The Cost of Convenience

The Cost of Convenience

The Cost of Convenience

Jun 11, 2020

Mindset >

Mindset >

Advanced Concepts

Advanced Concepts

Have you ever stopped to think about how much you’re spending on conveniences?

How often do you rush out the door, opting to hit a drive-thru for coffee or breakfast instead of waking up a few minutes earlier to make it yourself?

It may not seem like much at the time, but even eating out for lunch just once per week can add up to over $500 a year.

It may be an area of your budget you're willing to pay extra for, but make sure you're aware of the cost of convenience.

Here are some common conveniences that may be costing you more money than are worth it.

Eating Out

When you start tracking your spending you may discover what we did: you're spending a crazy amount on eating out.

While I love the convenience of having someone else cook for me, the expense can be hard to justify, especially when you’re in debt.

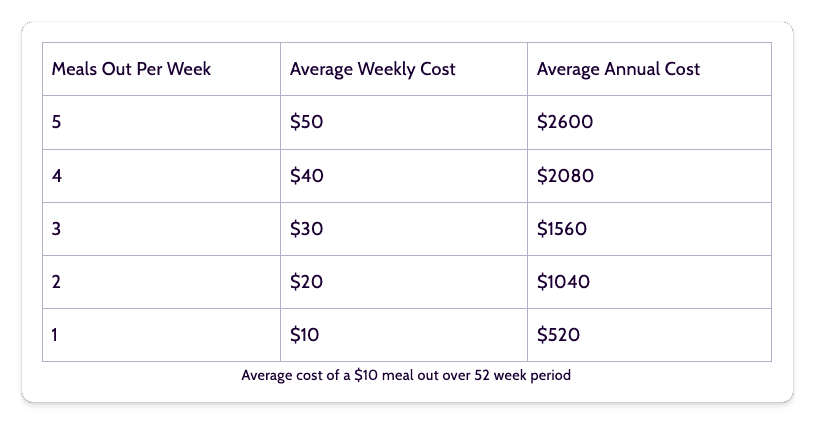

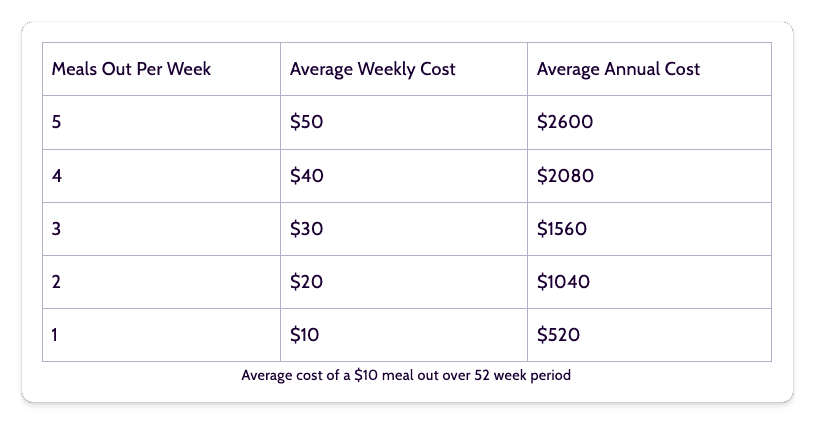

Look at how much you’re actually spending on those so called “value” meals. While $5-10 doesn’t sound like much by itself, letting it become a habit can empty your wallet quick.

