Monthly Money Challenge: Save the Spavings

Monthly Money Challenge: Save the Spavings

Monthly Money Challenge: Save the Spavings

Feb 28, 2019

Money Challenges >

Money Challenges >

Strategies & Techniques

Strategies & Techniques

It's a new month and that means a new money challenge!

This month I'm resolving to save the spavings!

What Is Spavings?

I know what you’re thinking, and no, I didn't just make up that word.

I actually heard about the whole concept from J. Money over on Budgets Are Sexy (who in turn heard it from The Lady In The Black where it seems to have originated).

So what is it?

Well, you know how someone says they "saved" x amount of dollars when they bought such and such on sale, when in reality they still "spent" money?

That discount isn't savings, since nothing was actually saved. Instead it's spavings, a combination of spending and perceived savings.

My goal with this month's challenge is to actually save that spavings.

How to Save the Spavings

If all you do when you get a discount is think you saved money, I hate to break it to you, but you actually only spent money.

You may have spent less, but when you check your accounts, you didn’t actually save anything.

So to convert these spavings into real savings I’m going to track all the discounts I get throughout the month and deposit the equivalent amount into a separate account.

Tracking My Spavings

Keeping track of all the deals I take advantage of will be the toughest part of this challenge.

Most in-store receipts summarize your savings at the bottom so, hopefully, I won’t have to tally up all my digital grocery coupons by hand.

But online spending will require more effort since prices tend to fluctuate quite a bit. And, to be honest, it’s usually the emails promising “savings” that tempt me into buying to begin with.

To help me keep track of online spending, I’m going to flag any email I get for things I’m even remotely interested in buying. That way I have a record of the discount if (or when) I choose to buy.

I'm also going to make the effort to record savings at the point of purchase. I already put my transactions in YNAB as soon as I'm done paying, so making a note of any spavings I need to transfer can be attached to that.

Where to Save My Spavings

While tracking may be the trickiest aspect of this challenge, the actual savings requires a bit of effort as well. (At least for me since I want to track it separately from our normal money).

The easiest thing to do would be to create a new sub-account in USAA, but that just seems boring.

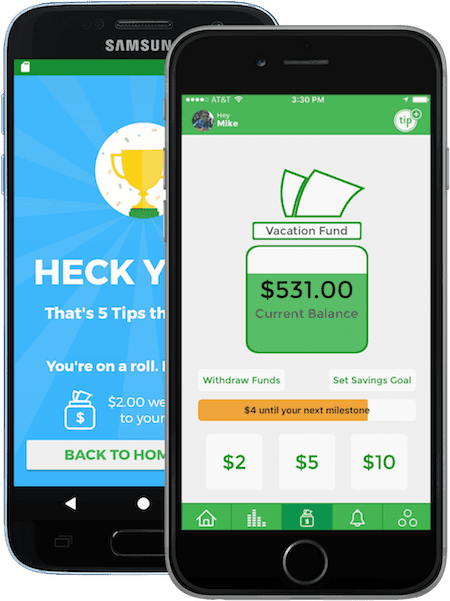

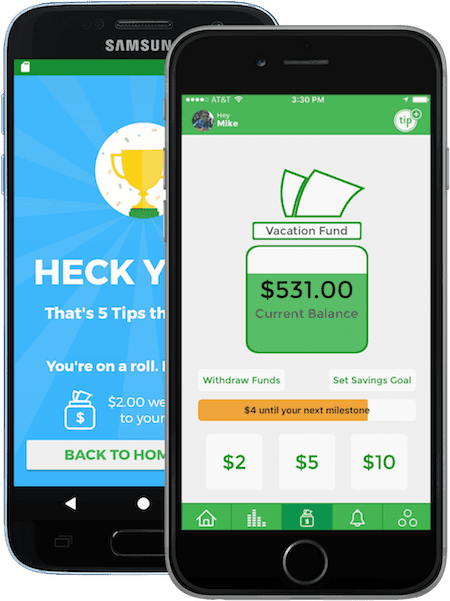

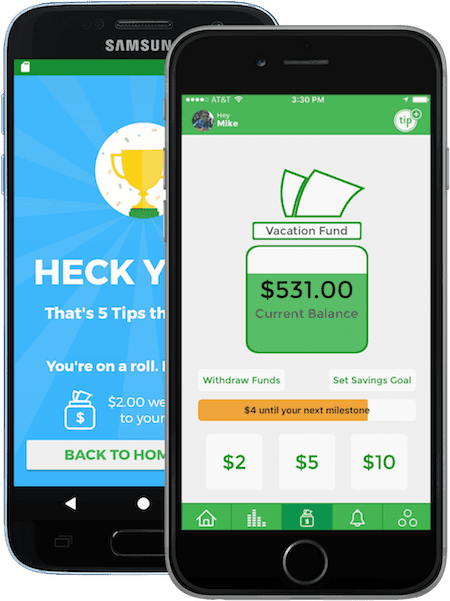

So since I've got my phone on me 24/7 (plus I like to play with new apps) I'm going to use the Tip Yourself app.

