Are You a Victim of Lifestyle Creep?

This post may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. Please read my disclosure policy for more info.

Do you ever wonder where your money is going? Or where it went? Do you feel like you can’t seem to get ahead even when you make more?

The problem likely comes down to a lack of awareness and intentionality with your spending. This can easily lead to lifestyle creep, which only makes things worse.

Stress less & save more!

This FREE budget guide will help you create a budget that works for you!

What is Lifestyle Creep?

Lifestyle creep is when you gradually increase your cost of living without even noticing it. It is often the reason you wonder where all your money went.

Traditionally it’s associated with an increase in income. You start making more money and think, “Oh now I can afford this! And this! And this!”

But you don’t have to be bringing in more money to unknowingly inflate your spending.

Every time we sign up for a “cheap” new monthly service, opt for convenience over value (I’m looking at you McDonald’s), and cave into other temptations we might once have turned away from, we’re gradually and unknowingly increasing our cost of living.

Don’t feel bad if you’re recognizing lifestyle creep has affected you. One of my favorite books summed it up like this:

That what each of us calls our ‘necessary expenses’ will always grow to equal our incomes unless we protest to the contrary.

Clason, George S.. The Richest Man in Babylon

It’s human nature to spend what you earn, so it’s important we learn how to overcome those desires.

How Do You Stop Lifestyle Creep?

It’s probably no surprise, but my answer to this is: You need a budget.

You can counter lifestyle creep by doing two things: tracking your spending and being intentional with it.

I suggest using

Let’s dive in a little bit.

Track Your Expenses

The first step is to start tracking your expenses. This is especially true if you often find yourself wondering “Where did all of my money go?” The only way to know is to have a record of your spending.

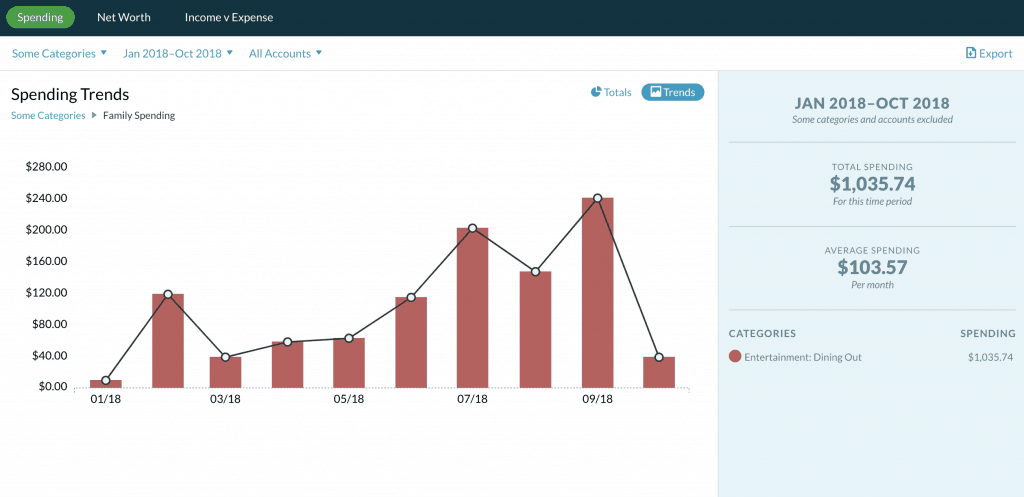

With

By using the Reports you can drill down to see not only how much you’ve spent in each category but also when you spent it.

This will help you spot trends so you can better prepare for them in the future. It will also keep you motivated as your trend line decreases or give you a kick in the pants if you notice it going in the wrong direction.

Tracking your spending will help you become more aware of your expenses, but it can also have the benefit of changing your spending habits. Your new awareness may lead you to feel resistance toward unnecessary spending.

To really gain insight into your spending habits I recommend you input your transactions manually. Don’t just rely on downloads from your bank or credit card. Transactions often take days to clear making your category balances inaccurate.

For the most accuracy and awareness, you need to manually input your expenses.

Be Intentional With Your Spending

The whole point of budgeting is learning to be intentional with your spending.

A budget is not meant to constrain you, it’s meant to liberate you.

It’s you taking control and telling your money what it needs to do instead of looking back wondering where it all went.

If you don’t like feeling broke, use your budget to prioritize savings over convenience or splurge spending.

It’s not easy and you’ll need to harness a bit of willpower. But by setting goals you can change your mindset and make it easier.

Setting goals for your money will help you overcome spending urges. It’s a lot easier to talk yourself out of splurging on take-out if you know that money will help you reach your other goals faster.

Stop Lifestyle Creep for Good

Once you’re in the habit of tracking your purchases and spending intentionally, you’ll not only stop lifestyle creep from sneaking up on you, but you’ll likely be dialing it back.

The goal is always to live below your means, but you don’t want to just mind that gap, you want to widen it.

And the best part is, once you’ve reduced your cost of living, your savings will go even further! The less you need, the longer what you have will last.

It’s a win-win!

Now I have a question for you: Have you noticed lifestyle creep taking over your finances? Or have you overcome it in the past and are rocking a massive income/expense gap? Let me know in the comments!

Want to work together?

I would love to help you gain clarity and confidence with your money! If you’re ready to stress less, save more, and enjoy your money, click below to learn more about financial coaching.