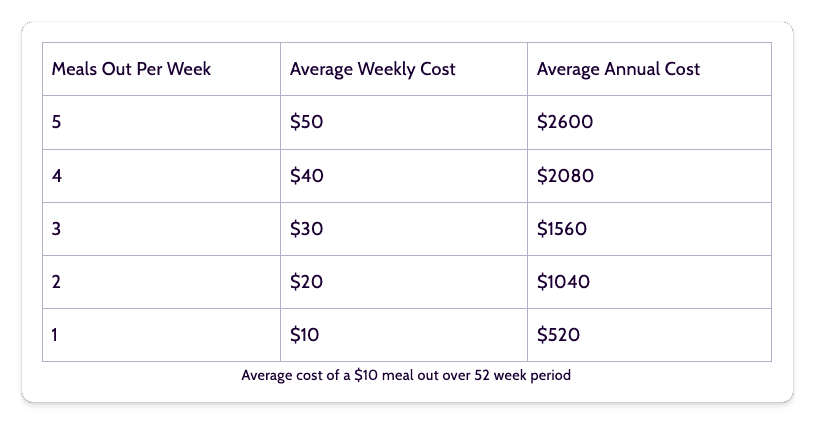

Let’s break down how much you could be spending by eating out for lunch. Assuming each meal averages $10:

Take a look at those annual averages. For every day you brown bag your lunch you can save over $500 a year!

ATM Fees

Any good checking account will have a large network of ATMs you can use for free or ones they'll reimburse you for using.

If your bank doesn't and you're not willing to move your accounts, an easy workaround is to get cash back when you shop.

Depending on where you are and what you're buying you may not want to pay for the entire purchase with your debit card.

In that case, just grab a pack of gum or some other cheap thing to ring up separately and get the cash back during that transaction.

Drinking Bottled Water

Depending on your brand, bottled water may not be a large expense for you, but compared to free it is a largely unnecessary one.

If tap water isn't an option look into a filtering system you can use. The one-off expense will pay for itself over time.

Also look at investing in a few reusable water bottles.

Having water always on hand may have the added benefit of saving you money on impulse coffee, sodas, and even snacks.

Buying Coffee

Do you consider small splurge expenses like a daily latte your little treat?

If so, have you ever done the math to determine if that daily indulgence is really worth it?

While $3-5 a day may not seem like it will make a difference, if you're struggling to save money, it's little expenses like these that can undermine your success.

You don't have to give up all life's pleasures or quit cold turkey. But you should at least examine these expenses in a broader context and make sure you're being intentional when you buy.

$3 a day = $15 a week = $780 a year

Is your Starbucks habit worth $780 a year?

Shopping Online

Online shopping is amazing. But by removing virtually all friction from the buying process, we're tempted to spend more money with less thought.

Without having to physically go to the store, the only barrier to getting that thing you want is waiting for it to arrive. And even that has largely been eliminated with upgraded shipping options.

So now not only are you paying for the convenience of not having to go to the store, but also of getting your items quicker.

One way to curb impulsive online shopping is to add things to a wishlist instead of the cart. Give yourself a day or more to think on your purchase before you click “buy.”

Also, be wary of “free shipping” offers.

Many online stores will offer free shipping if you hit a certain spending threshold. But that may cause you to spend more than you initially planned just to can get free shipping.

More often than not, trying to hit shipping minimums will leave you spending more than you anticipated.

If the product you’re buying doesn’t seem worth it when you factor in shipping, you should ask yourself if it’s worth buying at all.

Buying Theater Concessions

It's no great secret that movie theater concessions are crazy expensive. According to Movie Theater Prices, the average cost for a large popcorn and drinks for a family of 4 is around $35.

It may be part of the experience, but it may also be time to reconsider if it's worth the cost.

Try to avoid the desire for treats altogether by eating before the movie. Or opt for a dine-in movie theater and get a full dinner with your movie for a comparable price.

Buying Household Items at the Grocery Store

Do you buy your shampoo, trash bags, toilet paper and other household goods at the grocery store? If so you’re probably paying a premium for it.

While it may be more convenient to buy everything in one go, non-grocery items tend to be more expensive at grocery stores.

You may get lucky and spot a deal or find some coupons to clip, but in general, household goods are cheaper when bought in bulk. Grocery stores simply don't have the space to stock them so they charge more for them.

To check for yourself, compare your grocery store's per-unit price to your local warehouse club or Amazon to see if you can save by switching where you buy.

