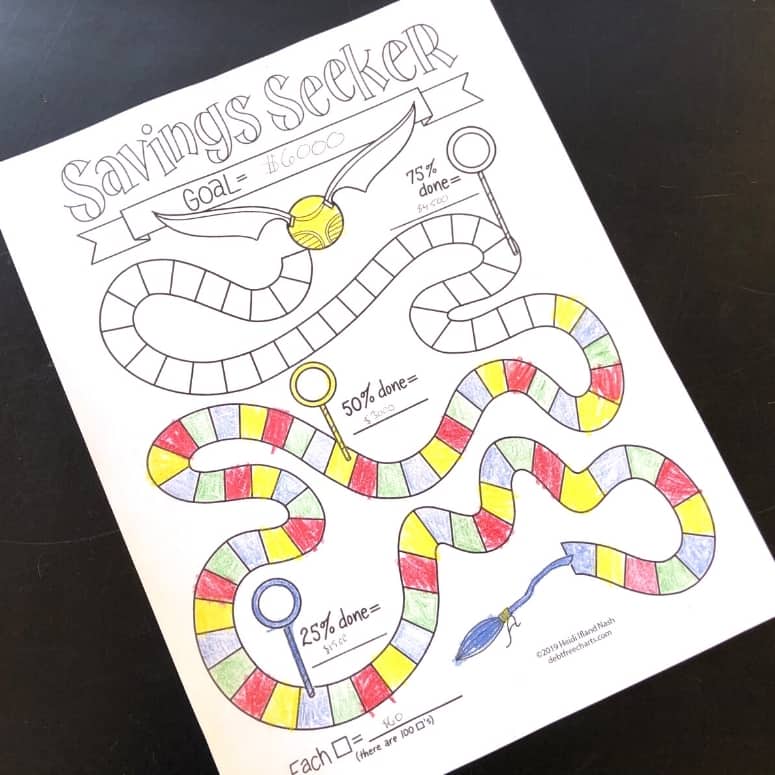

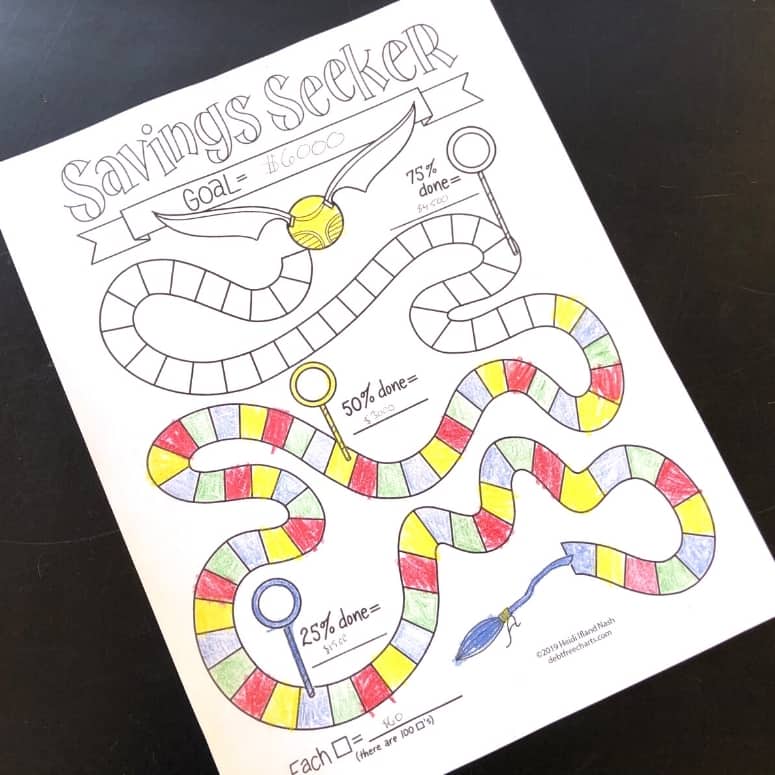

We're using this Savings Seeker chart (from DebtFreeCharts) for our trip to The Wizarding World of Harry Potter. You can see where we took our goal ($6000) and divided it by the number of spaces (100) to get the amount each block represents ($60).

This savings tracker is mapping our savings goal journey to the Wizarding World of Harry Potter.

For every $60 we save, we color in a block.

Where to put your savings tracker

While a savings tracker, in general, will help you hit your targets, keeping it someplace where you see it is the key to hitting them faster.

For my Christmas money goal tracker, I posted it on the wall in my office, directly in front of me.

This helped me see it anytime I was sitting down to budget so I knew I needed to prioritize those savings.

For our Hogwarts tracker, we have it posted on our homeschool whiteboard.

Since it’s a family goal, this keeps it front and center for the whole family.

This way when we’re tempted to order pizza or grab lunch out, we can be reminded of our bigger goal.

When you frame a decision as a choice between an established priority and a spontaneous splurge, you’re able to make a more informed decision.

That doesn’t mean you’ll always opt for a PB&J over a Big Mac, but at least the decision is intentional.

How to budget for savings

Savings trackers are great for visualizing and achieving your financial goals, but you still have to find the money to save if they’re going to work.

A lack of funding preventing you from coloring in your tracker can be demotivating, so it’s important to incorporate your savings into your budget.

You may have heard the phrase, “Pay yourself first.”

Typically when we sit down to budget we think of what bills and expenses are coming up that need to be paid and then put whatever is left over toward our savings goals.

We need to flip that process.

Start by budgeting for your savings goals first and then paying your obligations.

If things seem tight, it may be a sign that you’re overspending.

You can get a clearer idea of how much money you really need to cover the essentials by creating a bare-bones budget.