Tip Yourself shows your savings as a jar being filled and offers different milestones you can hit. So I'm hoping using the app will add an element of fun to the experiment as well.

It also doesn't require a long log-in process like most banking apps which will make it easier to get into the habit of transferring the spavings at the point of purchase.

My Goal with This Challenge

My purpose with these monthly money challenges is to experiment with ways to save, as well as change our money mindsets so that we can reach financial independence sooner.

My main goal with this challenge is to become more conscious of my spending. I may be getting a deal, but I'm still spending.

By rethinking perceived savings and actually forcing myself to save that money (I'll be putting all my spavings into my Roth IRA) I'm curious to see if our overall spending will be impacted.

For example, when Fry's runs their Buy 5, Save $5 sale, will I still go searching for extra items we may not need just so I can hit that magic number?

I have a tendency to save money with coupons so I can justify the expense. But I also view those savings as more money to spend elsewhere.

I'm curious to see if I'll feel any resistance to purchases I'd normally not think twice about. Or if I'll be more deliberate about my spending knowing those deals aren't leaving any more money in my budget.

Want to Join Me and Save the Spavings?

I'm super excited for this month's challenge!

Of all my monthly money challenges so far, this one seems like it may be the most rewarding with the least amount of effort required.

It's the perfect challenge to join in on if you've been sitting on the sidelines so far.

If you'd like to join me in saving the spavings, leave a comment below or shoot me a message. I'd love to check in with you at the end of the month and see how much you manage to save.

It's a new month and that means a new money challenge!

This month I'm resolving to save the spavings!

What Is Spavings?

I know what you’re thinking, and no, I didn't just make up that word.

I actually heard about the whole concept from J. Money over on Budgets Are Sexy (who in turn heard it from The Lady In The Black where it seems to have originated).

So what is it?

Well, you know how someone says they "saved" x amount of dollars when they bought such and such on sale, when in reality they still "spent" money?

That discount isn't savings, since nothing was actually saved. Instead it's spavings, a combination of spending and perceived savings.

My goal with this month's challenge is to actually save that spavings.

How to Save the Spavings

If all you do when you get a discount is think you saved money, I hate to break it to you, but you actually only spent money.

You may have spent less, but when you check your accounts, you didn’t actually save anything.

So to convert these spavings into real savings I’m going to track all the discounts I get throughout the month and deposit the equivalent amount into a separate account.

Tracking My Spavings

Keeping track of all the deals I take advantage of will be the toughest part of this challenge.

Most in-store receipts summarize your savings at the bottom so, hopefully, I won’t have to tally up all my digital grocery coupons by hand.

But online spending will require more effort since prices tend to fluctuate quite a bit. And, to be honest, it’s usually the emails promising “savings” that tempt me into buying to begin with.

To help me keep track of online spending, I’m going to flag any email I get for things I’m even remotely interested in buying. That way I have a record of the discount if (or when) I choose to buy.

I'm also going to make the effort to record savings at the point of purchase. I already put my transactions in YNAB as soon as I'm done paying, so making a note of any spavings I need to transfer can be attached to that.

Where to Save My Spavings

While tracking may be the trickiest aspect of this challenge, the actual savings requires a bit of effort as well. (At least for me since I want to track it separately from our normal money).

The easiest thing to do would be to create a new sub-account in USAA, but that just seems boring.

So since I've got my phone on me 24/7 (plus I like to play with new apps) I'm going to use the Tip Yourself app.

Tip Yourself shows your savings as a jar being filled and offers different milestones you can hit. So I'm hoping using the app will add an element of fun to the experiment as well.

It also doesn't require a long log-in process like most banking apps which will make it easier to get into the habit of transferring the spavings at the point of purchase.

My Goal with This Challenge

My purpose with these monthly money challenges is to experiment with ways to save, as well as change our money mindsets so that we can reach financial independence sooner.

My main goal with this challenge is to become more conscious of my spending. I may be getting a deal, but I'm still spending.