I got tired of trying to squeeze giant bundles of toilet paper, paper towels, and Kleenex in my car so I started ordering those things via Amazon's Subscribe and Save.

Not only does Amazon email me before things ship so I can double-check pricing and delay any items we may not need, but they also give me a discount for automating the process!

I save time and money using Amazon's Subscribe & Save.

Travel Upgrades

Do you travel a lot?

It's understandable to want your travel to be as comfortable as possible, but airlines, in particular, have become masters at squeezing extra cash out of you.

Pay close attention to the various fees when planning your next trip.

Most airlines now charge you for your bags, as well as offering various upgrade options like premium snacks, pre-boarding, seat selection, and WIFI access.

Also, don't forget to bring your own headphones or you'll be paying a premium for the ones from the airline.

PRO TIP – If you plan to use WiFi, buy it in advance. It's usually cheaper than buying once you've taken off.

Final Thoughts

There are many conveniences well worth the expense, but there are just as many, if not more, that may be draining your budget without you noticing.

Take a look through your expenses and see what the true cost of convenience is for you, and determine the impact those conveniences are having on your financial goals.

Have you ever stopped to think about how much you’re spending on conveniences?

How often do you rush out the door, opting to hit a drive-thru for coffee or breakfast instead of waking up a few minutes earlier to make it yourself?

It may not seem like much at the time, but even eating out for lunch just once per week can add up to over $500 a year.

It may be an area of your budget you're willing to pay extra for, but make sure you're aware of the cost of convenience.

Here are some common conveniences that may be costing you more money than are worth it.

Eating Out

When you start tracking your spending you may discover what we did: you're spending a crazy amount on eating out.

While I love the convenience of having someone else cook for me, the expense can be hard to justify, especially when you’re in debt.

Look at how much you’re actually spending on those so called “value” meals. While $5-10 doesn’t sound like much by itself, letting it become a habit can empty your wallet quick.

Let’s break down how much you could be spending by eating out for lunch. Assuming each meal averages $10:

Take a look at those annual averages. For every day you brown bag your lunch you can save over $500 a year!

ATM Fees

Any good checking account will have a large network of ATMs you can use for free or ones they'll reimburse you for using.

If your bank doesn't and you're not willing to move your accounts, an easy workaround is to get cash back when you shop.

Depending on where you are and what you're buying you may not want to pay for the entire purchase with your debit card.

In that case, just grab a pack of gum or some other cheap thing to ring up separately and get the cash back during that transaction.

Drinking Bottled Water

Depending on your brand, bottled water may not be a large expense for you, but compared to free it is a largely unnecessary one.

If tap water isn't an option look into a filtering system you can use. The one-off expense will pay for itself over time.

Also look at investing in a few reusable water bottles.

Having water always on hand may have the added benefit of saving you money on impulse coffee, sodas, and even snacks.

Buying Coffee

Do you consider small splurge expenses like a daily latte your little treat?

If so, have you ever done the math to determine if that daily indulgence is really worth it?

While $3-5 a day may not seem like it will make a difference, if you're struggling to save money, it's little expenses like these that can undermine your success.

You don't have to give up all life's pleasures or quit cold turkey. But you should at least examine these expenses in a broader context and make sure you're being intentional when you buy.

$3 a day = $15 a week = $780 a year

Is your Starbucks habit worth $780 a year?

Shopping Online

Online shopping is amazing. But by removing virtually all friction from the buying process, we're tempted to spend more money with less thought.

Without having to physically go to the store, the only barrier to getting that thing you want is waiting for it to arrive. And even that has largely been eliminated with upgraded shipping options.

So now not only are you paying for the convenience of not having to go to the store, but also of getting your items quicker.

One way to curb impulsive online shopping is to add things to a wishlist instead of the cart. Give yourself a day or more to think on your purchase before you click “buy.”

Also, be wary of “free shipping” offers.