A bare-bones budget will help you clarify your needs from your wants so you can make a more informed decision about the expenses you have.

If things are still tight, you may need to find some ways to earn extra money.

Here are a few ideas for how to generate some extra cash:

Also, don’t be afraid to think outside the box.

Sites like Facebook and Etsy have made it easy to connect and sell to people both local and thousands of miles away.

With a little creativity and some determination, you can turn almost any hobby into a money-making venture.

Where to Save Your Money

A savings tracker is just a means of letting you see your progress towards your savings goal, but the actual funds still need to be kept somewhere.

Ideally, you’ll separate your goal money from your everyday spending money.

This helps avoid the temptation to spend that money prematurely.

If you’re using the cash envelope method, you’ll want to create an envelope for your savings goal and physically move the money each time you fill in a section.

For non-cash folks, you may want to create a separate account with your bank to hold your savings funds.

I recommend separating the savings for each of the goals you’re actively working on.

Many banks will allow you to create multiple accounts for free.

I’m not a huge fan of having lots of accounts, but I’d rather have my money separated by its purpose than risk accidentally spending it.

If you like the idea of savings goals, but don’t want a load of accounts, take a look at Simple Bank.

While we do the bulk of our banking with USAA, I’ve found Simple Bank to be ideal for our sinking funds and savings goals.

With Simple, I can easily create savings goals and automatically fund them.

Instead of having multiple accounts, Simple lets us create goals and fund them all in one spot. Any money assigned to a goal will not show up as available to spend.

As a part of our “pay yourself first” approach, we transfer a percentage into Simple each month and then assign those funds to the goals we’re working toward.

**UPDATE: Simple Bank has been bought out and is no longer available. For similar functionality I now use Betterment, but Ally is also a popular choice.

Savings Tracker Apps

While I’ve found printable savings trackers more effective for reaching our savings goals, there are a few apps I like to use that not only help us track our savings, but actually help us save money.

Here are some savings tracker apps to help you reach your goals:

Personally, I use the Qapital app to automatically save for certain goals. My favorite method is the round-up challenge.

Since I primarily use credit cards for spending, I’m able to connect my cards to Qapital and have every purchase rounded up to the nearest dollar.

Those round-ups are then withdrawn from my checking account (funding source) and into my Qapital account.

By moving the money I make sure those savings are set aside for their purpose so I don't accidentally spend that money on something else.

Popular Savings Trackers

If you’re the creative type, savings trackers can be pretty easy to make on your own.

Here are a few of my favorites:

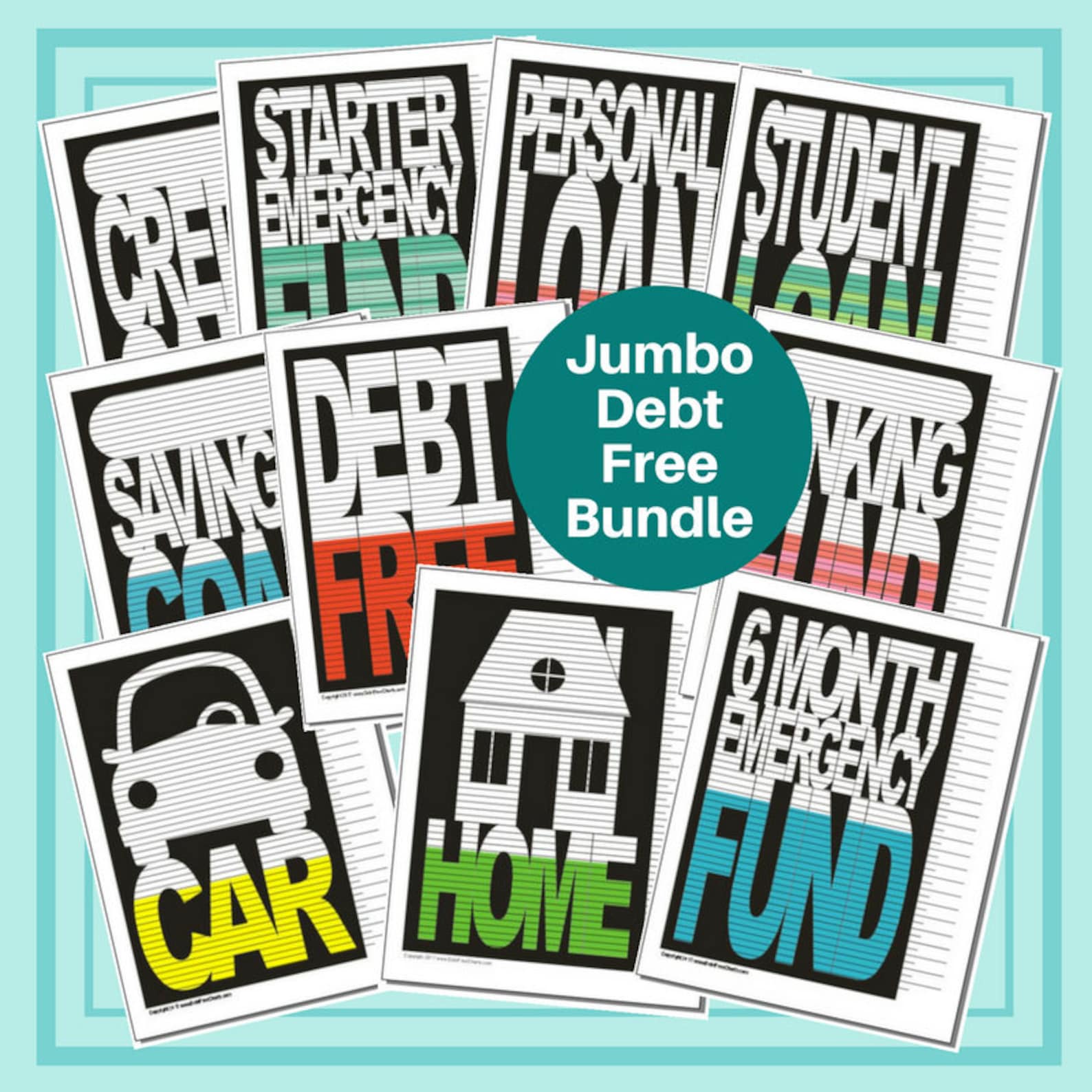

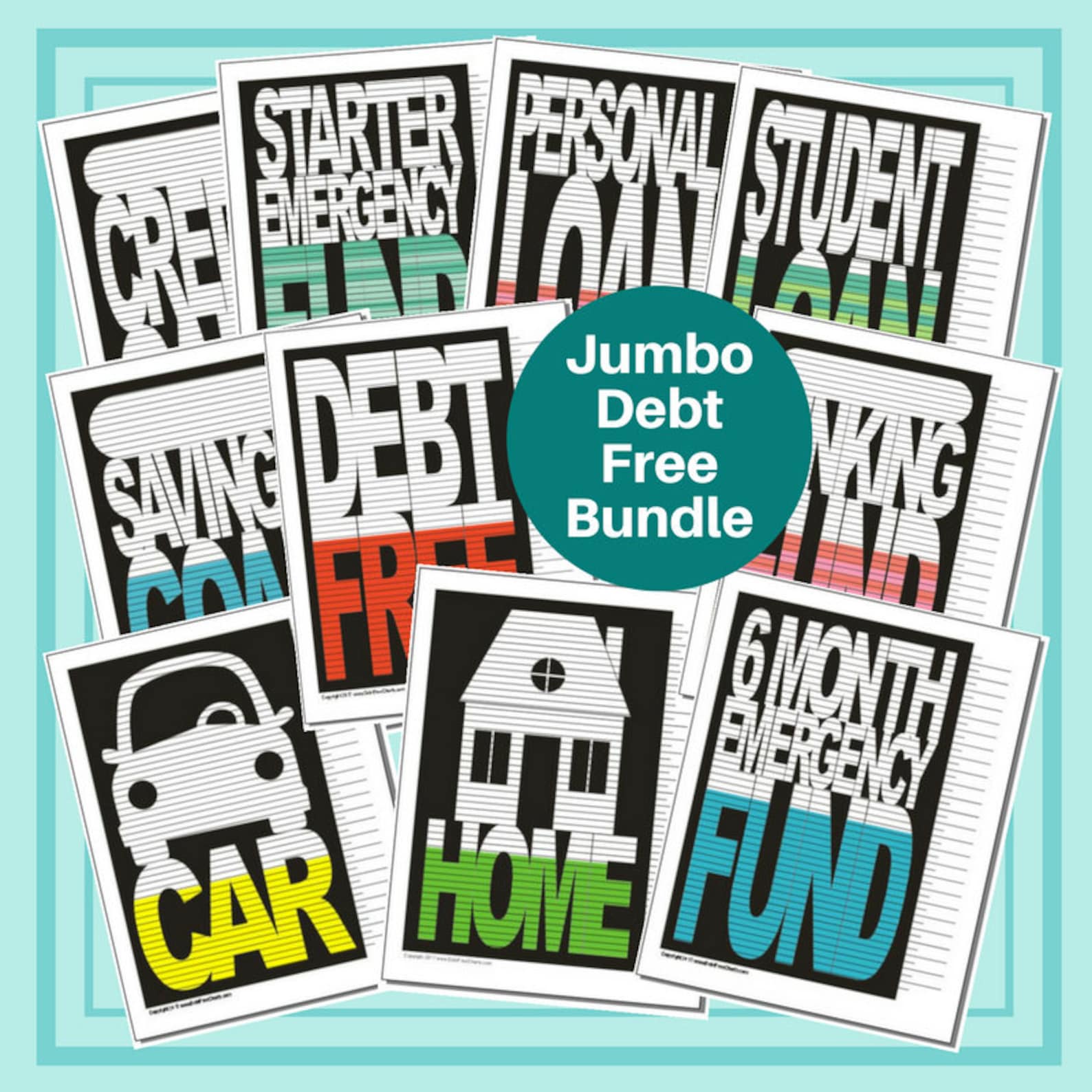

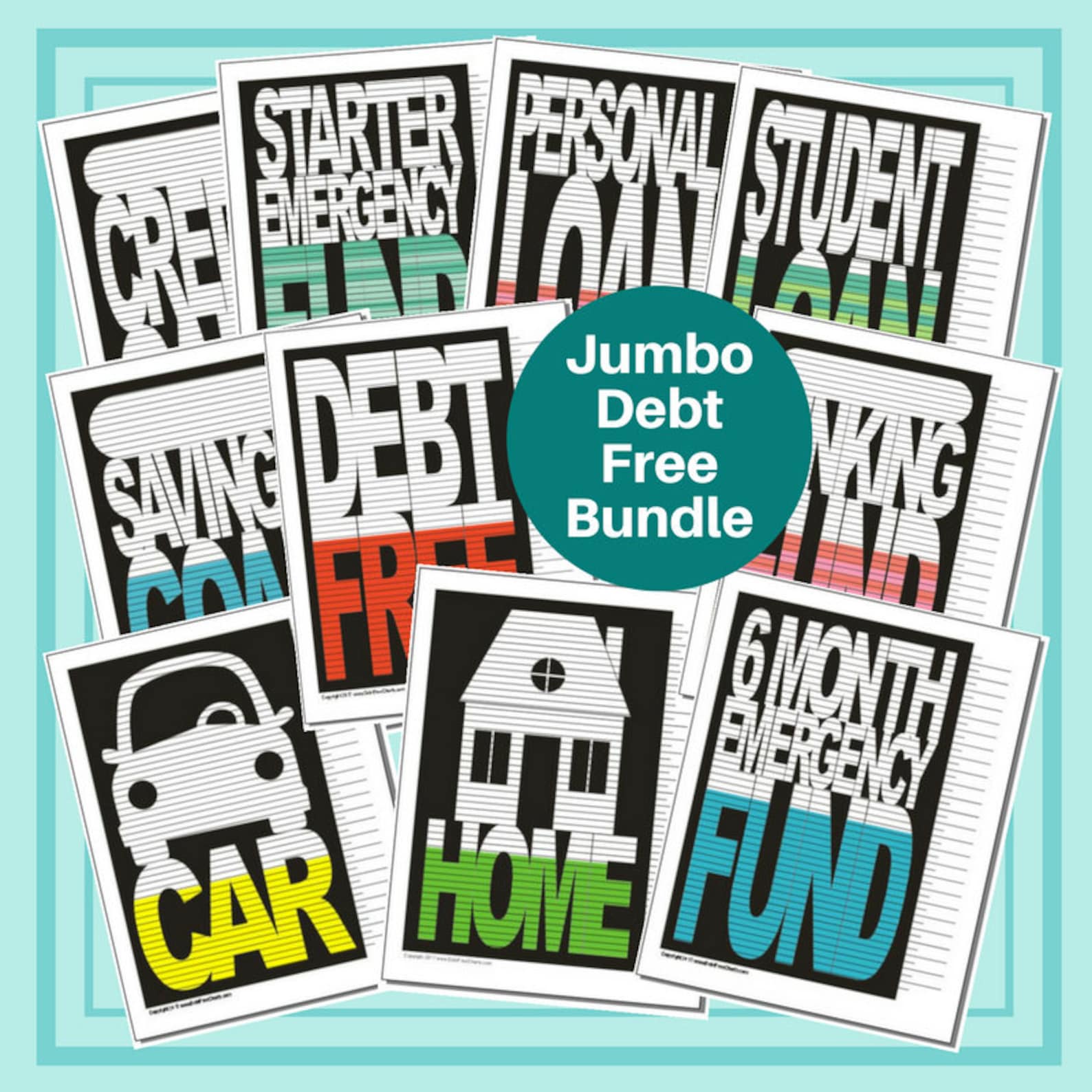

Debt Free Savings Tracker Bundle by DebtFreeCharts

3-6 Month Emergency Fund by PrettySimpleThing

$1000 Savings Tracker by RADishPaperCo

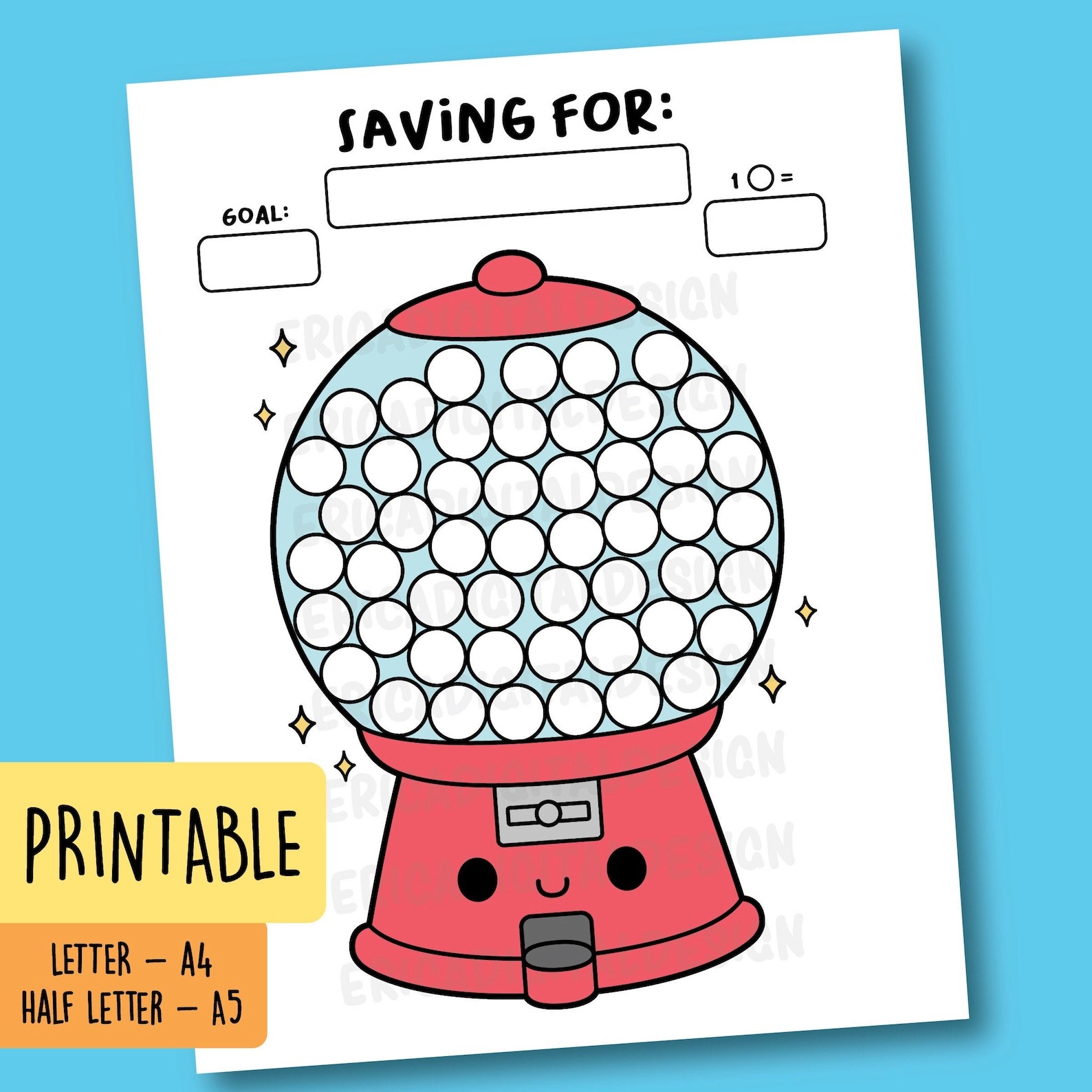

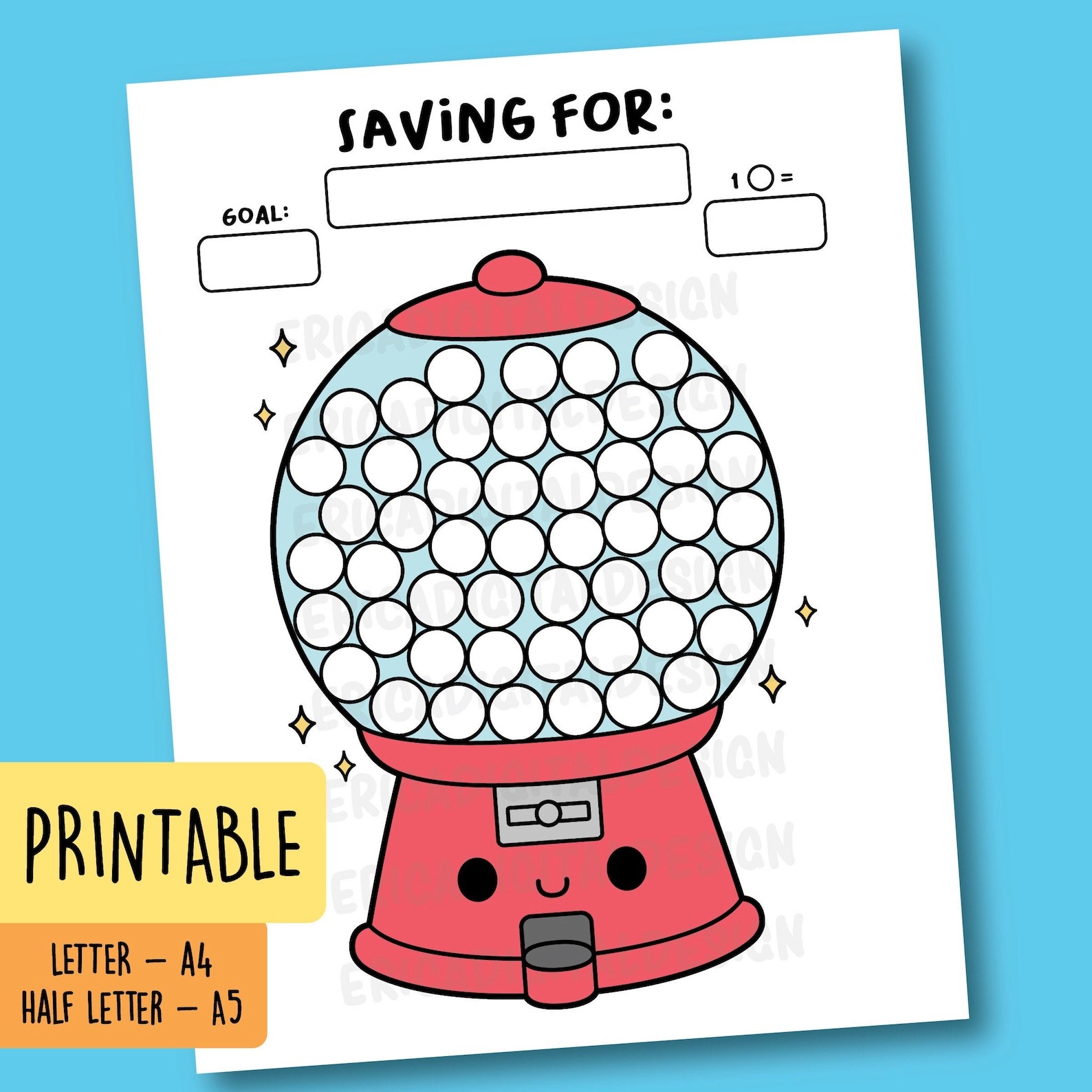

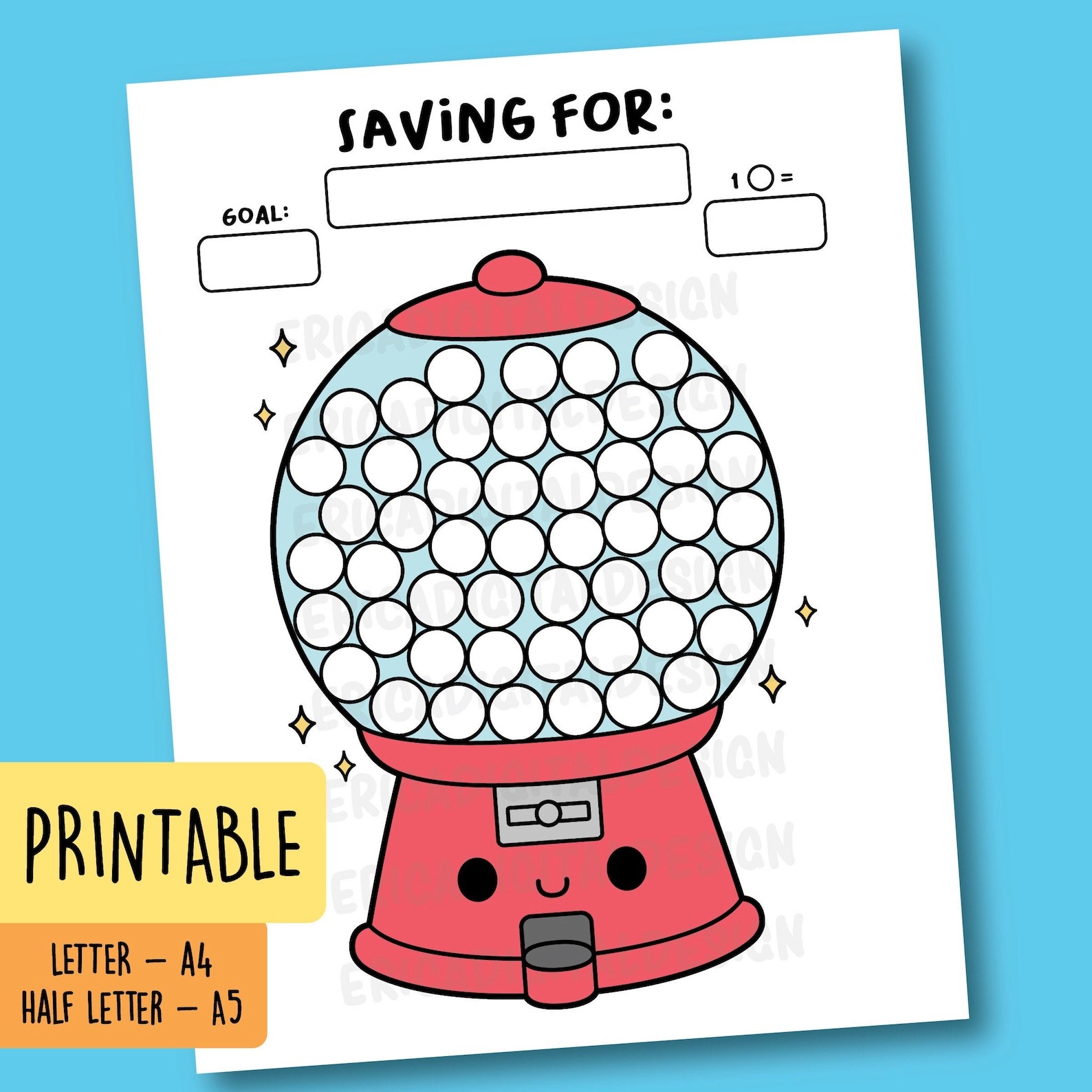

Kids Savings Tracker by EricaDigitalDesign

Final Thoughts

Visualizing your savings goals and tracking your progress is one of the most effective ways to achieve them.

Plus having a record of your savings journey is a nice keepsake and may help you as you tackle your other money goals.

Leave a comment and let me know what you’re saving for!

Are you saving up for anything?

Maybe you’re planning an amazing vacation or you want to finally get your emergency fund topped off.

While in theory, saving money is simple. In practice, it can be anything but.