By rethinking perceived savings and actually forcing myself to save that money (I'll be putting all my spavings into my Roth IRA) I'm curious to see if our overall spending will be impacted.

For example, when Fry's runs their Buy 5, Save $5 sale, will I still go searching for extra items we may not need just so I can hit that magic number?

I have a tendency to save money with coupons so I can justify the expense. But I also view those savings as more money to spend elsewhere.

I'm curious to see if I'll feel any resistance to purchases I'd normally not think twice about. Or if I'll be more deliberate about my spending knowing those deals aren't leaving any more money in my budget.

Want to Join Me and Save the Spavings?

I'm super excited for this month's challenge!

Of all my monthly money challenges so far, this one seems like it may be the most rewarding with the least amount of effort required.

It's the perfect challenge to join in on if you've been sitting on the sidelines so far.

If you'd like to join me in saving the spavings, leave a comment below or shoot me a message. I'd love to check in with you at the end of the month and see how much you manage to save.

It's a new month and that means a new money challenge!

This month I'm resolving to save the spavings!

What Is Spavings?

I know what you’re thinking, and no, I didn't just make up that word.

I actually heard about the whole concept from J. Money over on Budgets Are Sexy (who in turn heard it from The Lady In The Black where it seems to have originated).

So what is it?

Well, you know how someone says they "saved" x amount of dollars when they bought such and such on sale, when in reality they still "spent" money?

That discount isn't savings, since nothing was actually saved. Instead it's spavings, a combination of spending and perceived savings.

My goal with this month's challenge is to actually save that spavings.

How to Save the Spavings

If all you do when you get a discount is think you saved money, I hate to break it to you, but you actually only spent money.

You may have spent less, but when you check your accounts, you didn’t actually save anything.

So to convert these spavings into real savings I’m going to track all the discounts I get throughout the month and deposit the equivalent amount into a separate account.

Tracking My Spavings

Keeping track of all the deals I take advantage of will be the toughest part of this challenge.

Most in-store receipts summarize your savings at the bottom so, hopefully, I won’t have to tally up all my digital grocery coupons by hand.

But online spending will require more effort since prices tend to fluctuate quite a bit. And, to be honest, it’s usually the emails promising “savings” that tempt me into buying to begin with.

To help me keep track of online spending, I’m going to flag any email I get for things I’m even remotely interested in buying. That way I have a record of the discount if (or when) I choose to buy.

I'm also going to make the effort to record savings at the point of purchase. I already put my transactions in YNAB as soon as I'm done paying, so making a note of any spavings I need to transfer can be attached to that.

Where to Save My Spavings

While tracking may be the trickiest aspect of this challenge, the actual savings requires a bit of effort as well. (At least for me since I want to track it separately from our normal money).

The easiest thing to do would be to create a new sub-account in USAA, but that just seems boring.

So since I've got my phone on me 24/7 (plus I like to play with new apps) I'm going to use the Tip Yourself app.

Tip Yourself shows your savings as a jar being filled and offers different milestones you can hit. So I'm hoping using the app will add an element of fun to the experiment as well.

It also doesn't require a long log-in process like most banking apps which will make it easier to get into the habit of transferring the spavings at the point of purchase.

My Goal with This Challenge

My purpose with these monthly money challenges is to experiment with ways to save, as well as change our money mindsets so that we can reach financial independence sooner.

My main goal with this challenge is to become more conscious of my spending. I may be getting a deal, but I'm still spending.

By rethinking perceived savings and actually forcing myself to save that money (I'll be putting all my spavings into my Roth IRA) I'm curious to see if our overall spending will be impacted.

For example, when Fry's runs their Buy 5, Save $5 sale, will I still go searching for extra items we may not need just so I can hit that magic number?

I have a tendency to save money with coupons so I can justify the expense. But I also view those savings as more money to spend elsewhere.

I'm curious to see if I'll feel any resistance to purchases I'd normally not think twice about. Or if I'll be more deliberate about my spending knowing those deals aren't leaving any more money in my budget.

Want to Join Me and Save the Spavings?

I'm super excited for this month's challenge!

Of all my monthly money challenges so far, this one seems like it may be the most rewarding with the least amount of effort required.

It's the perfect challenge to join in on if you've been sitting on the sidelines so far.

If you'd like to join me in saving the spavings, leave a comment below or shoot me a message. I'd love to check in with you at the end of the month and see how much you manage to save.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

You're in good hands

You're in good hands

You're in good hands

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.