Many online stores will offer free shipping if you hit a certain spending threshold. But that may cause you to spend more than you initially planned just to can get free shipping.

More often than not, trying to hit shipping minimums will leave you spending more than you anticipated.

If the product you’re buying doesn’t seem worth it when you factor in shipping, you should ask yourself if it’s worth buying at all.

Buying Theater Concessions

It's no great secret that movie theater concessions are crazy expensive. According to Movie Theater Prices, the average cost for a large popcorn and drinks for a family of 4 is around $35.

It may be part of the experience, but it may also be time to reconsider if it's worth the cost.

Try to avoid the desire for treats altogether by eating before the movie. Or opt for a dine-in movie theater and get a full dinner with your movie for a comparable price.

Buying Household Items at the Grocery Store

Do you buy your shampoo, trash bags, toilet paper and other household goods at the grocery store? If so you’re probably paying a premium for it.

While it may be more convenient to buy everything in one go, non-grocery items tend to be more expensive at grocery stores.

You may get lucky and spot a deal or find some coupons to clip, but in general, household goods are cheaper when bought in bulk. Grocery stores simply don't have the space to stock them so they charge more for them.

To check for yourself, compare your grocery store's per-unit price to your local warehouse club or Amazon to see if you can save by switching where you buy.

I got tired of trying to squeeze giant bundles of toilet paper, paper towels, and Kleenex in my car so I started ordering those things via Amazon's Subscribe and Save.

Not only does Amazon email me before things ship so I can double-check pricing and delay any items we may not need, but they also give me a discount for automating the process!

I save time and money using Amazon's Subscribe & Save.

Travel Upgrades

Do you travel a lot?

It's understandable to want your travel to be as comfortable as possible, but airlines, in particular, have become masters at squeezing extra cash out of you.

Pay close attention to the various fees when planning your next trip.

Most airlines now charge you for your bags, as well as offering various upgrade options like premium snacks, pre-boarding, seat selection, and WIFI access.

Also, don't forget to bring your own headphones or you'll be paying a premium for the ones from the airline.

PRO TIP – If you plan to use WiFi, buy it in advance. It's usually cheaper than buying once you've taken off.

Final Thoughts

There are many conveniences well worth the expense, but there are just as many, if not more, that may be draining your budget without you noticing.

Take a look through your expenses and see what the true cost of convenience is for you, and determine the impact those conveniences are having on your financial goals.

Have you ever stopped to think about how much you’re spending on conveniences?

How often do you rush out the door, opting to hit a drive-thru for coffee or breakfast instead of waking up a few minutes earlier to make it yourself?

It may not seem like much at the time, but even eating out for lunch just once per week can add up to over $500 a year.

It may be an area of your budget you're willing to pay extra for, but make sure you're aware of the cost of convenience.

Here are some common conveniences that may be costing you more money than are worth it.

Eating Out

When you start tracking your spending you may discover what we did: you're spending a crazy amount on eating out.

While I love the convenience of having someone else cook for me, the expense can be hard to justify, especially when you’re in debt.

Look at how much you’re actually spending on those so called “value” meals. While $5-10 doesn’t sound like much by itself, letting it become a habit can empty your wallet quick.

Let’s break down how much you could be spending by eating out for lunch. Assuming each meal averages $10:

Take a look at those annual averages. For every day you brown bag your lunch you can save over $500 a year!

ATM Fees

Any good checking account will have a large network of ATMs you can use for free or ones they'll reimburse you for using.

If your bank doesn't and you're not willing to move your accounts, an easy workaround is to get cash back when you shop.

Depending on where you are and what you're buying you may not want to pay for the entire purchase with your debit card.

In that case, just grab a pack of gum or some other cheap thing to ring up separately and get the cash back during that transaction.

Drinking Bottled Water

Depending on your brand, bottled water may not be a large expense for you, but compared to free it is a largely unnecessary one.