Especially if you’re trying to save without making other changes to you behavior.

Using a savings goal tracker will not only help you save money faster, it’ll make the process easy and fun too!

What is a Savings Tracker?

Have you ever seen one of those fundraising posters with a thermometer drawn on it?

You know the ones where they color in the donations as they reach different levels until gradually the thermometer is filled?

That’s a savings tracker!

A savings tracker is a visual representation of your goal and your progress towards reaching it.

Typically savings trackers are printable designs with sections you can color in to show your progress.

Some are specific to your goal, like a printable Christmas or Disney savings tracker.

Others are more customizable with room for you to specify not only your goals, but the length of time you want to take to reach it.

There are also challenge-based money goal trackers for things like a 52-week savings challenge or for paying off credit card debt.

Regardless of what you’re saving for, you can find or create a savings tracker to help you reach your goal.

Why You Should Use Savings Trackers to Reach Your Financial Goals

Savings trackers are a great way to reach your financial goals.

Not only do they help you clarify and visualize your goals, but by allowing you to visualize your progress, you’re conditioning yourself to succeed.

The visual reminder of your priorities and the steps you’ve taken to achieve them helps keep you focused and motivated.

How to Use a Savings Tracker

So you’re convinced you need to start tracking your savings, but how do you go about actually using or creating a savings tracker?

First, you need to decide on a few things:

What are you saving for?

How much do you need to save?

Is there a time you need the money by?

Once you know what you’re saving for, how much you need, and when you need it by, you’re ready to start tracking.

How to fill in your savings trackers

There are different types of savings trackers, each with different methods of filling in your progress.

Usually, you’ll start by dividing up your coloring spaces by the total amount you want to save. This way each colored-in segment corresponds to a specific amount saved.

You can see in my Christmas savings tracker image below that I set a savings goal of $600 over a 12-week span. That means for each week my goal was to save $50. (600/12)

My Christmas savings tracker

Some trackers, specifically debt payoff and long-term savings goals, may not have dates associated with them. The same principle applies, however.

We're using this Savings Seeker chart (from DebtFreeCharts) for our trip to The Wizarding World of Harry Potter. You can see where we took our goal ($6000) and divided it by the number of spaces (100) to get the amount each block represents ($60).

This savings tracker is mapping our savings goal journey to the Wizarding World of Harry Potter.