If tap water isn't an option look into a filtering system you can use. The one-off expense will pay for itself over time.

Also look at investing in a few reusable water bottles.

Having water always on hand may have the added benefit of saving you money on impulse coffee, sodas, and even snacks.

Buying Coffee

Do you consider small splurge expenses like a daily latte your little treat?

If so, have you ever done the math to determine if that daily indulgence is really worth it?

While $3-5 a day may not seem like it will make a difference, if you're struggling to save money, it's little expenses like these that can undermine your success.

You don't have to give up all life's pleasures or quit cold turkey. But you should at least examine these expenses in a broader context and make sure you're being intentional when you buy.

$3 a day = $15 a week = $780 a year

Is your Starbucks habit worth $780 a year?

Shopping Online

Online shopping is amazing. But by removing virtually all friction from the buying process, we're tempted to spend more money with less thought.

Without having to physically go to the store, the only barrier to getting that thing you want is waiting for it to arrive. And even that has largely been eliminated with upgraded shipping options.

So now not only are you paying for the convenience of not having to go to the store, but also of getting your items quicker.

One way to curb impulsive online shopping is to add things to a wishlist instead of the cart. Give yourself a day or more to think on your purchase before you click “buy.”

Also, be wary of “free shipping” offers.

Many online stores will offer free shipping if you hit a certain spending threshold. But that may cause you to spend more than you initially planned just to can get free shipping.

More often than not, trying to hit shipping minimums will leave you spending more than you anticipated.

If the product you’re buying doesn’t seem worth it when you factor in shipping, you should ask yourself if it’s worth buying at all.

Buying Theater Concessions

It's no great secret that movie theater concessions are crazy expensive. According to Movie Theater Prices, the average cost for a large popcorn and drinks for a family of 4 is around $35.

It may be part of the experience, but it may also be time to reconsider if it's worth the cost.

Try to avoid the desire for treats altogether by eating before the movie. Or opt for a dine-in movie theater and get a full dinner with your movie for a comparable price.

Buying Household Items at the Grocery Store

Do you buy your shampoo, trash bags, toilet paper and other household goods at the grocery store? If so you’re probably paying a premium for it.

While it may be more convenient to buy everything in one go, non-grocery items tend to be more expensive at grocery stores.

You may get lucky and spot a deal or find some coupons to clip, but in general, household goods are cheaper when bought in bulk. Grocery stores simply don't have the space to stock them so they charge more for them.

To check for yourself, compare your grocery store's per-unit price to your local warehouse club or Amazon to see if you can save by switching where you buy.

I got tired of trying to squeeze giant bundles of toilet paper, paper towels, and Kleenex in my car so I started ordering those things via Amazon's Subscribe and Save.

Not only does Amazon email me before things ship so I can double-check pricing and delay any items we may not need, but they also give me a discount for automating the process!

I save time and money using Amazon's Subscribe & Save.

Travel Upgrades

Do you travel a lot?

It's understandable to want your travel to be as comfortable as possible, but airlines, in particular, have become masters at squeezing extra cash out of you.

Pay close attention to the various fees when planning your next trip.

Most airlines now charge you for your bags, as well as offering various upgrade options like premium snacks, pre-boarding, seat selection, and WIFI access.

Also, don't forget to bring your own headphones or you'll be paying a premium for the ones from the airline.

PRO TIP – If you plan to use WiFi, buy it in advance. It's usually cheaper than buying once you've taken off.

Final Thoughts

There are many conveniences well worth the expense, but there are just as many, if not more, that may be draining your budget without you noticing.

Take a look through your expenses and see what the true cost of convenience is for you, and determine the impact those conveniences are having on your financial goals.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

Need some help?

Whether you're struggling to stick to a budget, overwhelmed with debt, or just wanting to feel a bit more in control, I'm happy to guide you toward your best next step.

You're in good hands

You're in good hands

You're in good hands

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

© 2024 GO FROM BROKE

This site may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.