For every $60 we save, we color in a block.

Where to put your savings tracker

While a savings tracker, in general, will help you hit your targets, keeping it someplace where you see it is the key to hitting them faster.

For my Christmas money goal tracker, I posted it on the wall in my office, directly in front of me.

This helped me see it anytime I was sitting down to budget so I knew I needed to prioritize those savings.

For our Hogwarts tracker, we have it posted on our homeschool whiteboard.

Since it’s a family goal, this keeps it front and center for the whole family.

This way when we’re tempted to order pizza or grab lunch out, we can be reminded of our bigger goal.

When you frame a decision as a choice between an established priority and a spontaneous splurge, you’re able to make a more informed decision.

That doesn’t mean you’ll always opt for a PB&J over a Big Mac, but at least the decision is intentional.

How to budget for savings

Savings trackers are great for visualizing and achieving your financial goals, but you still have to find the money to save if they’re going to work.

A lack of funding preventing you from coloring in your tracker can be demotivating, so it’s important to incorporate your savings into your budget.

You may have heard the phrase, “Pay yourself first.”

Typically when we sit down to budget we think of what bills and expenses are coming up that need to be paid and then put whatever is left over toward our savings goals.

We need to flip that process.

Start by budgeting for your savings goals first and then paying your obligations.

If things seem tight, it may be a sign that you’re overspending.

You can get a clearer idea of how much money you really need to cover the essentials by creating a bare-bones budget.

A bare-bones budget will help you clarify your needs from your wants so you can make a more informed decision about the expenses you have.

If things are still tight, you may need to find some ways to earn extra money.

Here are a few ideas for how to generate some extra cash:

Also, don’t be afraid to think outside the box.

Sites like Facebook and Etsy have made it easy to connect and sell to people both local and thousands of miles away.

With a little creativity and some determination, you can turn almost any hobby into a money-making venture.

Where to Save Your Money

A savings tracker is just a means of letting you see your progress towards your savings goal, but the actual funds still need to be kept somewhere.

Ideally, you’ll separate your goal money from your everyday spending money.

This helps avoid the temptation to spend that money prematurely.

If you’re using the cash envelope method, you’ll want to create an envelope for your savings goal and physically move the money each time you fill in a section.

For non-cash folks, you may want to create a separate account with your bank to hold your savings funds.

I recommend separating the savings for each of the goals you’re actively working on.

Many banks will allow you to create multiple accounts for free.

I’m not a huge fan of having lots of accounts, but I’d rather have my money separated by its purpose than risk accidentally spending it.

If you like the idea of savings goals, but don’t want a load of accounts, take a look at Simple Bank.

While we do the bulk of our banking with USAA, I’ve found Simple Bank to be ideal for our sinking funds and savings goals.

With Simple, I can easily create savings goals and automatically fund them.

Instead of having multiple accounts, Simple lets us create goals and fund them all in one spot. Any money assigned to a goal will not show up as available to spend.

As a part of our “pay yourself first” approach, we transfer a percentage into Simple each month and then assign those funds to the goals we’re working toward.

**UPDATE: Simple Bank has been bought out and is no longer available. For similar functionality I now use Betterment, but Ally is also a popular choice.

Savings Tracker Apps

While I’ve found printable savings trackers more effective for reaching our savings goals, there are a few apps I like to use that not only help us track our savings, but actually help us save money.

Here are some savings tracker apps to help you reach your goals:

Personally, I use the Qapital app to automatically save for certain goals. My favorite method is the round-up challenge.

Since I primarily use credit cards for spending, I’m able to connect my cards to Qapital and have every purchase rounded up to the nearest dollar.

Those round-ups are then withdrawn from my checking account (funding source) and into my Qapital account.

By moving the money I make sure those savings are set aside for their purpose so I don't accidentally spend that money on something else.

Popular Savings Trackers

If you’re the creative type, savings trackers can be pretty easy to make on your own.

Here are a few of my favorites:

Debt Free Savings Tracker Bundle by DebtFreeCharts

3-6 Month Emergency Fund by PrettySimpleThing

$1000 Savings Tracker by RADishPaperCo

Kids Savings Tracker by EricaDigitalDesign

Final Thoughts

Visualizing your savings goals and tracking your progress is one of the most effective ways to achieve them.

Plus having a record of your savings journey is a nice keepsake and may help you as you tackle your other money goals.

Leave a comment and let me know what you’re saving for!

Are you saving up for anything?

Maybe you’re planning an amazing vacation or you want to finally get your emergency fund topped off.

While in theory, saving money is simple. In practice, it can be anything but.

Especially if you’re trying to save without making other changes to you behavior.

Using a savings goal tracker will not only help you save money faster, it’ll make the process easy and fun too!

What is a Savings Tracker?

Have you ever seen one of those fundraising posters with a thermometer drawn on it?

You know the ones where they color in the donations as they reach different levels until gradually the thermometer is filled?

That’s a savings tracker!

A savings tracker is a visual representation of your goal and your progress towards reaching it.

Typically savings trackers are printable designs with sections you can color in to show your progress.

Some are specific to your goal, like a printable Christmas or Disney savings tracker.

Others are more customizable with room for you to specify not only your goals, but the length of time you want to take to reach it.

There are also challenge-based money goal trackers for things like a 52-week savings challenge or for paying off credit card debt.

Regardless of what you’re saving for, you can find or create a savings tracker to help you reach your goal.

Why You Should Use Savings Trackers to Reach Your Financial Goals

Savings trackers are a great way to reach your financial goals.

Not only do they help you clarify and visualize your goals, but by allowing you to visualize your progress, you’re conditioning yourself to succeed.

The visual reminder of your priorities and the steps you’ve taken to achieve them helps keep you focused and motivated.

How to Use a Savings Tracker

So you’re convinced you need to start tracking your savings, but how do you go about actually using or creating a savings tracker?

First, you need to decide on a few things:

What are you saving for?

How much do you need to save?

Is there a time you need the money by?

Once you know what you’re saving for, how much you need, and when you need it by, you’re ready to start tracking.

How to fill in your savings trackers

There are different types of savings trackers, each with different methods of filling in your progress.

Usually, you’ll start by dividing up your coloring spaces by the total amount you want to save. This way each colored-in segment corresponds to a specific amount saved.

You can see in my Christmas savings tracker image below that I set a savings goal of $600 over a 12-week span. That means for each week my goal was to save $50. (600/12)

My Christmas savings tracker

Some trackers, specifically debt payoff and long-term savings goals, may not have dates associated with them. The same principle applies, however.

We're using this Savings Seeker chart (from DebtFreeCharts) for our trip to The Wizarding World of Harry Potter. You can see where we took our goal ($6000) and divided it by the number of spaces (100) to get the amount each block represents ($60).

This savings tracker is mapping our savings goal journey to the Wizarding World of Harry Potter.

For every $60 we save, we color in a block.

Where to put your savings tracker

While a savings tracker, in general, will help you hit your targets, keeping it someplace where you see it is the key to hitting them faster.

For my Christmas money goal tracker, I posted it on the wall in my office, directly in front of me.

This helped me see it anytime I was sitting down to budget so I knew I needed to prioritize those savings.

For our Hogwarts tracker, we have it posted on our homeschool whiteboard.

Since it’s a family goal, this keeps it front and center for the whole family.

This way when we’re tempted to order pizza or grab lunch out, we can be reminded of our bigger goal.

When you frame a decision as a choice between an established priority and a spontaneous splurge, you’re able to make a more informed decision.

That doesn’t mean you’ll always opt for a PB&J over a Big Mac, but at least the decision is intentional.

How to budget for savings

Savings trackers are great for visualizing and achieving your financial goals, but you still have to find the money to save if they’re going to work.

A lack of funding preventing you from coloring in your tracker can be demotivating, so it’s important to incorporate your savings into your budget.

You may have heard the phrase, “Pay yourself first.”

Typically when we sit down to budget we think of what bills and expenses are coming up that need to be paid and then put whatever is left over toward our savings goals.

We need to flip that process.

Start by budgeting for your savings goals first and then paying your obligations.

If things seem tight, it may be a sign that you’re overspending.

You can get a clearer idea of how much money you really need to cover the essentials by creating a bare-bones budget.

A bare-bones budget will help you clarify your needs from your wants so you can make a more informed decision about the expenses you have.

If things are still tight, you may need to find some ways to earn extra money.

Here are a few ideas for how to generate some extra cash:

Also, don’t be afraid to think outside the box.

Sites like Facebook and Etsy have made it easy to connect and sell to people both local and thousands of miles away.

With a little creativity and some determination, you can turn almost any hobby into a money-making venture.

Where to Save Your Money

A savings tracker is just a means of letting you see your progress towards your savings goal, but the actual funds still need to be kept somewhere.

Ideally, you’ll separate your goal money from your everyday spending money.

This helps avoid the temptation to spend that money prematurely.

If you’re using the cash envelope method, you’ll want to create an envelope for your savings goal and physically move the money each time you fill in a section.

For non-cash folks, you may want to create a separate account with your bank to hold your savings funds.

I recommend separating the savings for each of the goals you’re actively working on.

Many banks will allow you to create multiple accounts for free.

I’m not a huge fan of having lots of accounts, but I’d rather have my money separated by its purpose than risk accidentally spending it.

If you like the idea of savings goals, but don’t want a load of accounts, take a look at Simple Bank.

While we do the bulk of our banking with USAA, I’ve found Simple Bank to be ideal for our sinking funds and savings goals.

With Simple, I can easily create savings goals and automatically fund them.

Instead of having multiple accounts, Simple lets us create goals and fund them all in one spot. Any money assigned to a goal will not show up as available to spend.

As a part of our “pay yourself first” approach, we transfer a percentage into Simple each month and then assign those funds to the goals we’re working toward.

**UPDATE: Simple Bank has been bought out and is no longer available. For similar functionality I now use Betterment, but Ally is also a popular choice.

Savings Tracker Apps

While I’ve found printable savings trackers more effective for reaching our savings goals, there are a few apps I like to use that not only help us track our savings, but actually help us save money.

Here are some savings tracker apps to help you reach your goals:

Personally, I use the Qapital app to automatically save for certain goals. My favorite method is the round-up challenge.

Since I primarily use credit cards for spending, I’m able to connect my cards to Qapital and have every purchase rounded up to the nearest dollar.

Those round-ups are then withdrawn from my checking account (funding source) and into my Qapital account.

By moving the money I make sure those savings are set aside for their purpose so I don't accidentally spend that money on something else.

Popular Savings Trackers

If you’re the creative type, savings trackers can be pretty easy to make on your own.

Here are a few of my favorites:

Debt Free Savings Tracker Bundle by DebtFreeCharts

3-6 Month Emergency Fund by PrettySimpleThing

$1000 Savings Tracker by RADishPaperCo

Kids Savings Tracker by EricaDigitalDesign

Final Thoughts

Visualizing your savings goals and tracking your progress is one of the most effective ways to achieve them.

Plus having a record of your savings journey is a nice keepsake and may help you as you tackle your other money goals.

Leave a comment and let me know what you’re saving for!

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

You're in good hands

You're in good hands

You're in good hands

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.